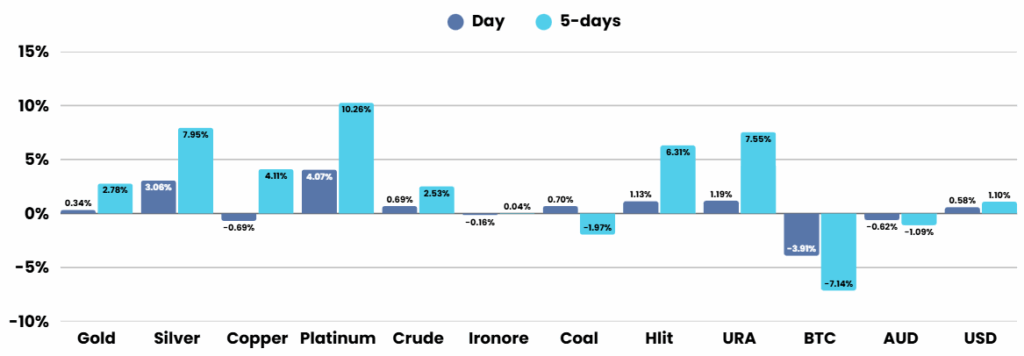

Overnight – Silver and Platinum surge to multi-decade highs

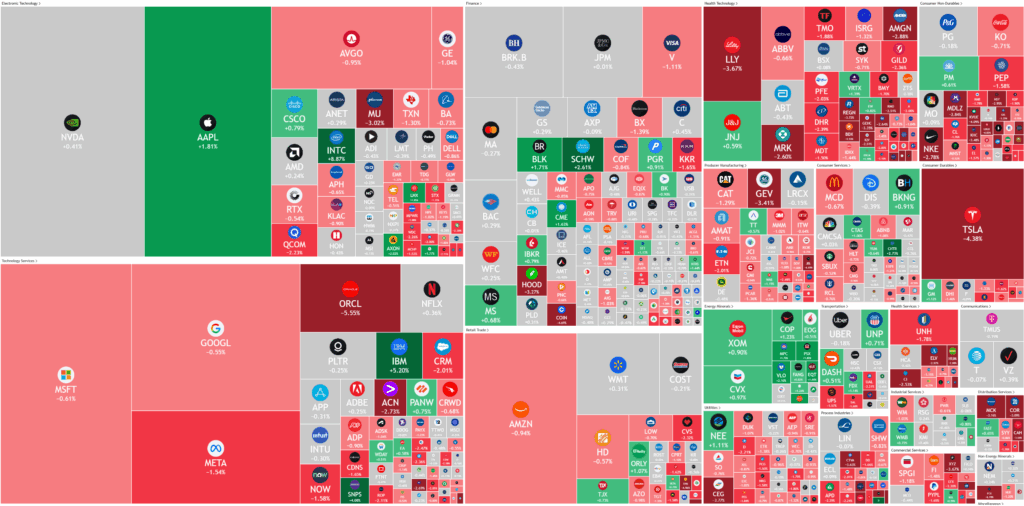

Stocks fell for a third-straight day as stronger-than-expected economic data dented hopes for deep Federal Reserve rate cuts. Despite this Silver and Platinum prices rallied to multi-decade highs as supply concerns and an imminent US Govt shutdown loom

Silver Futures climbed 2.1% to $45.13 per ounce and Platinum Futures rose 2.9% to $1,526.25 per ounce in the last 24 hours, while copper prices surged sharply after Freeport-McMoRan declared force majeure at its Grasberg mine in Indonesia.

U.S. economic data this week highlighted resilience, with jobless claims dropping by 14,000 to 218,000 and revised second-quarter GDP growth showing a stronger-than-expected 3.8% expansion after an earlier contraction. This positive momentum points to underlying strength in the labor market and the broader economy, though comments from Fed Chair Jerome Powell injected caution by stressing that there is “no risk-free path” in balancing inflation risks against labor market cooling. While the Fed recently cut rates by 25 basis points, uncertainty remains over how many additional reductions will be enacted this year, with projections split among policymakers.

Markets are also on alert as investors await the Fed’s preferred inflation measure, the personal consumption expenditures (PCE) index, while grappling with the possibility of a government shutdown. Lawmakers remain deadlocked over short-term funding measures, and reports indicate the White House has already instructed federal agencies to prepare for potential layoffs if a shutdown takes effect next week. The political standoff has added another layer of risk at a time when monetary policy and interest rate outlooks are already weighing heavily on investor sentiment.

In corporate earnings, results painted a mixed picture. Nvidia bounced nearly 1% as bargain hunters stepped in after recent weakness, while Intel surged on reports it has approached Apple for potential support amid its struggles in the chipmaking sector. In contrast, Stitch Fix and CarMax both tumbled as weak demand and disappointing financial results dragged down their outlooks. Accenture, however, delivered stronger-than-expected revenue and announced an $865 million restructuring plan, aimed at positioning the company to seize growing demand in digital and artificial intelligence services.

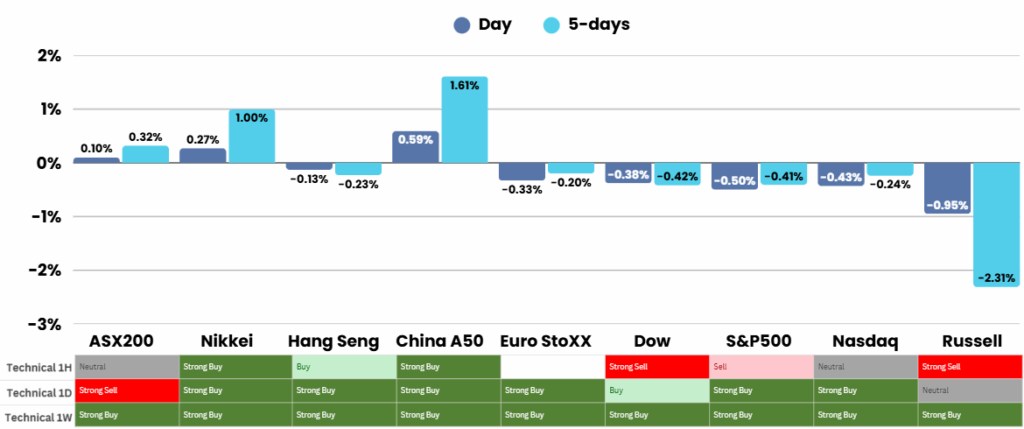

ASX Overnight: SPI 8810 (+0.01%)

The Day Ahead:

After 2 years of hibernation, it’s the materials sectors turn to take centre stage as Silver, Platinum and Copper are joining Gold’s rally.

A mud slide that literally wiped out 3% of global Copper supply last month at Freeport McMoRan’s Indonesian mine has placing the company in the unfortunate position of declaring force majeure* as the mine will be shut deep into 2026 or possible 2027

* Force majeure refers to a contractual provision that allows companies to suspend or alter their obligations when extraordinary and unforeseeable events—such as natural disasters, major equipment failures, or safety incidents—prevent them from fulfilling commitments, without penalty or liability.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.