Overnight – Nvidia/Intel Deal drives chip stocks & Index to fresh record

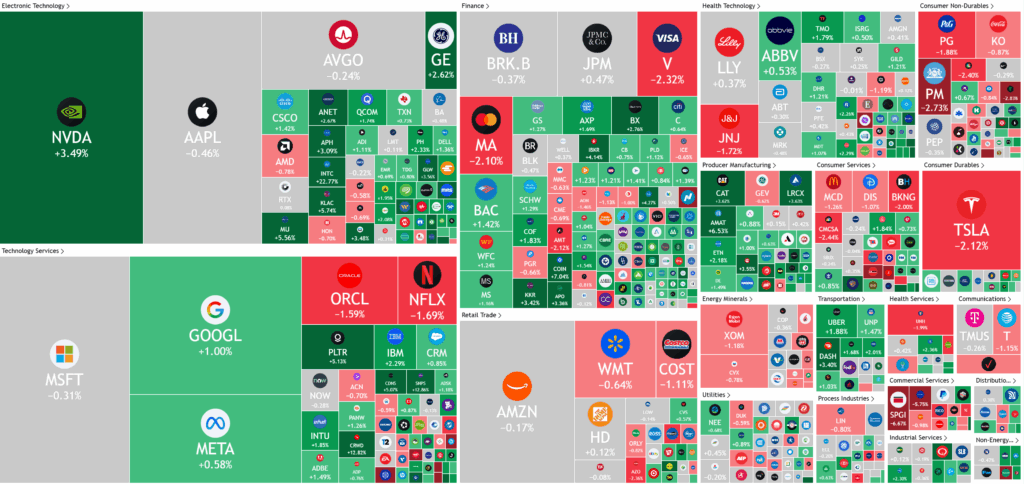

Stocks closed at a record high overnight, a day after the Federal Reserve cut rates as Intel led a surge in a chip stocks following news of a hefty investment by Nvidia.

Intel shares surged after Nvidia announced a $5 billion investment in the company, cementing a strategic partnership between the two semiconductor leaders. The collaboration will focus on integrating Nvidia’s AI and accelerated computing technologies with Intel’s CPUs and its x86 ecosystem, including the use of Nvidia’s NVLink to bridge their architectures. This deal comes on the heels of the U.S. government taking a significant stake in Intel, marking a fresh chapter for the once-dominant chipmaker after years of uneven turnaround efforts.

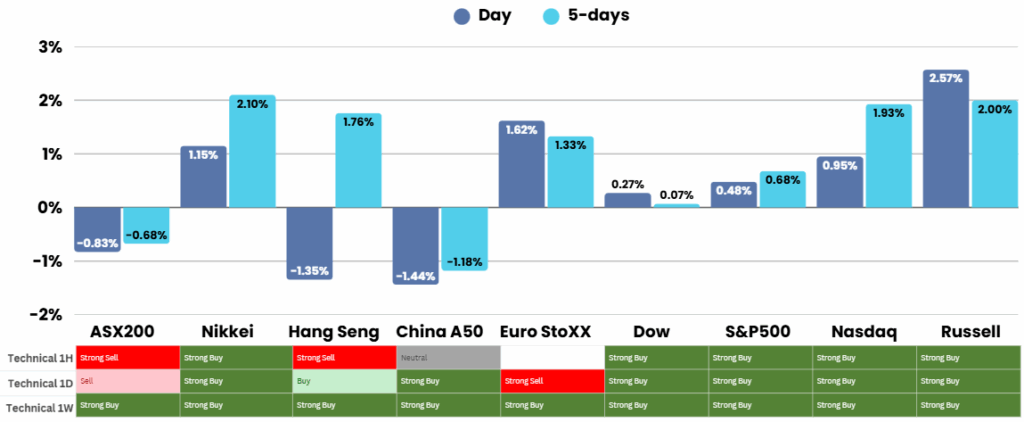

Meanwhile, the Federal Reserve delivered its first rate cut since December, lowering the benchmark federal funds rate by 25 basis points to a range of 4.00%–4.25%. Policymakers signalled at least two more cuts in 2025, reflecting concerns about a cooling labour market and persistent—but easing—inflation. Markets, however, believe the Fed may be forced into additional reductions, with expectations for up to three extra cuts this year. Debate within the Fed was evident as Governor Stephen Miran dissented, favouring a larger 50 basis point cut, underscoring a growing split on how aggressively to respond to changing economic conditions.

Economic data showed jobless claims fell by 33,000 last week to 231,000, partially retracing a prior jump, though hiring momentum has nearly stalled amid trade-related uncertainty. Global central banks remained cautious, with the Bank of England holding rates steady at 4% and the Bank of Japan expected to maintain current policy. In corporate news, Novo Nordisk shares spiked as its late-stage trial of an oral obesity drug showed major weight loss results comparable to its blockbuster Wegovy injection. In contrast, Darden Restaurants slipped after weak earnings, while American Express gained on new Platinum card upgrades that boost perks but raise annual fees.

ASX Overnight: SPI 8820 (+0.54%)

The Day Ahead:

The local market should recover nicely today after lagging global indexes all week.

Yesterdays Session:

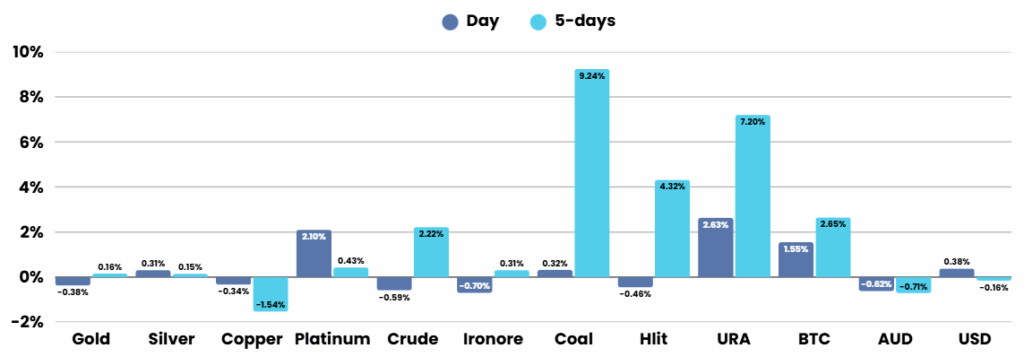

Santos tumbled 12 per cent after Abu Dhabi National Oil Co withdrew its bid, triggering a downgrade from Jarden, while the broader energy sector slid 5.8 per cent under pressure from weaker oil prices, with Brent dipping below US$68 a barrel. Other major energy names, including Woodside, Beach Energy, and Karoon, also posted heavy losses. Stocks with US exposure fell after the Fed signalled a cautious stance, with James Hardie, Transurban, and Ramsay Healthcare all retreating. In corporate news, Macquarie was steady despite reports of failed takeover talks with Carlyle, while Endeavour edged down after leadership changes at its BWS chain.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.