What's Affecting Markets Today

Nikkei Surges Past 45,000 as Asia-Pacific Markets Rally

Asian equities delivered a mixed performance Monday, with Japan’s Nikkei 225 leading gains after briefly surpassing the 45,000 milestone for the first time. The benchmark added 0.3 per cent to close at 44,902.27, buoyed by optimism over U.S.-China trade talks. President Donald Trump said negotiations in Spain were progressing well, though attention shifted to a “framework” deal on the divestment of TikTok, confirmed by U.S. Treasury Secretary Scott Bessent. Trump and Chinese President Xi Jinping are scheduled to discuss the terms on Friday.

Japan’s Topix index advanced 0.25 per cent to a record 3,168.36. South Korea’s Kospi rose 1.24 per cent to 3,449.62, notching another all-time high after the government scrapped plans for a capital gains tax increase on equities. Gains were led by Kolon Mobility Group, up nearly 30 per cent, alongside Il Dong Pharmaceutical and Nongshim.

Elsewhere, Australia’s S&P/ASX 200 gained 0.28 per cent to 8,877.7. By contrast, Hong Kong’s Hang Seng slipped 0.13 per cent and China’s CSI 300 fell 0.21 per cent to 4,523.34, highlighting regional divergence.

ASX Stocks

ASX 200 8,809.0 (-0.78%)

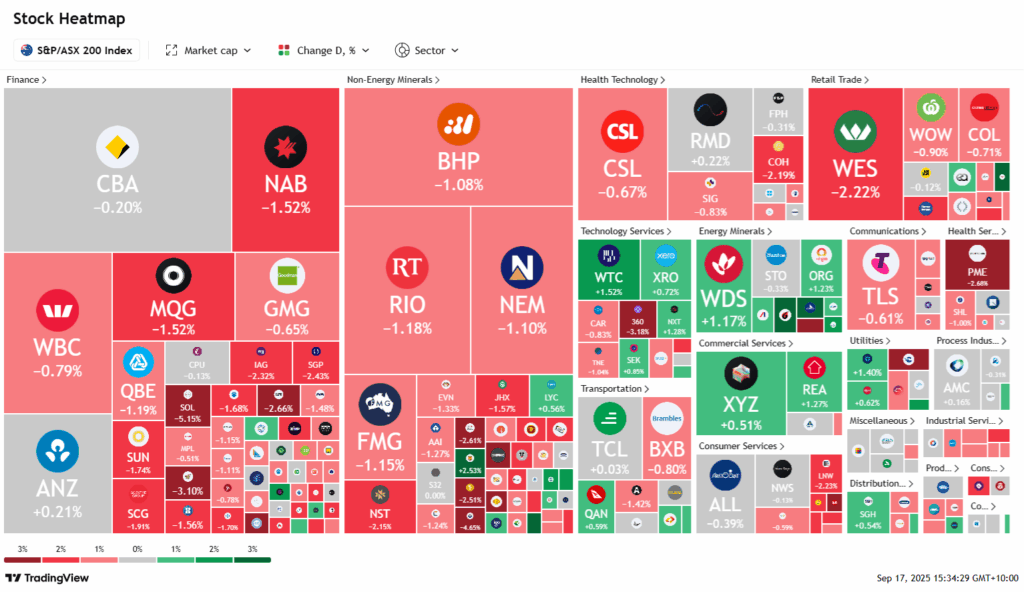

ASX Falls as Mining and Retail Stocks Weigh

The Australian sharemarket retreated on Wednesday, pressured by declines in mining, retail, and real estate sectors as investors positioned ahead of the US Federal Reserve’s policy announcement.

The S&P/ASX 200 Index dropped 62 points, or 0.7 per cent, to 8815.7 by midday AEST, with eight of 11 sectors trading lower. A quarter-point US rate cut is widely expected, with markets also pricing in two further reductions this year.

Consumer discretionary names underperformed, with Wesfarmers down 2.1 per cent and Harvey Norman off 2.2 per cent, despite data from UBS showing consumer spending intentions at their highest since 2019. Real estate trusts also weakened, led by GPT Group, which fell 2.7 per cent.

The big miners weighed on the index, with BHP and Rio Tinto retreating even as iron ore futures edged higher. Gold producers lost ground despite bullion briefly topping US$3700 an ounce.

Energy stocks were mixed, while tech shares slipped. A bright spot was DroneShield, which gained 2.1 per cent after securing $7.9 million in new US defence contracts.

Leaders

SLX SILEX Systems Ltd (+16.00%)

DTR Dateline Resources Ltd (+6.90%)

VUL Vulcan Energy Resources Ltd (+5.77%)

WHC Whitehaven Coal Ltd (+4.89%)

4DX 4DMEDICAL Ltd (+4.59%)

Laggards

DYL Deep Yellow Ltd (-8.41%)

NHC New Hope Corporation Ltd (-8.30%)

ING Inghams Group Ltd (-4.51%)

GMD Genesis Minerals Ltd (-4.47%)

SX2 Southern Cross Gold (-3.99%)