What's Affecting Markets Today

Kospi Hits Record High as Asia Markets Trade Mixed

South Korea’s Kospi index climbed to a record high of 3,420.23 on Monday, marking its 10th consecutive session of gains. The rally followed Finance Minister Koo Yun-cheol’s announcement that the government would scrap a planned tax hike on stock investments, boosting investor sentiment. The tech-heavy Kosdaq also edged up 0.15 per cent.

Elsewhere in the region, markets were mixed as investors monitored U.S.–China talks in Madrid and digested fresh Chinese economic data. U.S. Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer met with Chinese Vice Premier He Lifeng and senior trade negotiator Li Chenggang to address security, economic, and tariff issues, including the looming TikTok divestment deadline.

Hong Kong’s Hang Seng Index added 0.16 per cent at the open, with the Hang Seng Tech Index up 0.27 per cent. On the mainland, the CSI 300 rose 0.59 per cent despite August data showing weaker-than-expected retail sales, soft industrial output, and a 12.9 per cent slump in real estate investment year-to-date. Australia’s S&P/ASX 200 slipped 0.34 per cent, while Japanese and Malaysian markets remained closed for holidays.

ASX Stocks

ASX 200 8,853.0 (-0.13%)

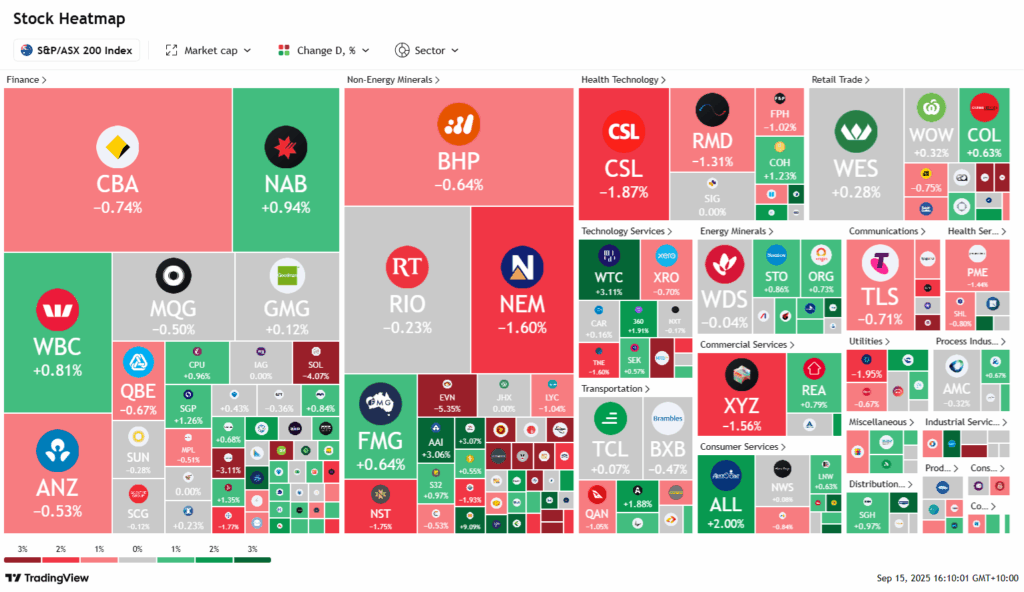

ASX Slips as Healthcare and Gold Stocks Weigh

The Australian sharemarket eased on Monday, with the S&P/ASX 200 falling 19.7 points, or 0.2 per cent, to 8845.2, extending last week’s steep decline. Investors largely shrugged off the US Federal Reserve’s widely expected rate cut, while healthcare and gold miners dragged the local bourse lower.

Medical imaging giant Pro Medicus slipped 1.6 per cent to its weakest level in two months, while CSL shed 2 per cent. Gold miners faced heavy profit-taking as bullion retreated from record highs, with Evolution down 5.7 per cent, Regis off 3.8 per cent, and Newmont easing 1.4 per cent.

By contrast, lithium stocks gained, with Pilbara Minerals up 4.8 per cent, Liontown 3.4 per cent higher, and IGO adding 3.7 per cent after a Citi upgrade. Corporate moves added to market activity: ANZ dipped 0.7 per cent after a $240 million penalty, while WiseTech rose 2.5 per cent despite insider selling. GrainCorp and Bubs Australia both advanced, and Emeco surged 8.3 per cent on takeover interest.

Leaders

DTR Dateline Resources Ltd (+16.35%)

VUL Vulcan Energy Resources Ltd (+12.00%)

REG Regis Healthcare Ltd (+9.19%)

PLS Pilbara Minerals Ltd (+8.08%)

ZIM Zimplats Holdings Ltd (+7.64%)

Laggards

OBM Ora Banda Mining Ltd (-9.96%)

EVN Evolution Mining Ltd (-5.86%)

CMM Capricorn Metals Ltd (-5.11%)

PNR Pantoro Gold Ltd (-4.94%)

HMC HMC Capital Ltd (-4.18%)