What's Affecting Markets Today

Asian Pharma Stocks Slide as Trump Unveils Fresh Tariffs

Asian equity markets were mixed on Friday, with pharmaceutical shares under sharp pressure after U.S. President Donald Trump announced sweeping new tariffs on key imports, including drugs, furniture and heavy trucks.

From October 1, all branded or patented pharmaceutical products entering the U.S. will face a 100 per cent tariff unless their manufacturers establish local production facilities. The announcement sparked a sell-off across the region’s pharma sector. Japan’s Topix Pharma Index fell 1.39 per cent, led by declines in Daiichi Sankyo (–3.34%), Chugai Pharmaceutical (–2.18%) and Sumitomo Pharma (–3.03%). South Korean majors Samsung Biologics and SK Bio Pharmaceuticals slid 1.66 and 2.66 per cent, respectively, while Hong Kong-listed Wuxi Biologics dropped 2.95 per cent. Alibaba Health and Sino Biopharmaceutical also weakened.

Trump also announced a 25 per cent levy on imported heavy trucks, a 50 per cent tariff on cabinets and vanities, and 30 per cent on upholstered furniture.

Meanwhile, regional markets were mixed. Japan’s Topix rose 0.59 per cent to a record, while South Korea’s Kospi fell 2.02 per cent. Hong Kong’s Hang Seng slipped 0.86 per cent, and Australia’s ASX 200 traded flat.

ASX Stocks

ASX 200 8,789.50 (+0.19%)

Miners and Banks Offset Pharma Slump; Vulcan Soars on Plant Deal

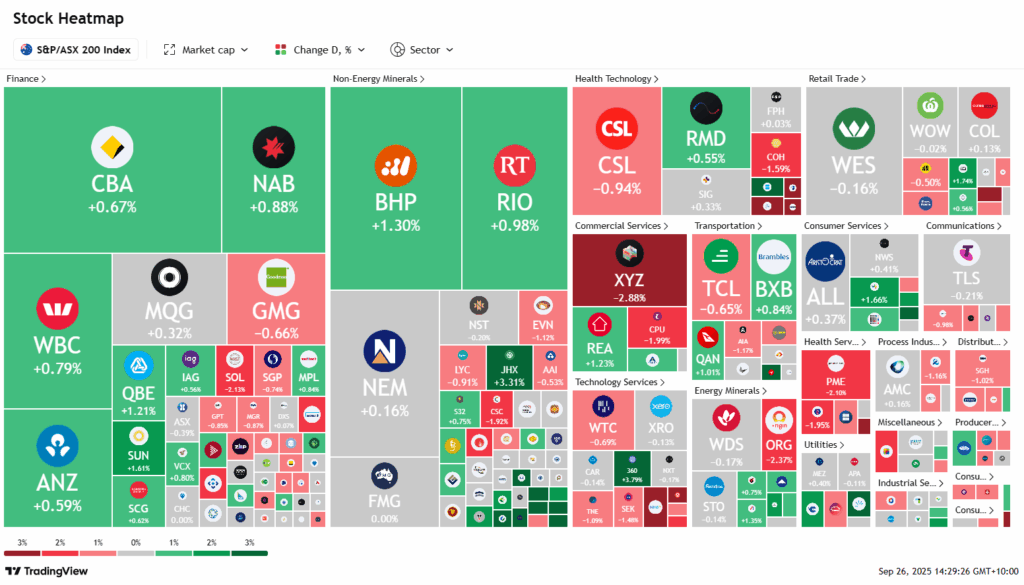

The Australian sharemarket eked out modest gains on Friday as strength in miners and banks outweighed steep losses across the healthcare sector. The S&P/ASX 200 edged 11.6 points higher, or 0.1 per cent, to 8758.6 in early afternoon trade, with four of the 11 industry groups in positive territory.

Healthcare lagged after the White House confirmed a 100 per cent tariff on branded pharmaceutical imports from October unless manufacturers establish US facilities. CSL slipped 1.9 per cent, Telix lost nearly 3 per cent, and Pro Medicus dropped 2.2 per cent. Analysts cautioned on potential supply chain vulnerabilities, though Citi flagged CSL’s relative flexibility.

By contrast, resource stocks advanced as silver hit a 14-year high. Unico Silver surged 16 per cent, Andean Silver rose 6.2 per cent, and Silver Mines climbed 5.7 per cent. Lithium also rallied, with Evergreen Lithium up 32 per cent and Liontown 6.3 per cent firmer. The major banks added up to 1.1 per cent, led by NAB.

Corporate highlights included Vulcan Energy, which surged 15 per cent on a €110m contract for a German geothermal power plant. Fortescue was flat despite unveiling clean-energy partnerships, while Elanor Commercial Property firmed after rejecting a takeover bid.

Leaders

DTR Dateline Resources Ltd (+16.25%)

VUL Vulcan Energy Resources Ltd (+15.10%)

LTR Liontown Resources Ltd (+6.63%)

PNR Pantoro Gold Ltd (+5.81%)

IPX Iperionx Ltd (+5.23%)

Laggards

PNV Polynovo Ltd (-6.16%)

BVS Bravura Solutions Ltd (-5.10%)

CMW Cromwell Property Group (-5.05%)

HUB HUB24 Ltd (-4.07%)

MSB Mesoblast Ltd (-3.82%)