What's Affecting Markets Today

South Korean Chip Stocks Surge to Record Highs on AI Momentum

South Korean semiconductor giants SK Hynix and Samsung Electronics surged to record highs on Friday as investors returned from a weeklong holiday to renewed optimism around artificial intelligence partnerships. SK Hynix jumped 10%, while Samsung gained nearly 6%, buoyed by a series of AI-related deals and growing global demand for high-performance chips.

The rally followed reports that OpenAI plans to take a 10% stake in Advanced Micro Devices (AMD), sending AMD shares up more than 40% this week. Nvidia also rose 2.6% after CEO Jensen Huang told CNBC that demand has accelerated in recent months and confirmed the company’s role in financing Elon Musk’s AI startup, xAI.

Elsewhere, Asia-Pacific markets were mixed. Japan’s Nikkei 225 slipped 0.33% and the Topix declined 0.92%. South Korea’s Kospi added 0.66% while the small-cap Kosdaq eased 0.37%. Australia’s S&P/ASX 200 lost 0.26%, and Hong Kong’s Hang Seng Index fell 1%, with China’s CSI 300 down 1.01% amid continued investor caution.

ASX Stocks

ASX 200 8,958.3 (-0.13%)

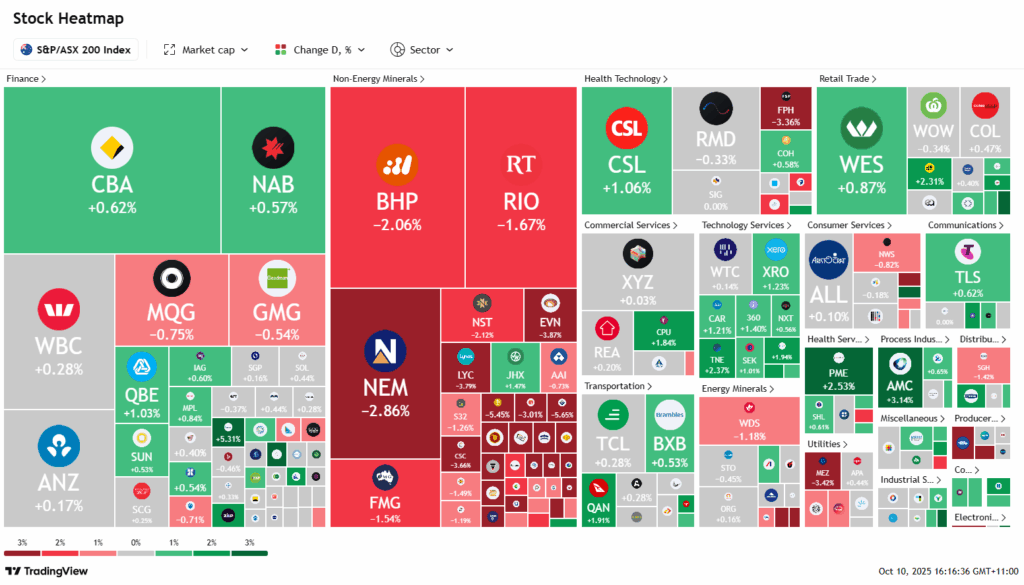

ASX Falls as Gold Stocks Plummet on Gaza Ceasefire News

The Australian sharemarket edged lower on Friday, weighed down by sharp losses in gold and energy stocks after a breakthrough ceasefire agreement between Israel and Hamas triggered a broad risk-off sentiment. The S&P/ASX 200 slipped 11.1 points, or 0.1 per cent, to 8958.7, with eight of 11 sectors finishing higher.

Gold miners led the declines as bullion dropped 1.6 per cent to $US3976 an ounce. Regis, Ramelius and Genesis each tumbled more than 4 per cent, while Alkane sank 7.3 per cent. Oil producers also weakened, with Woodside down 1.4 per cent and Beach Energy 2.2 per cent lower, as crude prices retreated on easing geopolitical tensions.

Iron ore majors were also under pressure amid reports of a price dispute between BHP and China’s state buyer, with BHP down 2 per cent and Rio Tinto off 2.1 per cent. Offsetting some of the weakness, tech stocks gained on Wall Street momentum, with Life360 up 2.7 per cent and NextDC adding 1.4 per cent.

Leaders

L1G L1 Group Ltd (+17.32%)

DTR Dateline Resources Ltd (+9.09%)

TPW Temple & Webster Group Ltd (+5.24%)

SLX SILEX Systems Ltd (+5.23%)

NWL Netwealth Group Ltd (+5.22%)

Laggards

PNR Pantoro Gold Ltd (-10.31%)

ALK Alkane Resources Ltd (-7.97%)

CHN Chalice Mining Ltd (-7.65%)

EOS Electro Optic Systems Holdings Ltd (-7.62%)

C79 Chrysos Corporation Ltd (-5.99%)