Overnight – Stocks shrug off…. Everything, as Government heads for shutdown

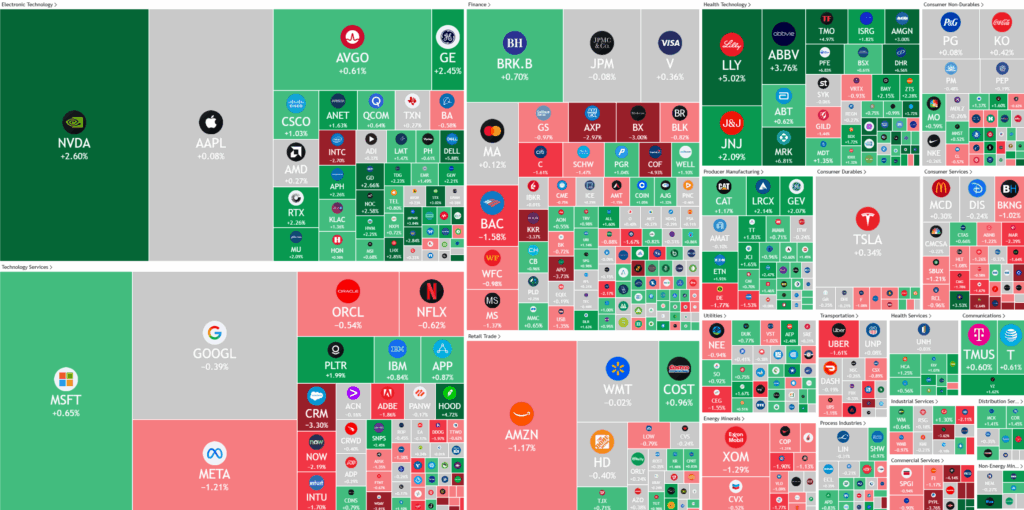

Stocks shrugged off an almost certain Govt shutdown, high valuations, overly ambitious rate cut expectations and more tariffs to finish higher in what can only be described as a bulletproof market

The United States is on the verge of a government shutdown as Congress struggles to pass a funding extension beyond Tuesday. Vice President JD Vance warned that the outcome looks likely after negotiations between President Donald Trump and bipartisan leaders failed to reach progress. The deadlock is primarily focused on disagreements over healthcare and social welfare spending. While Republicans maintain a slight majority in the Senate, they lack the 60 votes required to advance their proposal. Shutdowns have historically provided limited impact on corporate earnings but can cause broader economic disruptions. The last such shutdown occurred in 2018–2019, lasting 35 days and costing the economy an estimated $11 billion in GDP. A new shutdown threatens to delay the release of September’s crucial jobs report, which could affect expectations around future Federal Reserve interest rate moves.

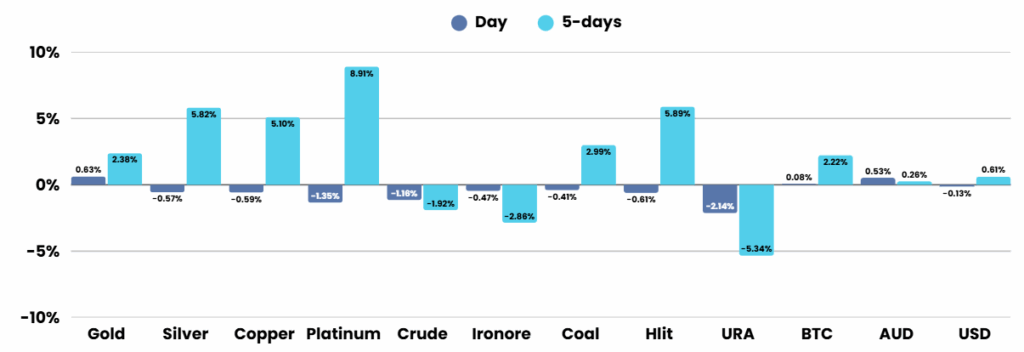

At the same time, markets face fresh uncertainty from new tariffs announced by President Trump on imports of lumber, furniture, and kitchen fittings. The measures, set to take effect on October 14, include a 10% tariff on softwood lumber and 25% tariffs on kitchen cabinets, vanities, and upholstered wooden products. These tariffs are intended to bolster U.S. manufacturing and stem reliance on foreign goods, following a Commerce Department investigation. Separately, Pfizer is preparing to announce an agreement to lower Medicaid drug prices in exchange for a three-year reprieve from pharmaceutical tariffs, while also advancing plans to expand its manufacturing presence in the U.S.

Meanwhile, the technology sector showed notable strength as AI-linked stocks rebounded. CoreWeave surged 12% after securing a $14.2 billion deal to supply AI cloud hardware to Mea, while Nvidia extended earlier gains with a 2% increase as investors sought to capitalize on a recent dip. The renewed investor enthusiasm for AI underscores the sector’s role as a key driver of market momentum, even amid broader concerns tied to potential government disruption and increased trade tensions.

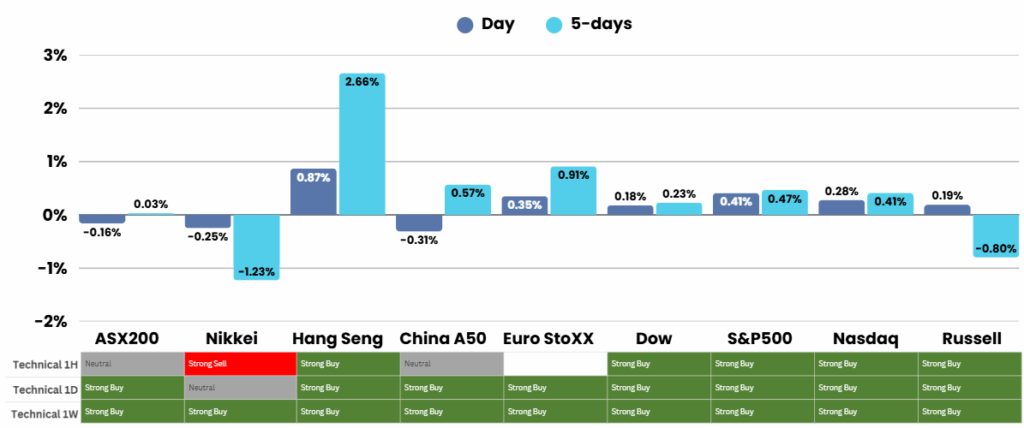

ASX Overnight: SPI 8862 (-0.11%)

The Day Ahead:

The ASX is likely to head lower over the day as the Aussie markets ability to climb the “wall of worry” is no where near the US investors skill level of remaining bullish. Add to this a hawkish RBA yesterday wont fill ASX investors with optimism

BHP was banned by Chinese authorities for Iron Ore imports, the first such ban on a single company. The negotiation tactic has been used in other forms in the past with the Chinese trying to boycott Aussie iron ore back in 2008-2009 with no success. BHP fell 5% on the news in London, but finished down just 1% in New York trade

Yesterdays Session:

The Reserve Bank of Australia kept the cash rate steady at 3.6 per cent amid ongoing economic uncertainty, despite rising inflation and weaker employment numbers in recent data; markets are split on the likelihood of a November rate cut, while the Australian dollar and bond yields rose, and gold miners led stock gains following a new record high in bullion prices

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.