What's Affecting Markets Today

Asia-Pacific Markets Mixed as Gold Hits Record, BOJ Tankan Survey Disappoints

Asia-Pacific equities delivered a mixed performance on Wednesday as investors weighed Wall Street’s overnight gains against regional economic developments and the looming U.S. government shutdown.

Spot gold touched another record at US$3,875.32 an ounce, reflecting safe-haven demand as political uncertainty persisted in Washington.

In Japan, the Bank of Japan released its closely watched Tankan survey for the third quarter. Business sentiment among large manufacturers improved to +14 from +13 in the prior quarter but fell short of the +15 forecast. The non-manufacturing index held steady at +34, underscoring strength in services. Japanese equities reacted negatively, with the Nikkei 225 down 1.16% and the broader Topix losing 1.71%.

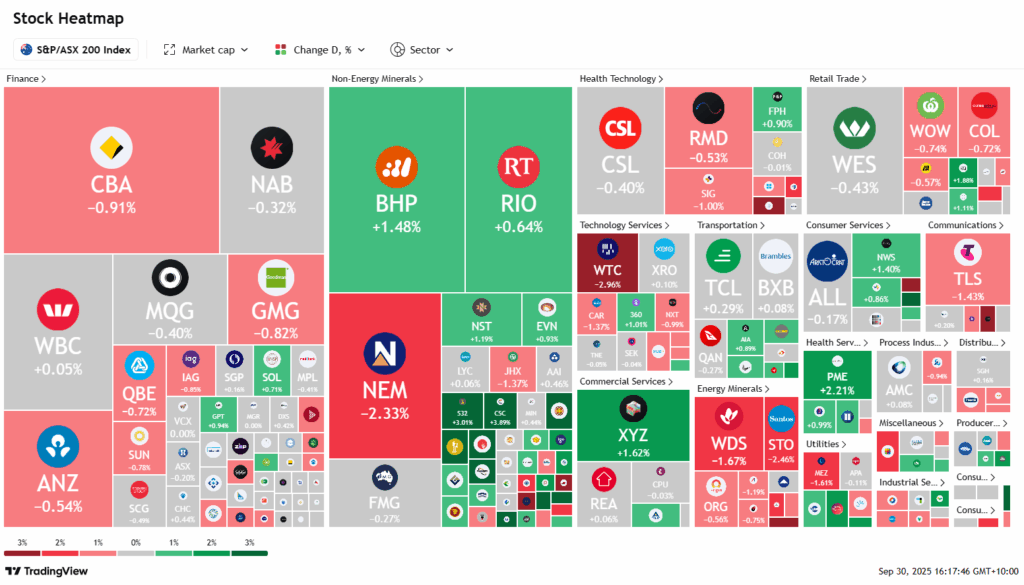

Elsewhere, Taiwan’s Weighted Index led regional gains, climbing 1.14% as healthcare and technology stocks rallied. Semiconductor giant TSMC advanced 2.3% following Nvidia’s surge past a US$4.5 trillion valuation. South Korea’s Kospi rose 0.79% while the Kosdaq gained 0.56%. Australia’s S&P/ASX 200 slipped 0.26%. Mainland Chinese and Hong Kong markets were closed for a holiday.

ASX Stocks

ASX 200 8,825.1 (-0.27%)

ASX Seesaws as Gold Hits Record Amid US Shutdown Concerns

The Australian sharemarket traded lower on Wednesday as investors weighed the likelihood of a looming US government shutdown. After rising 0.2 per cent in early trade, the S&P/ASX 200 reversed course to fall 34.8 points, or 0.4 per cent, by mid-afternoon. Losses in energy, consumer discretionary and major banks outweighed gains in healthcare and utilities.

Market nerves were fuelled by uncertainty in Washington, where President Donald Trump’s threats to cut programs heightened fears of a federal shutdown that could delay critical economic data. Gold surged to a fresh record of US$3,875.53 an ounce, with Westgold Resources rallying 11.3 per cent on plans to lift production.

Resource stocks were volatile: BHP slid 1.8 per cent amid reports of Chinese import restrictions, while lithium miners sold off sharply following reserve approvals in China. In contrast, DroneShield extended its rally, soaring 15.5 per cent, while Bravura Solutions jumped 19.2 per cent after lifting guidance. Austal rose 3.8 per cent on a new US Navy agreement.

Leaders

BVS Bravura Solutions Ltd (+19.76%)

DRO Droneshield Ltd (+15.34%)

WGX Westgold Resources Ltd (+11.16%)

4DX 4DMEDICAL Ltd (+6.57%)

A2M The a2 Milk Company Ltd (+5.21%)

Laggards

LTR Liontown Resources Ltd (-10.15%)

PLS Pilbara Minerals Ltd (-6.94%)

VUL Vulcan Energy Resources Ltd (-6.17%)

XYZ Block, Inc (-5.64%)

MIN Mineral Resources Ltd (-3.89%)