Overnight – Rally continues on US/China Tik Tok deal and rate cut hopes

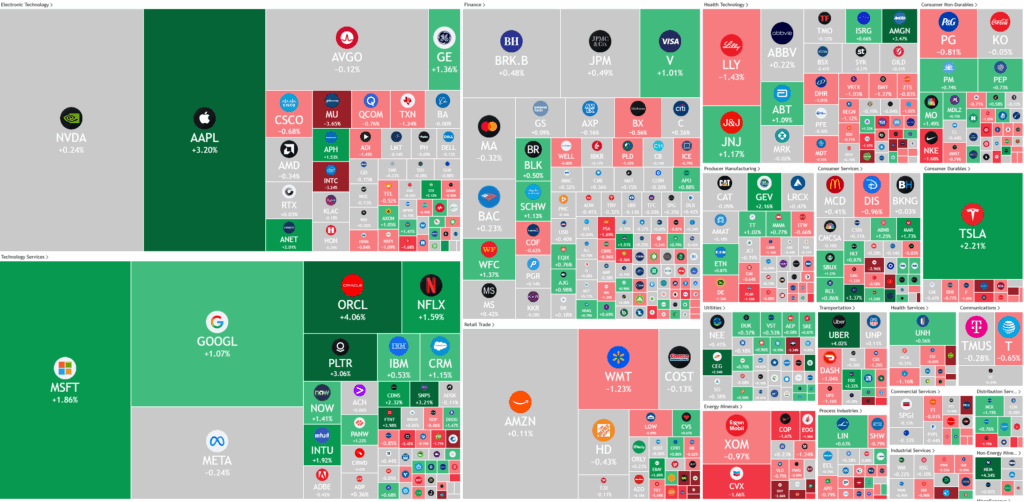

Stocks climbed Friday notching another all-time closing high and hefty weekly gains, underpinned by a jump in Apple, hopes of a Tik Tok deal and further rate cuts hopes.

Wall Street rallied on the Federal Reserve’s decision to cut interest rates by 25 basis points, lowering the benchmark range to 4.00%–4.25%. The move, labelled by Fed Chair Jerome Powell as a “risk-management cut,” is intended to support a cooling Labor market while balancing inflation concerns. Policymakers projected two more cuts this year and another in 2026, suggesting a gradual approach rather than a sharp easing cycle. Analysts noted that the combination of monetary and fiscal stimulus, alongside continued enthusiasm for AI stocks, is fueling optimism among investors.

In politics, President Donald Trump said he made key progress in trade and other discussions during a phone call with Chinese President Xi Jinping. Among the topics covered were U.S.-China trade relations, the fentanyl crisis, efforts to end the Russia-Ukraine war, and the approval of the TikTok deal, which remains a central issue in bilateral talks. The call, the first in three months, may pave the way for an in-person meeting at an upcoming summit in South Korea, signaling a potential thaw in tensions. A resolution over TikTok’s future in the U.S. would also eliminate a long-standing point of uncertainty for the platform’s parent company, ByteDance.

On the corporate front, FedEx reported stronger-than-expected quarterly results, with cost-cutting efforts helping offset weaker international volumes after the expiration of a tariff exemption. Revenue came in at $22.24 billion, ahead of forecasts, while adjusted profit also topped expectations. Conversely, homebuilder Lennar saw profits fall 46% amid weakened housing demand, despite offering incentives like mortgage-rate buydowns that have squeezed margins. Tech stocks also made headlines: Apple shares jumped after JPMorgan boosted its price target, citing strong demand for its new iPhones, while Intel slipped following a sharp rally the previous day tied to Nvidia’s $5 billion investment.

Congress is deadlocked over government funding, with both Republican and Democrat proposals blocked in the Senate as the September 30 shutdown deadline approaches; leaders from both parties continue to blame each other, and unless a last-minute deal is reached, a government shutdown beginning October 1 is almost certain, disrupting federal services and employee pay.

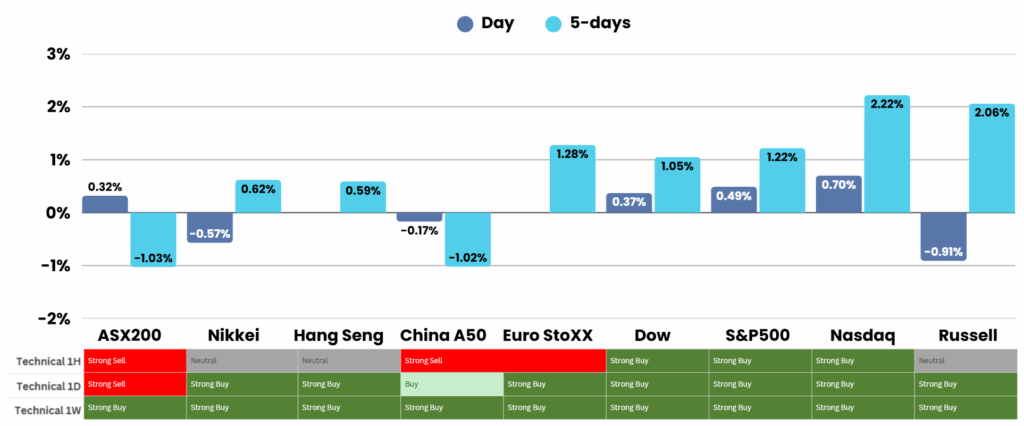

ASX Overnight: SPI 8834 (+0.35%)

The Day Ahead:

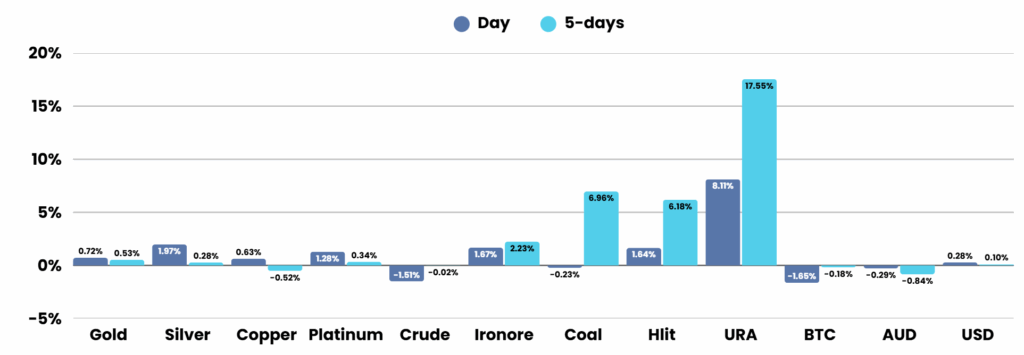

We should see a recovery in the ASX200 today, with the materials and energy sectors providing most of the support. Uranium stocks should see another push with global Uranium stocks up 20% over the last week and the ASX counterparts lagging horribly, up only 5%

Fridays Session:

Healthcare stocks led gains, with Telix Pharmaceuticals and Pro Medicus both jumping 6.5 per cent after Citi’s positive coverage, citing Telix’s prostate cancer therapy potential and Pro Medicus’s strong pricing power. Utilities also advanced, while BHP and Rio Tinto slipped on weaker iron ore prices. Energy stocks rebounded, with Santos and Woodside recovering modestly, and AGL Energy rose 1.6 per cent on federal approval for a major renewable project. Banks were mixed, though Commonwealth Bank and NAB edged higher.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.