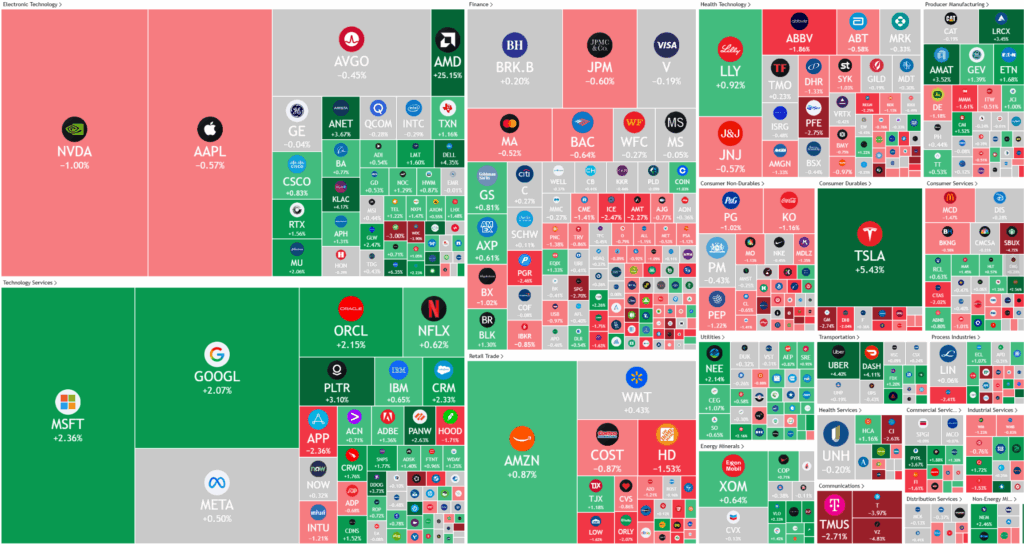

Overnight – AMD Deal leads tech & S&P500 higher

Stocks headed higher as AMD surged following a deal with AI-darling OpenAI, lifting broader tech and overshadowing an ongoing government shutdown.

Treasury Secretary Scott Bessent warned that the current U.S. government shutdown could inflict deeper economic damage than previous ones, even as analysts suggested that markets remain more sensitive to labor market weakness than fiscal disruptions. The recent cooling in labor conditions poses a greater risk to equities, Treasury yields, and the dollar. The absence of key government data releases, particularly the nonfarm payrolls report, has intensified uncertainty for markets and policymakers, given the Federal Reserve’s reliance on such statistics when shaping interest rate decisions.

Economic indicators in recent weeks have offered mixed signals. Layoffs have eased, but private payroll growth slowed, and the ISM non-manufacturing PMI fell to 50, suggesting stagnant services activity and persistent employment weakness. The data delays caused by the shutdown have forced analysts and traders to rely more heavily on private-sector surveys and trackers, which currently project elevated inflation risks and deteriorating business confidence. This lack of official data comes at a crucial time, with the Fed’s next rate decision due later this month and investors broadly anticipating additional rate cuts despite the uncertainty.

In the corporate sphere, several major developments captured market attention. Applied Materials reduced its revenue outlook amid export restriction concerns, while Palantir shares slid after a U.S. Army memo raised system security issues. Conversely, USA Rare Earth stock surged following reports of discussions with the Trump administration, and Entergy revealed plans to provide power for Google’s $4 billion Arkansas data center. The political standoff prolonging the shutdown has also intensified, with threats of widespread federal worker layoffs should negotiations fail, deepening worries about consumer spending and confidence.

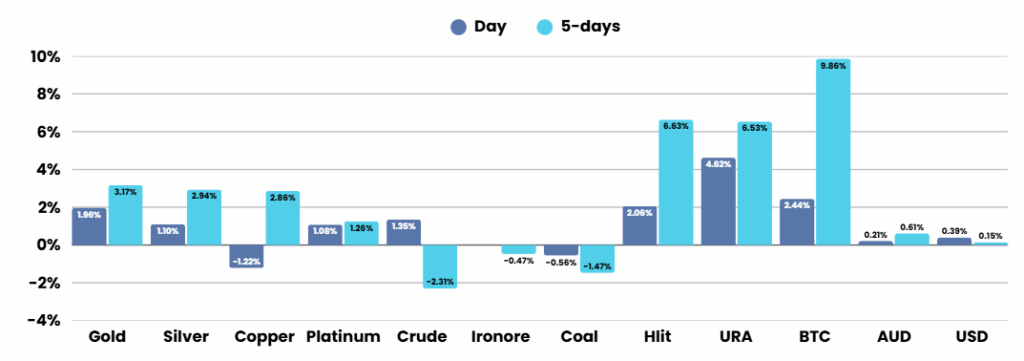

Meanwhile, shares in Advanced Micro Devices (AMD) soared 29% after announcing a multiyear agreement to supply AI chips to OpenAI, a deal projected to generate tens of billions in annual revenue and potentially include a 10% equity stake acquisition by OpenAI. This partnership positions AMD at the core of the AI hardware market, with plans to deploy massive GPU capacity from 2026 onward. In other stock moves, Constellation Brands prepared to report earnings amid tariff pressures, Critical Metals Corp. surged after reports of a potential federal equity investment in its Greenland rare earth project, Starbucks rose amid cost-cutting store closures, and Tesla advanced after reports of a potential tariff exemption alongside renewed optimism for a forthcoming model launch.

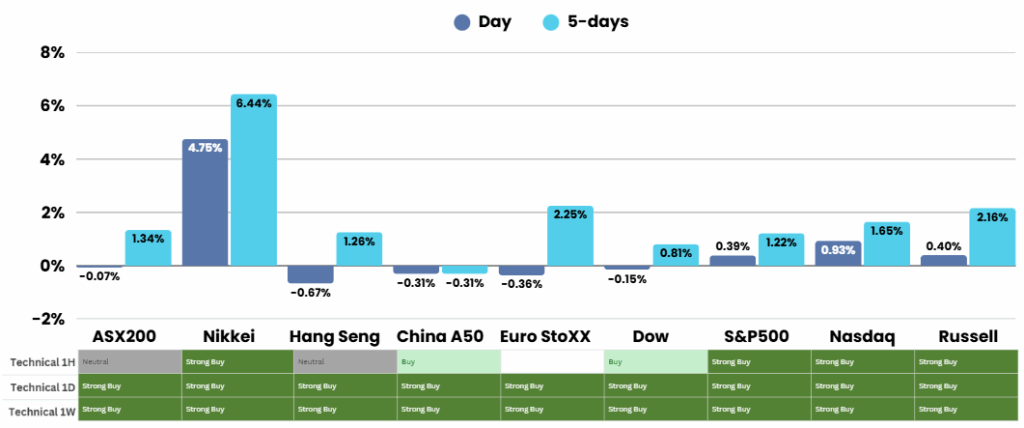

ASX Overnight: SPI 9017 (+0.10%)

The Day Ahead:

The ASX should head to fresh records today as the markets ability to filter out the bad and focus on the good reaches new levels.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.