What's Affecting Markets Today

Asian Markets Mixed as Taiwan Hits Record; Hong Kong Braces for Typhoon

Asian equities delivered a mixed performance on Tuesday, with Taiwan’s benchmark Taiex climbing 1.42 per cent to a fresh record high. The rally followed strong overnight gains in US technology shares, led by Nvidia’s announcement of a partnership with OpenAI.

Australia’s S&P/ASX 200 advanced 0.52 per cent, supported by strength in financials and gold stocks, while South Korea’s Kospi rose 0.69 per cent and the small-cap Kosdaq added 0.56 per cent. In contrast, Hong Kong’s Hang Seng Index slid 0.99 per cent as investors weighed the approach of Super Typhoon Ragasa, which is expected to pass near the Pearl River Estuary on Wednesday morning. Mainland China’s CSI 300 also retreated 1.02 per cent, reflecting weaker investor sentiment.

Elsewhere, Japan’s markets were closed for a public holiday. Indian technology stocks remained under scrutiny after US President Donald Trump unveiled a $100,000 visa fee for new H-1B visas, impacting skilled foreign workers—71 per cent of whom last year were Indian nationals. Meanwhile, Singapore’s core inflation slowed to 0.3 per cent in August, its weakest pace in more than four years.

ASX Stocks

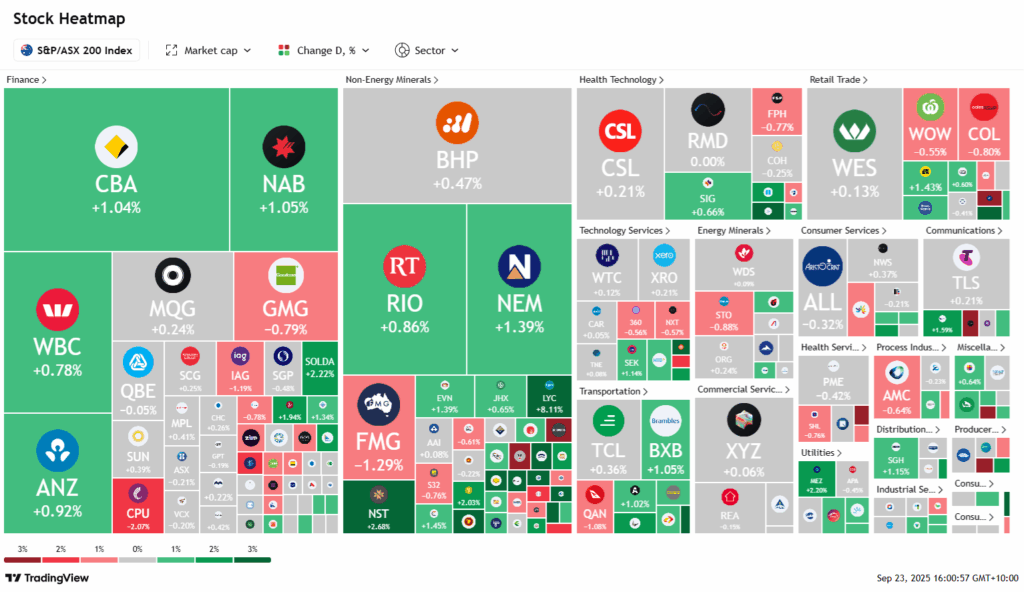

ASX 200 8,849.5 (+0.45%)

ASX Rises as Gold Stocks Rally; Myer Plunges

The Australian sharemarket advanced on Tuesday, supported by strength in banks and a surge in gold miners after bullion prices hit record highs. By 2.10 pm, the S&P/ASX 200 had climbed 55 points, or 0.6 per cent, to 8866.3, with nine of 11 sectors in positive territory following a strong Wall Street lead.

In New York, major US indices rallied, with Nvidia gaining 4 per cent on plans to invest up to $US100 billion in OpenAI to expand artificial intelligence infrastructure. Locally, the big four banks each added more than 1 per cent, driving financials higher. The materials sector also strengthened as gold spiked to $US3749.27 an ounce. Gold miners outperformed, led by Emerald Resources (+4.6%), Ramelius (+3.7%), Westgold (+3.6%) and Perseus (+3.3%), while BHP and Rio Tinto rose around 1 per cent.

Among individual moves, Myer slumped 28 per cent after posting a steep earnings decline, while Telix Pharmaceuticals jumped 7 per cent on positive US regulatory news. Cettire surged 11.8 per cent after founder Dean Mintz increased his stake.

Leaders

DTR Dateline Resources Ltd (+12.86%)

DRO Droneshield Ltd (+8.46%)

LYC Lynas Rare EARTHS Ltd (+8.14%)

TLX TELIX Pharmaceuticals Ltd (+7.53%)

OBM Ora Banda Mining Ltd (+6.46%)

Laggards

MYR Myer Holdings Ltd (-25.39%)

VAU Vault Minerals Ltd (-5.07%)

REG Regis Healthcare Ltd (-4.27%)

PMV Premier Investments Ltd (-3.74%)

DRR Deterra Royalties Ltd (-3.30%)