Overnight – Stocks rise as Investors bet Govt shutdown will trigger rate cuts

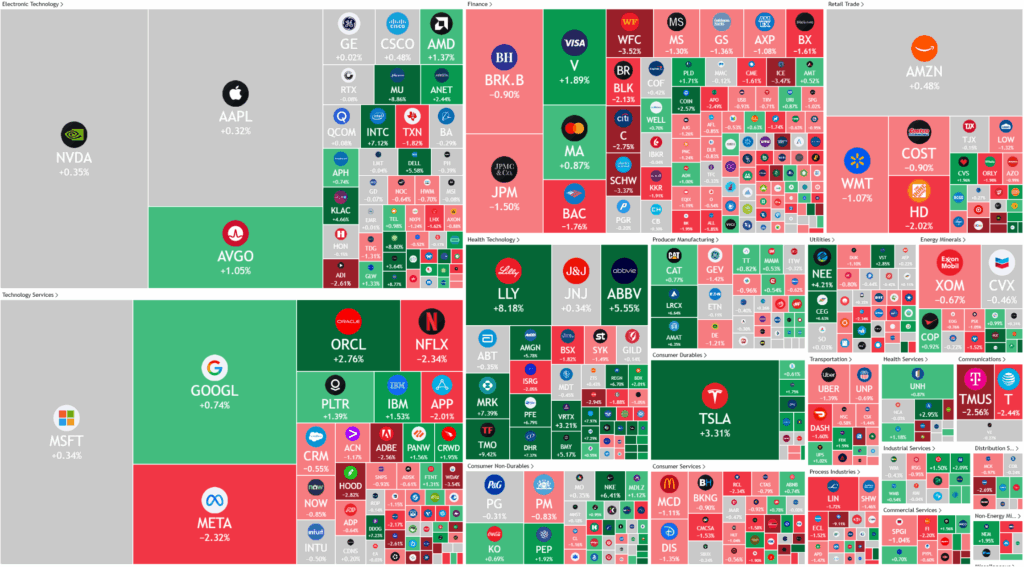

Investors strapped on the “Rose coloured glasses” overnight as stocks rose on bets the US government shutdown will trigger rate cuts.

A U.S. government shutdown has begun after Senate Democrats rejected a Republican-backed funding bill that lacked provisions to continue healthcare subsidies. The impasse, which follows the House’s passage of the bill earlier this month, has resulted in thousands of federal employees facing the possibility of furloughs and services such as air traffic control and disaster relief being disrupted. While Wall Street analysts believe the economic impact will be limited if the shutdown is brief, some warn that an extended standoff could worsen existing concerns about a weakening labor market and prompt volatility in stocks and bonds.

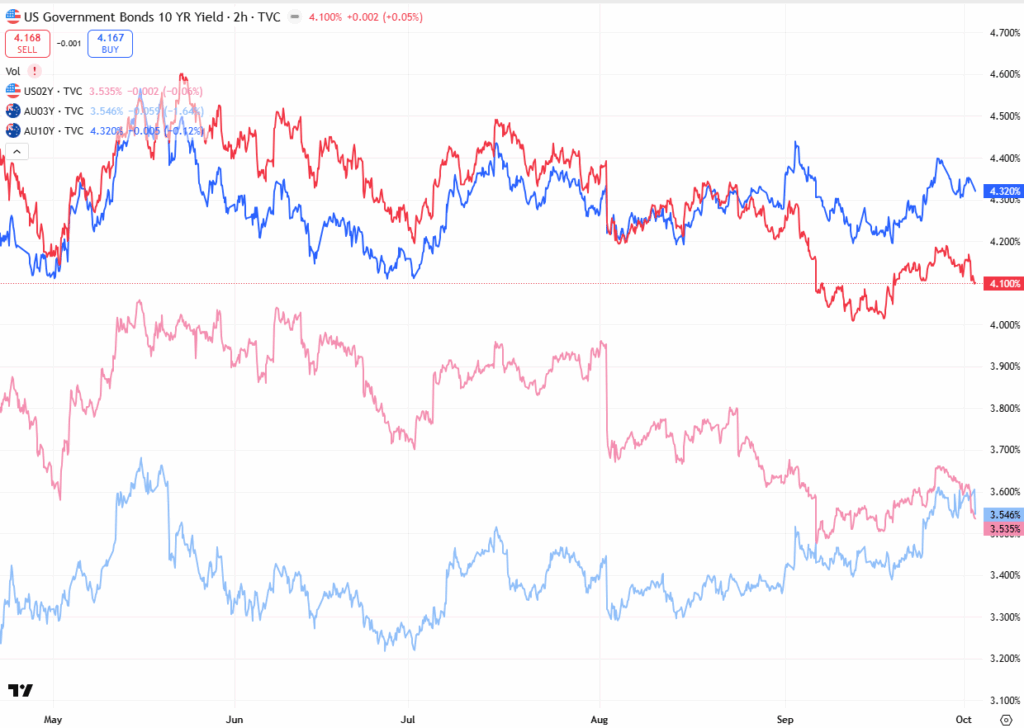

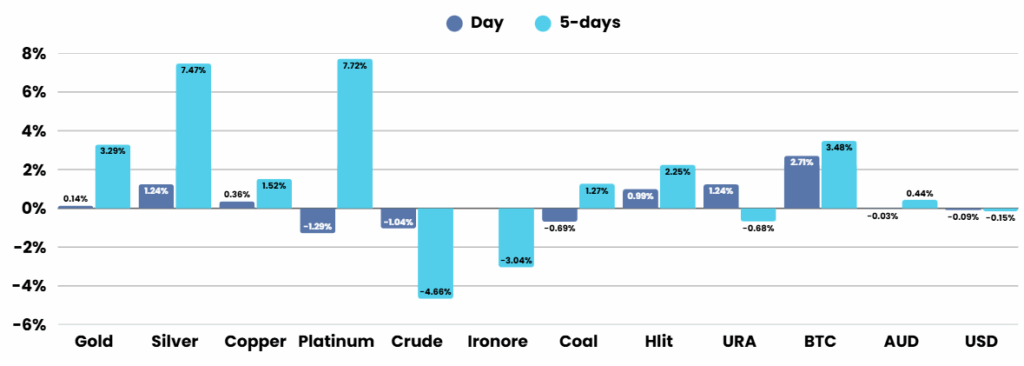

Labor market worries deepened after new data showed that U.S. private payrolls fell by 32,000 in September, the largest monthly drop in over two years. August’s figures were also revised downward, amplifying concerns about an already cooling jobs market. This backdrop has boosted expectations of further Federal Reserve rate cuts, reflected in falling Treasury yields. However, the shutdown is likely to delay the release of the closely watched nonfarm payrolls report, depriving investors of a key indicator that could confirm whether job losses are continuing at an accelerating pace. Analysts cautioned that while the delay might temporarily shield markets from negative data, it risks masking deeper weaknesses.

In corporate news, Nike shares rose after the sportswear giant delivered stronger-than-expected earnings and revenue, signaling early progress in its turnaround plan despite international headwinds. Intel stock surged on reports it may add longtime rival AMD as a manufacturing customer, a move that could reshape the semiconductor industry. By contrast, Netflix shares slipped after Elon Musk urged his followers to cancel subscriptions in protest of the platform’s content, while packaged food giant Conagra Brands gained after posting robust earnings despite inflationary pressures and cautious consumer spending.

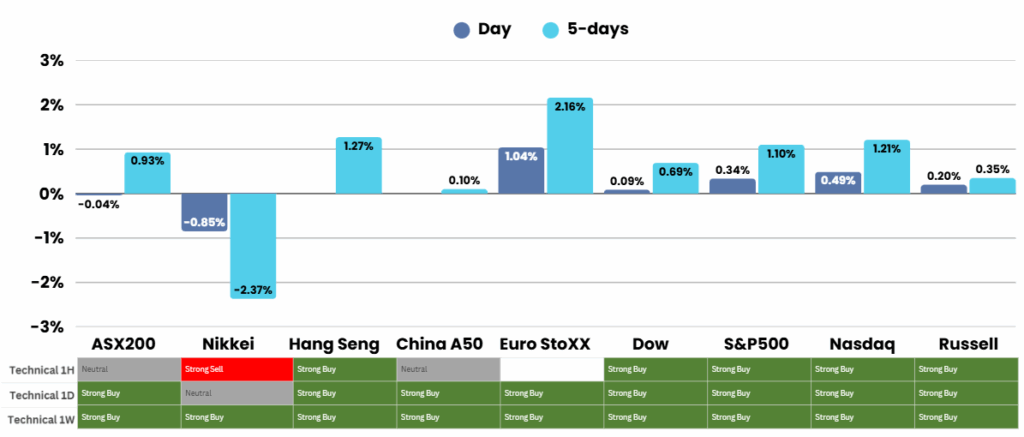

ASX Overnight: SPI 8921 (+0.49%)

The Day Ahead:

The fear from ASX investors was made a mockery of by US markets as US investors didn’t just climb the “wall of worry” they just tore it down. Expect the ASX to have some initial buying on the open and grind higher over the day.

Yesterdays Session:

The Australian sharemarket fell on Wednesday as investor concerns over a potential US government shutdown weighed on sentiment, with the S&P/ASX 200 dropping 0.4 per cent by mid-afternoon. Losses in energy, consumer discretionary, and major banks offset gains in healthcare and utilities, while gold hit a record high. Resource stocks were mixed, with BHP and lithium miners sliding, but standout performers included DroneShield, Bravura Solutions, and Austal, which all posted strong gains on company-specific news.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.