Overnight – Stocks fall as investors question Oracle’s margins on Nvidia Chips

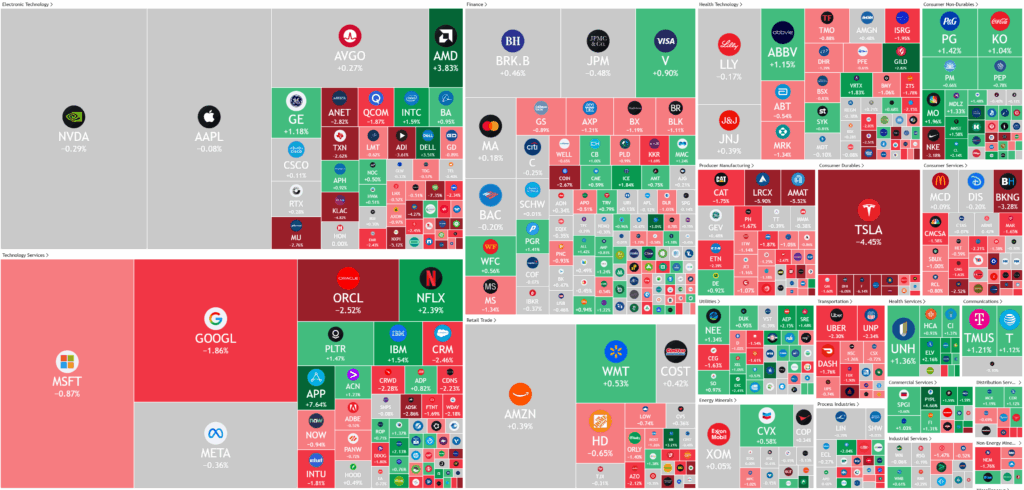

Stocks fell overnight as questions around the profitability of AI margins were raised as internal Oracle memos suggested the companies margins were softer than stated on renting Nvidia chips .

Oracle shares experienced a sharp decline of over 5% after reports indicated its cloud business margins are softer than anticipated, due in part to a nearly $100 million loss from renting Nvidia chip access. This set a negative tone for the broader tech sector, with Alphabet and Meta both falling more than 1%. However, Dell provided a positive counterpoint by raising its long-term revenue and earnings forecasts, citing strong prospects in AI and data center infrastructure, which pushed its shares up over 4%.

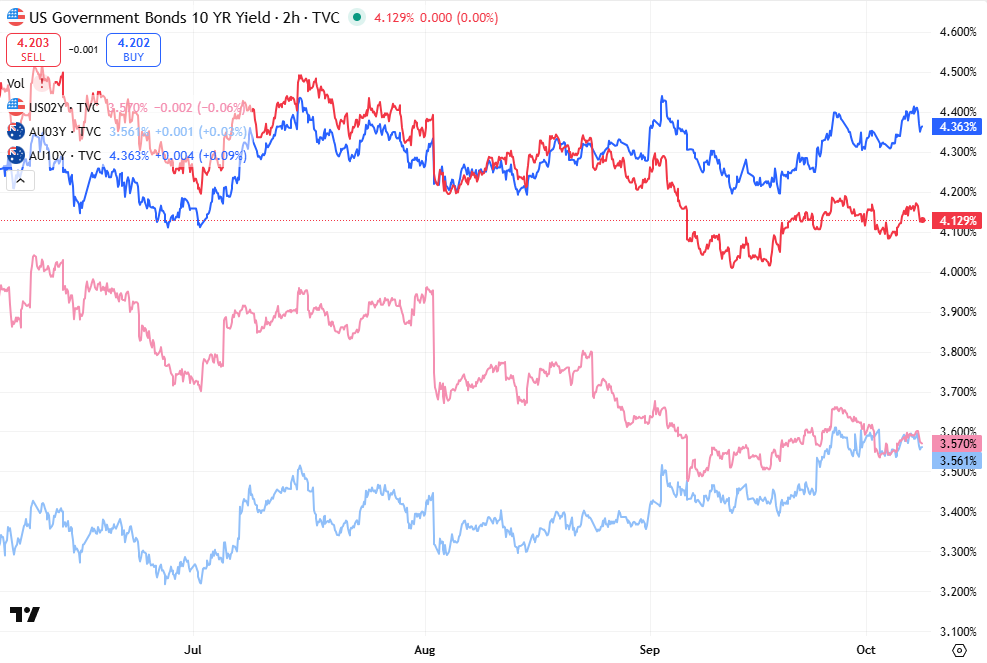

The ongoing federal government shutdown has entered its second week, delaying crucial economic data releases and complicating the Federal Reserve’s decision-making process regarding interest rates. Despite the logistical hurdles, some Fed-linked data and member speeches are still expected. President Trump has signaled openness to a compromise over healthcare subsidies, potentially paving the way for progress in negotiations with Democrats to resolve the standoff.

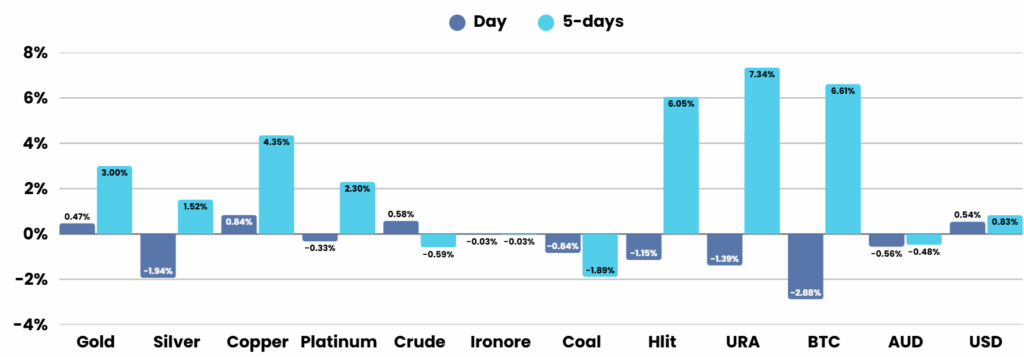

In the automotive sector, Tesla is expected to unveil a more affordable Model Y, aiming to build on recent strong sales, though future growth may slow due to U.S. tax credit expirations. Ford shares slid following supply chain disruptions, while Constellation Brands saw a modest rise after reporting better-than-expected sales despite immigration concerns. Meanwhile, gold prices reached a record high near $4,000 an ounce, buoyed by safe-haven demand amid U.S. political uncertainty and expectations of a Federal Reserve rate cut, while oil prices declined due to concerns over a supply glut despite smaller OPEC+ output increases.

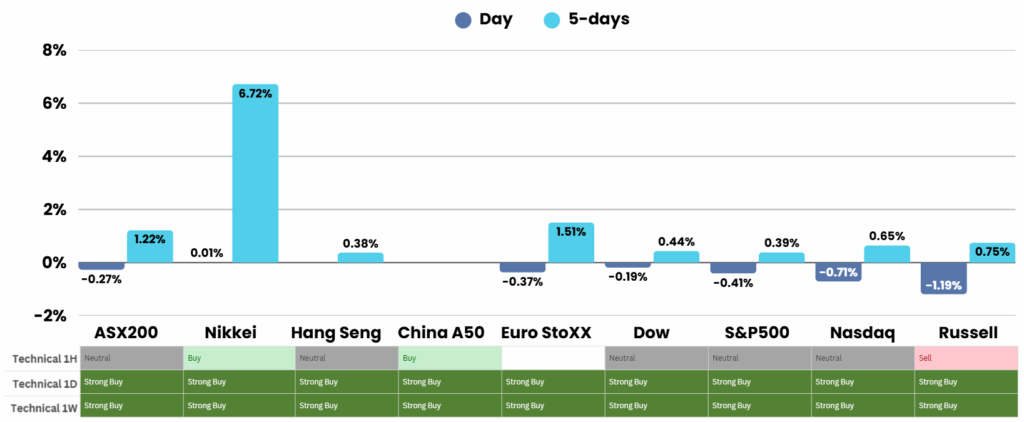

ASX Overnight: SPI 8986 (FLAT)

The Day Ahead:

There is likely to be a continued holding pattern around the highs today as the market takes a breather. Healthcare should remain resilient as the sector continues to steady after a rough 3-4 months

James Hardie soared 8.91 per cent in New York overnight after the dual-listed building-materials company reported preliminary net sales for the second quarter that beat the average analyst estimate

Yesterdays Session:

Australian shares fell on Tuesday despite Wall Street’s gains, with the S&P/ASX 200 down 0.3 per cent to 8952.1 as all sectors traded lower. Communication services led declines, particularly REA Group, Seek, and CAR Group, while financials and consumer stocks also weakened. ASX Limited slipped after new competition approval for Cboe Australia, and Breville tumbled 5.1 per cent. Gold prices surged to a record near $US4000 an ounce, boosting Newmont slightly. Among individual movers, Rio Tinto reaffirmed its Pilbara expansion, Web Travel rose on strong guidance, while St Barbara and Brisbane Broncos plunged after capital raising and post-final losses, respectively.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.