What's Affecting Markets Today

Gold Hits Record $4,000 as Safe-Haven Demand Surges; Asia Markets Mixed

Spot gold prices reached a historic $4,000 an ounce on Wednesday as investors sought safety amid global political and economic uncertainty. Vivek Dhar, head of commodities at Commonwealth Bank of Australia, said the surge “likely reflects safe-haven demand tied to the U.S. government shutdown and the resignation of France’s prime minister, Sebastien Lecornu.” The rally follows months of volatility sparked by U.S. tariff tensions that rattled global markets.

Across Asia, markets traded mixed despite Wall Street’s pullback, buoyed by an improved World Bank growth forecast for the region. Hong Kong’s Hang Seng Index slipped 1.01%, though CF PharmTech shares soared 224% on debut after raising $78 million, underscoring renewed strength in the city’s IPO market. Japan’s Nikkei 225 was flat while the Topix rose 0.66%, and the yen weakened to 152.48 per dollar.

Australia’s ASX 200 fell 0.3%, while China and South Korea remained closed for holidays. In New Zealand, the central bank cut rates by 50 basis points to 2.5%, citing weak mid-2025 economic activity.

ASX Stocks

ASX 200 8,937.2 (-0.22%)

ASX Slips as Retail and Tech Weigh; James Hardie and Mesoblast Lead Gainers

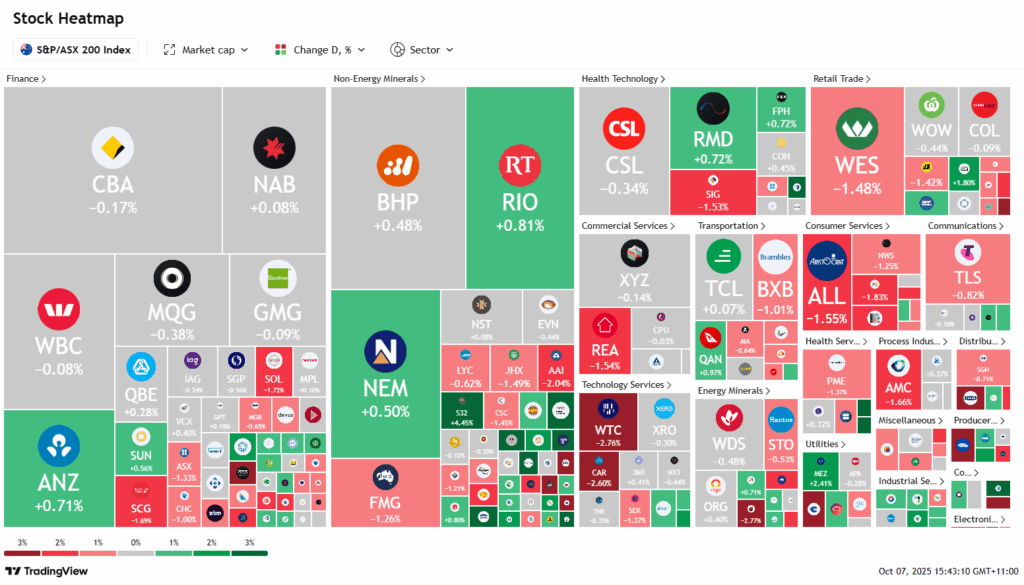

The Australian sharemarket edged lower on Wednesday, with the S&P/ASX 200 slipping 6.3 points to 8950.5 as weakness in retail and technology stocks offset gains elsewhere. Profit-taking in gold miners also dragged on sentiment, despite bullion briefly topping US$4000 an ounce amid a U.S. government shutdown and softer Wall Street trade.

Wesfarmers led the consumer discretionary sector down 2.3%, with JB Hi-Fi, Myer, and Harvey Norman also weaker. Tech names followed global peers lower, including Life360 (-3.3%), NextDC (-1.8%), and Xero (-1.7%).

In contrast, James Hardie surged 10.5% after quarterly sales beat estimates, while Mesoblast rallied another 10.5% on stronger U.S. revenue for its Ryoncil therapy. NRW Holdings gained 2.8% following a guidance upgrade and a $200 million acquisition, and DroneShield rose 5.6% after announcing faster detection software.

Apiam Animal Health jumped 8.1% as private equity suitor Adamantem completed due diligence, while Catalyst Metals slid 4.5% after weaker gold output.

Leaders

MSB Mesoblast Ltd (+10.30%)

JHX James Hardie Industries Plc (+9.79%)

L1G L1 Group Ltd (+7.04%)

DRO Droneshield Ltd (+6.02%)

LTR Liontown Resources Ltd (+5.41%)

Laggards

DTR Dateline Resources Ltd (-26.77%)

EOS Electro Optic Systems Holdings Ltd (-5.53%)

4DX 4DMEDICAL Ltd (-4.20%)

CYL Catalyst Metals Ltd (-3.55%)

FBU Fletcher Building Ltd (-3.41%)