Overnight – Tech stumbles as Powell cautions market on further rate cuts

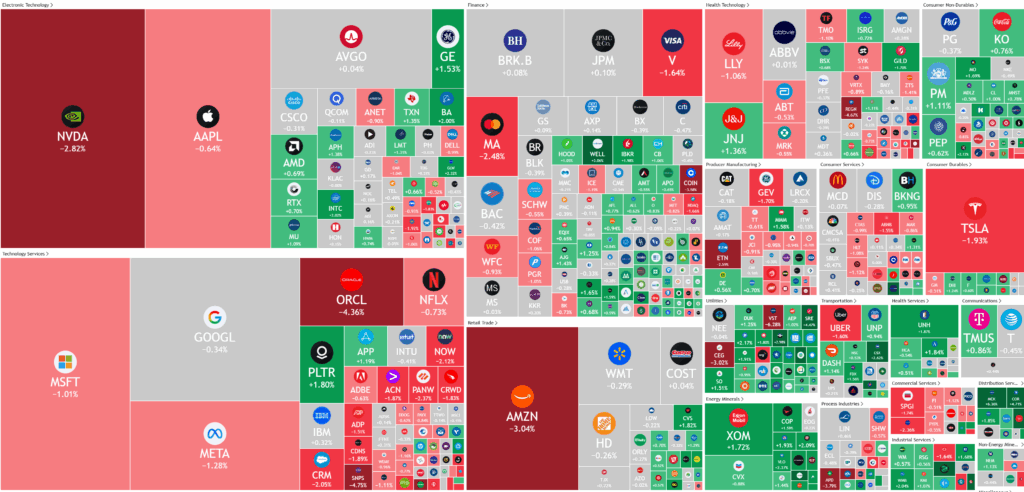

Stocks headed lower overnight after hitting a record high as big tech including Nvidia took a breather and investors digested remarks from Federal Reserve Chair Jerome Powell signalling a wait-and-see approach to further rate cuts.

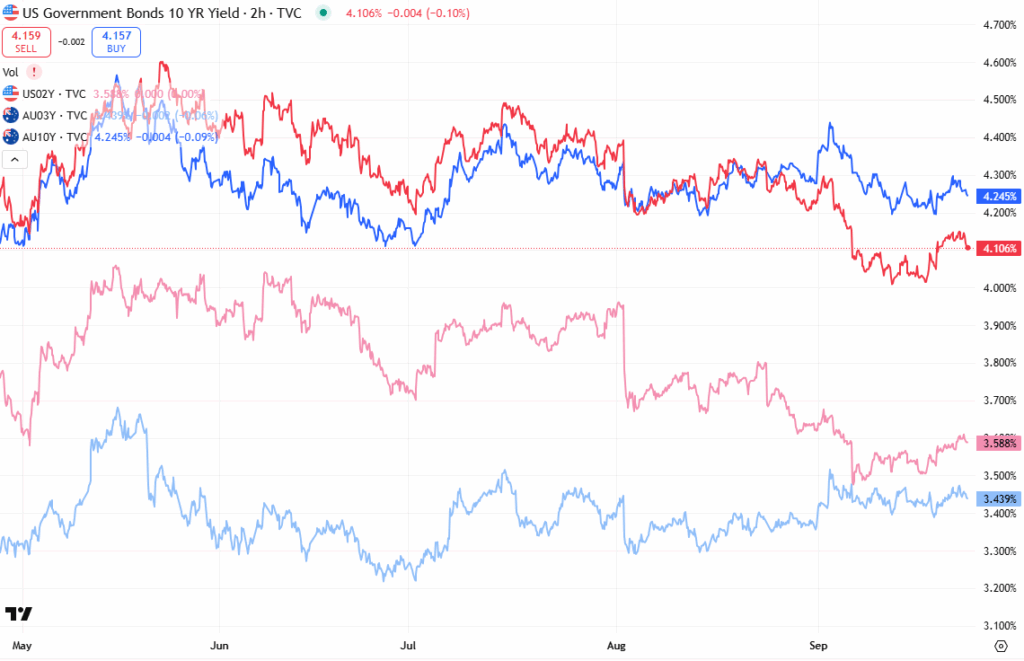

Federal Reserve Chair Jerome Powell emphasized a cautious approach to future rate cuts, noting the Fed’s challenge of balancing inflation risks with employment concerns. While the central bank reduced rates by 25 basis points last week and signalled at least two more cuts this year, Powell warned that persistent inflation and a still-resilient labour market could complicate further easing. Diverging views within the Fed have emerged, with some policymakers urging restraint while new Governor Stephen Miran pushed for more aggressive reductions, and Chicago Fed President Austan Goolsbee hinting at future cuts if inflation continues to cool.

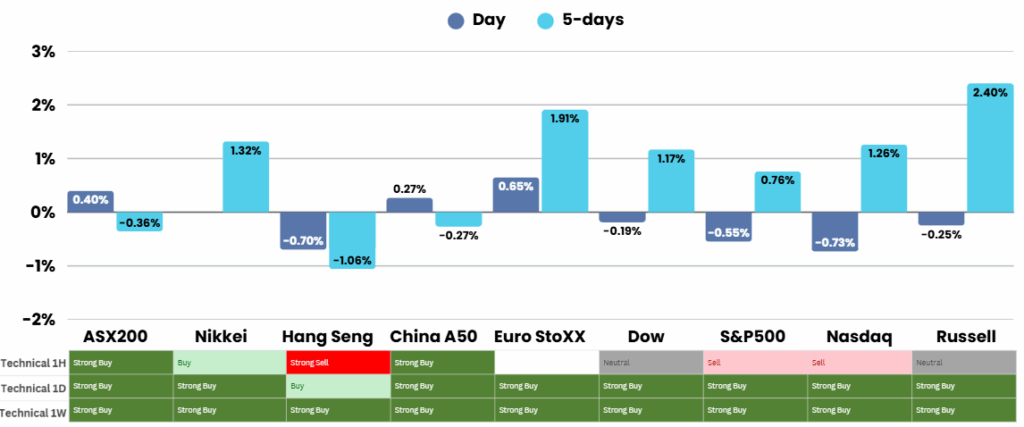

Markets remain broadly confident that additional rate cuts are forthcoming, with CME’s FedWatch Tool showing a near 90% probability of another quarter-point cut in October and a 75% chance of one more in December. Meanwhile, U.S. business activity data has signalled some weakening momentum. The S&P Global composite PMI slipped to 53.6 in September, undershooting expectations, with both manufacturing and services activity declining modestly from the prior month. The cooling growth backdrop reinforces arguments in favour of easing, though policymakers remain wary of inflation dynamics.

In equities, major tech names, including NVIDIA and Apple, took a pause following strong rallies, weighing on broader market sentiment. NVIDIA, a major driver of the AI boom, stalled after announcing a planned $100 billion collaboration with OpenAI for data centre chip supply. Elsewhere, Kenvue shares staged a sharp rebound after plunging to record lows, despite political controversies tied to its Tylenol brand. On the other hand, Firefly Aerospace tumbled after reporting a larger loss and revenue miss in its first quarterly earnings since its Nasdaq debut, highlighting divergent performances across sectors outside of technology.

ASX Overnight: SPI 8852 (-0.34%)

The Day Ahead:

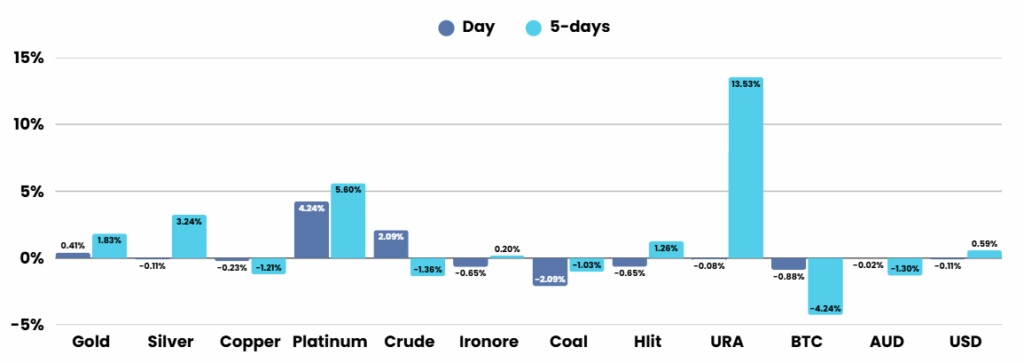

We are likely to see a “risk off” day on the ASX with CPI the central focus at 1130am. Trumps move to take a stake in Lithium Americas may see a bid tone in the lithium sector, while precious metals should remain positive

Fridays Session:

In Australia, bank stocks climbed over 1% each, gold hit a record $US3749.27 an ounce, and miners like Emerald Resources and Ramelius led gains. BHP and Rio Tinto also rose about 1%. Meanwhile, Myer plunged 28% on weaker earnings, but Telix Pharmaceuticals gained 7% on positive US regulatory updates, and Cettire surged nearly 12% after its founder lifted his stake.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.