What's Affecting Markets Today

Asia-Pacific Markets Mixed as Tech Stocks Weigh

Asia-Pacific equities traded in choppy fashion on Thursday, diverging from Wall Street, where selling in major technology names continued for a second session. Nvidia fell nearly 1 per cent overnight, extending earlier declines amid concerns about sustainability in the AI sector. Oracle also retreated, adding to the negative tone for global tech.

In Hong Kong, the Hang Seng Index edged 0.24 per cent higher, supported by the strong debut of Chery Automobile following its $1.2 billion IPO. The automaker’s shares jumped 11 per cent at the open, while Xiaomi gained 1.85 per cent after unveiling new smartphones and home appliances. On the mainland, the CSI 300 advanced 0.76 per cent.

South Korea’s Kospi hovered near flat, though defense names extended gains, with Korea Aerospace up 0.66 per cent and Poongsan 4 per cent higher. Internet giant Naver surged over 7 per cent on news of an investment in health startup GravityLabs.

Japan’s Nikkei 225 rose 0.2 per cent, the Topix added 0.43 per cent, while Australia’s ASX 200 firmed 0.21 per cent.

ASX Stocks

ASX 200 8,772.7 (+0.09%)

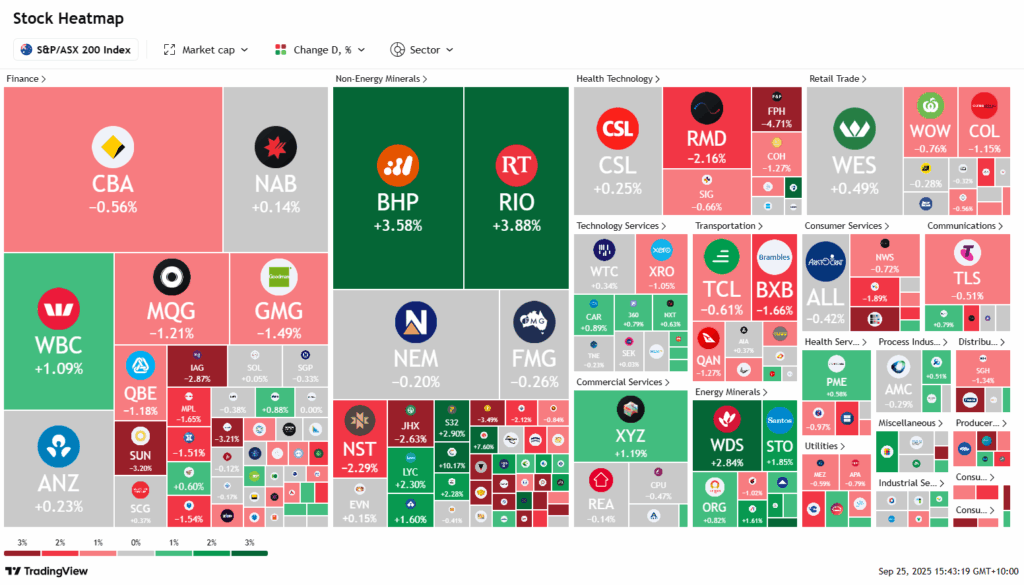

ASX Seesaws as Miners Rally on Copper Surge

The Australian sharemarket traded in a choppy fashion on Thursday, with strong gains in heavyweight miners offsetting weakness across property, industrials, technology and retail. The S&P/ASX 200 index edged up 5.6 points, or 0.1 per cent, to 8770.1 by mid-afternoon, despite a lacklustre lead from Wall Street, where the S&P 500 slipped 0.3 per cent on profit-taking after the US Federal Reserve’s cautious tone on rate cuts.

BHP and Rio Tinto both climbed more than 3 per cent as copper prices hit a one-year high following supply disruptions at Freeport-McMoRan’s Grasberg mine. Sandfire Resources surged 7.4 per cent and Capstone Copper gained nearly 10 per cent. Oil producers Woodside and Santos also advanced, tracking firmer crude prices on renewed geopolitical concerns.

Banks were mixed, while gold stocks weakened on a stronger US dollar. Rate-sensitive sectors, including property and consumer discretionary, declined after Australia’s hotter inflation print tempered expectations for a November rate cut. In company news, Premier Investments rose on a slight earnings beat, while Macquarie Group fell after a $321 million settlement with regulators.

Leaders

DVP Develop Global Ltd (+9.87%)

CSC Capstone Copper Corp (+9.68%)

SFR Sandfire Resources Ltd (+7.76%)

KAR Karoon Energy Ltd (+5.98%)

CU6 Clarity Pharmaceuticals Ltd (+5.37%)

Laggards

ALK Alkane Resources Ltd (-9.22%)

EOS Electro Optic Systems Holdings Ltd (-6.69%)

DRR Deterra Royalties Ltd (-6.09%)

CYL Catalyst Metals Ltd (-5.74%)

DYL Deep Yellow Ltd (-5.37%)