What's Affecting Markets Today

Asia-Pacific Markets Slide as U.S.-China Trade Tensions Escalate

Asia-Pacific markets fell sharply Monday after the U.S. and China reignited trade tensions, with both nations tightening restrictions and trading new accusations. Hong Kong’s Hang Seng Index slumped 3.4%, while China’s CSI 300 dropped 1.8%. The offshore yuan edged 0.1% higher to 7.1267 per dollar, and 10-year Chinese government bond yields fell more than five basis points to 1.75%.

China’s Ministry of Commerce accused Washington of “double standards” after U.S. President Donald Trump pledged to impose an additional 100% tariff on Chinese imports in retaliation for Beijing’s rare earth export curbs. In response, China declared it was “not afraid” of a trade war.

Despite the political friction, China’s exports rose 8.3% year-on-year in September, the fastest pace in six months, while imports logged their strongest increase in over a year.

Elsewhere, Australia’s ASX 200 fell 0.68%, South Korea’s Kospi plunged 2.35%, and Singapore’s index slipped 1.5%. Japanese markets were closed for a holiday.

ASX Stocks

ASX 200 8,869.5 (-0.99%)

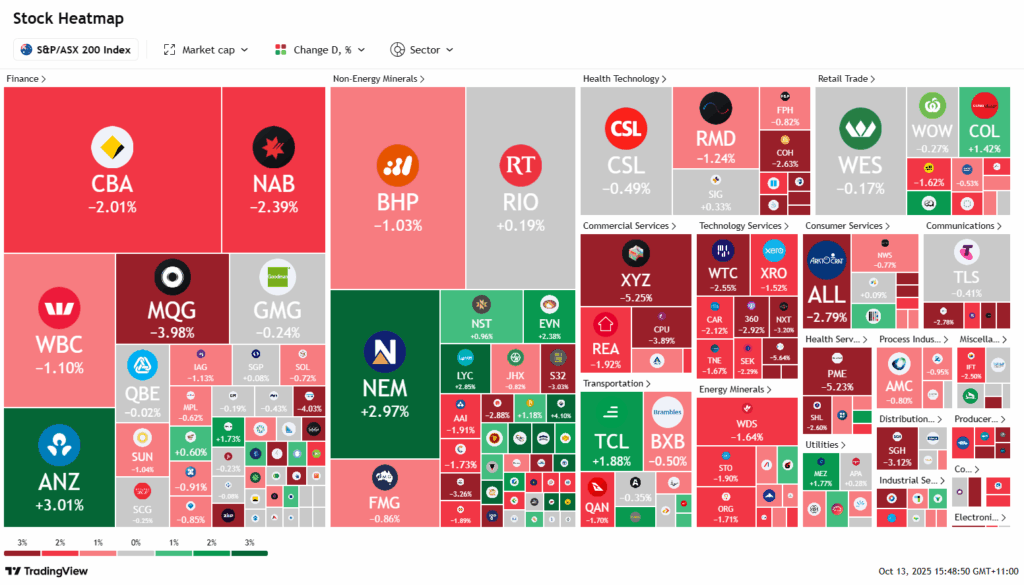

ASX Retreats as Trump Trade Tensions Weigh; Sun Silver Hits Record High

The Australian sharemarket slipped on Monday as renewed trade tensions between the US and China dampened sentiment. The S&P/ASX 200 fell 0.5 per cent, or 44.9 points, to 8913.4, retreating from last week’s six-week high. Tech stocks led declines, with Life360 down 2.3 per cent, WiseTech 2.6 per cent, and Computershare 3.5 per cent.

Financials also weakened, although ANZ gained 3 per cent after outlining an ambitious cost-cutting plan. Commonwealth Bank, NAB, and Westpac fell up to 1.3 per cent. Gold miners shone as bullion hit a fresh record above US$4050, boosting Regis Resources, Newmont, and Evolution Mining.

Silver surged to near-record highs, propelling Sun Silver up 20 per cent to a record, while rare-earths stocks rallied after Trump’s renewed trade war talk. Lynas hit a 14-year high and Iluka rose 4 per cent.

In corporate news, Qantas dropped 1.4 per cent after a major data breach, and Treasury Wines plunged 14 per cent after scrapping guidance. Toro Energy soared 37 per cent on a $75 million takeover deal.

Leaders

L1G L1 Group Ltd (+7.93%)

RRL Regis Resources Ltd (+6.85%)

PNR Pantoro Gold Ltd (+6.47%)

ALK Alkane Resources Ltd (+6.28%)

CYL Catalyst Metals Ltd (+6.20%)

Laggards

TWE Treasury Wine Estates Ltd (-15.40%)

4DX 4DMEDICAL Ltd (-8.56%)

VUL Vulcan Energy Resources Ltd (-7.08%)

PNV Polynovo Ltd (-6.57%)

NXL NUIX Ltd (-5.63%)