What's Affecting Markets Today

Asia-Pacific equities delivered a mixed performance on Monday as investors weighed China’s policy stance against global central bank easing. The region followed a strong Wall Street close on Friday, though sentiment remained cautious after Beijing opted to leave benchmark lending rates unchanged.

China’s CSI 300 opened flat after the People’s Bank of China held the one-year Loan Prime Rate steady at 3.0% and the five-year at 3.5%, in line with expectations. The decision marked a fourth consecutive month of no change, contrasting with last week’s 25 basis point rate cut by the U.S. Federal Reserve.

In Hong Kong, the Hang Seng Index slipped 1% and the Hang Seng Tech Index declined 1.18%. Japan outperformed, with the Nikkei 225 rising 1.28% and the Topix advancing 0.8%, while 10-year Japanese government bond yields hit 1.65%, their highest since 2007.

South Korea’s Kospi added 0.71% and the Kosdaq gained 0.9%, driven by a 4% jump in Samsung Electronics after reports that Nvidia had approved its latest high-bandwidth memory product. Australia’s ASX 200 added 0.49%. India lagged, with the Nifty 50 down 0.12% and Sensex 0.48% lower, though Adani Power soared 15% following a five-for-one stock split.

ASX Stocks

ASX 200 8,810.90 (+0.43%)

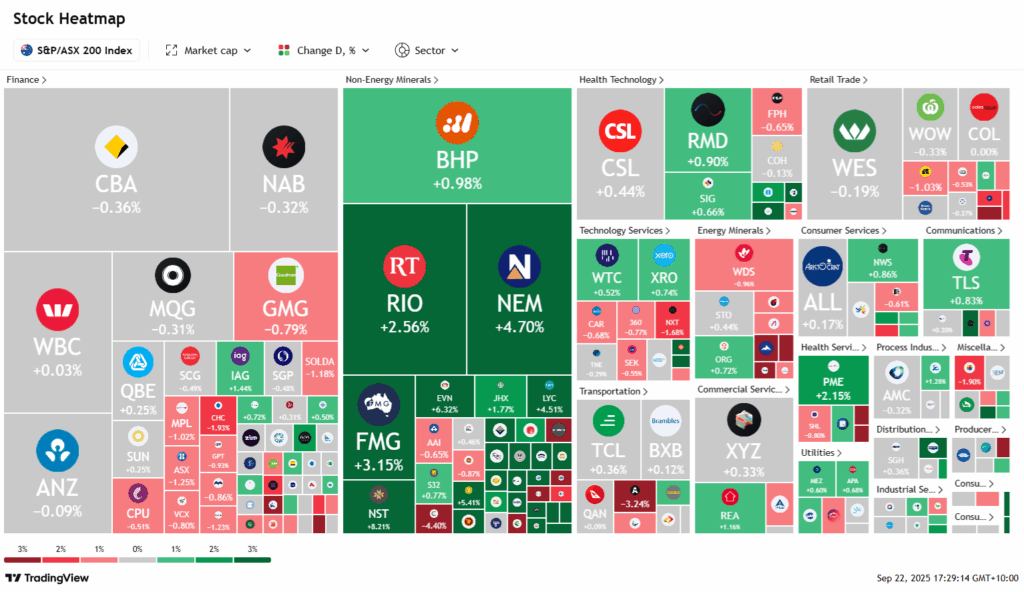

The Australian sharemarket advanced for a second straight session on Monday, buoyed by broad-based strength in commodity-linked stocks. The S&P/ASX 200 index climbed 37.4 points, or 0.4 per cent, to close at 8810.9, with miners leading gains as iron ore, uranium, copper, lithium, and gold prices rallied.

Rio Tinto added 2.6 per cent and Fortescue rose 3.1 per cent, while BHP gained 1 per cent despite reports of strained supply talks with Chinese buyers. Gold miners extended their run, with Regis Resources up nearly 9 per cent, Evolution 6.3 per cent higher, and Newmont lifting 4.7 per cent following a $666 million asset sale. Uranium producers Boss Energy and Paladin climbed strongly after fresh signals of rising nuclear demand.

In corporate news, plumbing supplier Reece jumped 14.2 per cent on a $250 million buyback plan, while biotech Starpharma surged 73 per cent on a licensing deal with Roche’s Genentech. By contrast, Viva Energy slumped 8 per cent after the resignation of a key executive. Banks edged lower, tempering the broader rally.

Leaders

REH Reece Ltd (+14.15%)

GMD Genesis Minerals Ltd (+13.86%)

GGP Greatland Resources Ltd (+11.58%)

EOS Electro Optic Systems Holdings Ltd (+10.69%)

DTR Dateline Resources Ltd (+9.38%)

Laggards

REG Regis Healthcare Ltd (-26.25%)

VEA Viva Energy Group Ltd (-8.12%)

NHC New Hope Corporation Ltd (-6.68%)

PNV Polynovo Ltd (-5.73%)

NXL NUIX Ltd (-5.28%)