What's Affecting Markets Today

Asia-Pacific Markets Weaken as Powell Flags Valuation Concerns

Asia-Pacific equities retreated on Wednesday, mirroring Wall Street declines after U.S. Federal Reserve Chair Jerome Powell warned that “equity prices are fairly highly valued” and stressed uncertainty over the rate-cut trajectory. He described the monetary outlook as a “challenging situation,” prompting regional risk-off sentiment.

Australia’s S&P/ASX 200 slipped 0.61%, while Japan’s Nikkei 225 shed 0.33% and the Topix declined 0.35%. South Korea’s Kospi eased 0.11% and the Kosdaq 0.39%, though defense manufacturers bucked the trend. Hanwha Aerospace, Korea Aerospace, and Hyundai Rotem advanced 2%–4% after U.S. President Donald Trump reaffirmed support for Ukraine and NATO, bolstering demand expectations for South Korean defense exports.

In New Zealand, the Reserve Bank announced Anna Breman as its next governor, the first woman to hold the role. She will begin a five-year term on December 1, succeeding acting governor Christian Hawkesby.

Meanwhile, Hong Kong’s Hang Seng and China’s CSI 300 traded flat amid severe weather from Super Typhoon Ragasa. Alibaba surged over 6% after unveiling a $53 billion AI investment and its most advanced language model, Qwen3-Max.

ASX Stocks

ASX 200 8,756.4 (-1.01%)

ASX Slumps as Rate Cut Hopes Fade

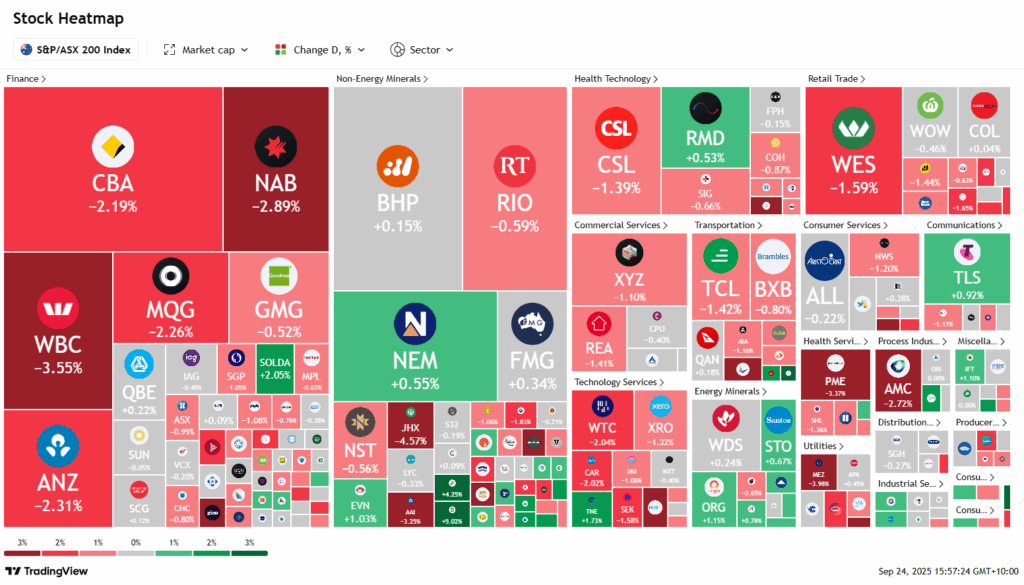

The Australian sharemarket fell sharply on Tuesday, dragged lower by financials, technology, and consumer discretionary stocks as investors reassessed the outlook for interest rate cuts. The S&P/ASX 200 dropped 87.4 points, or 1 per cent, to 8758.5 by mid-afternoon, with 10 of 11 sectors in negative territory.

Overnight, US Federal Reserve chair Jerome Powell reiterated caution on inflation, saying risks remained “tilted to the upside,” which dampened expectations for imminent policy easing. Locally, a hotter-than-expected August CPI reading of 3 per cent effectively removed prospects of a near-term Reserve Bank rate cut.

Rate-sensitive tech stocks mirrored Wall Street declines, with Zip down 4.1 per cent and WiseTech 2.5 per cent weaker. Banks were the heaviest drag as Westpac slid 2.5 per cent and NAB 2.2 per cent. Consumer names also struggled, with Myer off 3.1 per cent.

In corporate moves, DroneShield gained 6.5 per cent on US expansion plans, while James Hardie tumbled 4.9 per cent after Citi flagged risks to earnings expectations. Deterra Royalties rose 2 per cent on a $91 million asset sale.

Leaders

FRW Freightways Group Ltd (+8.41%)

VUL Vulcan Energy Resources Ltd (+6.11%)

DRO Droneshield Ltd (+5.23%)

PLS Pilbara Minerals Ltd (+4.59%)

MIN Mineral Resources Ltd (+4.07%)

Laggards

ALX Atlas Arteria (-5.40%)

TLX TELIX Pharmaceuticals Ltd (-5.01%)

JHX James Hardie Industries Plc (-4.87%)

MEZ Meridian Energy Ltd (-3.80%)

WBC Westpac Banking Corporation (-3.53%)