Overnight – US/China Critical minerals scramble continues, forcing reactive Trump to TACO

Stocks bounced hard overnight as Trump walked back, then forward, then back again on his tariff threats to China as the scramble for critical minerals continues

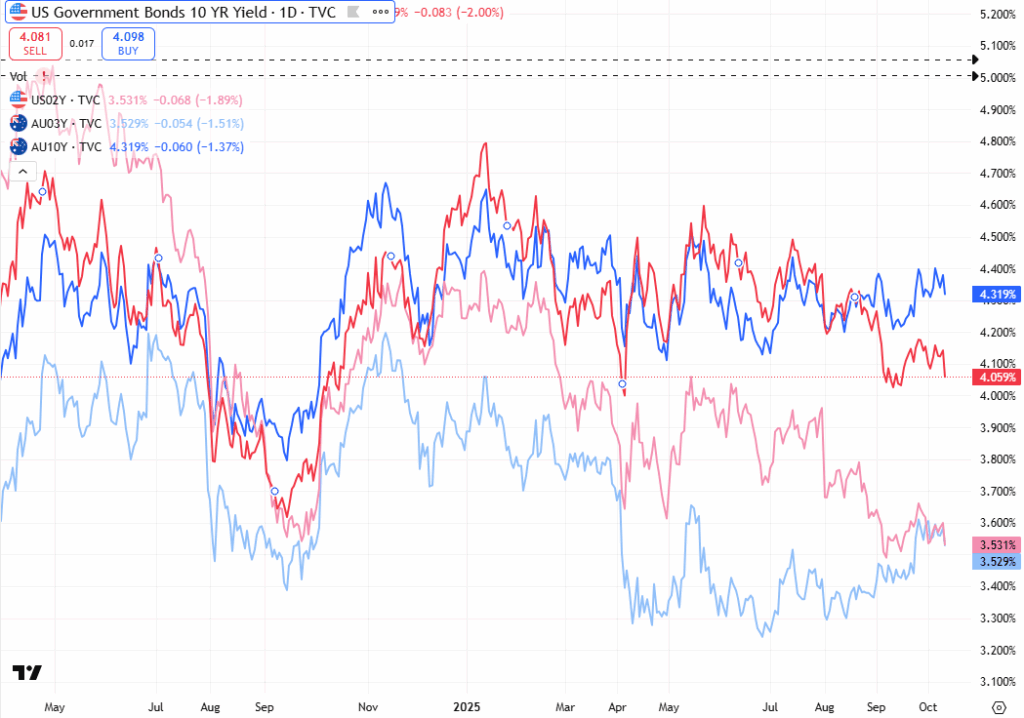

Trump has recently tempered his rhetoric on China, stating that relations would be “fine” and that the U.S. is not seeking to damage Beijing, marking a softer approach compared to previous confrontational remarks. His comments come amid renewed trade friction sparked by his earlier threats of steep tariffs and export controls, following China’s announcement of expanded curbs on rare earth exports. Analysts suggest the upcoming meeting between Trump and Xi Jinping could offer a path to ease tensions, though risks remain as both sides may hold firm in the expectation the other will concede.

Despite early signs of de-escalation, Washington and Beijing continue to exchange trade threats, unnerving financial markets. Trump warned of additional levies of up to 100% on Chinese goods and restrictions on critical software exports by November 1, though he maintained plans to meet with Xi later this month in South Korea. The uncertainty around trade policy has coincided with heightened market interest in artificial intelligence, exemplified by a partnership between Broadcom and OpenAI to develop large-scale AI accelerators, and anticipation ahead of Oracle’s AI event and upcoming semiconductor earnings. Elsewhere, Warner Bros Discovery shares rose following reports it rejected a buyout offer from Paramount Skydance, potentially paving the way for alternative bids or a hostile takeover, while banks prepare to report quarterly earnings amid a prolonged government shutdown.

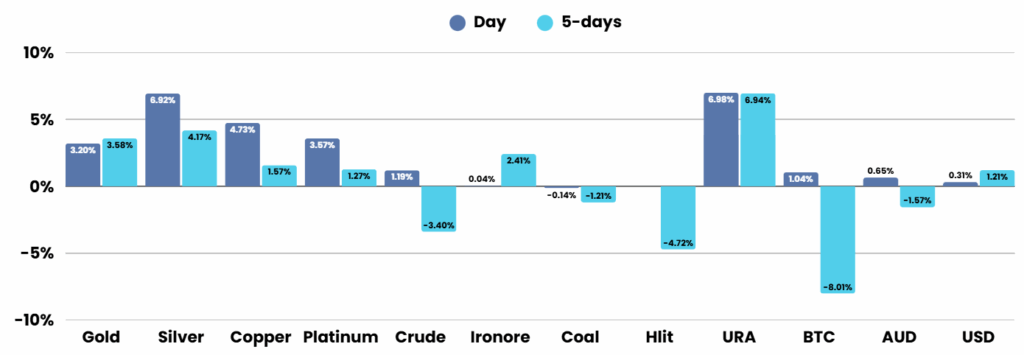

Gold prices surged to fresh record highs above $4,100 per ounce as renewed U.S.-China tensions fueled demand for safe-haven assets. Silver also reached all-time highs, with bullion’s rally driven by investor caution after Trump’s tariff threats rattled global markets. While Trump’s more conciliatory tone has brought temporary relief, traders remain vigilant given the administration’s history of abrupt policy shifts. Precious metals continue to be viewed as a defensive hedge against political and economic instability, underscoring the market’s cautious stance ahead of key diplomatic and corporate events.

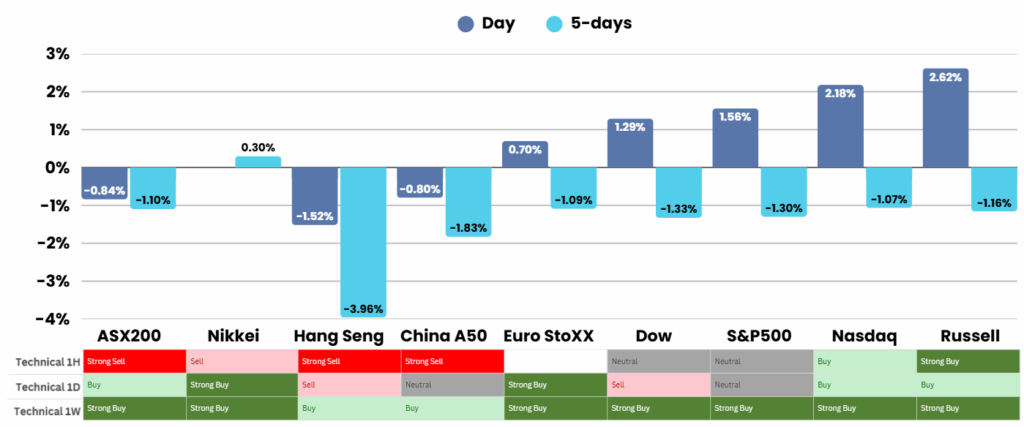

ASX Overnight: SPI 8927 (+0.30%)

The Day Ahead:

Major catch up to be played today by the ASX IF investors wise up to the opportunities they are spoilt with in the materials sector.

Yesterdays Session:

The Australian sharemarket slipped 0.5 per cent to 8913.4 on Monday as renewed US-China trade tensions weighed on sentiment. Tech and financial stocks dragged the index lower, while gold miners rose on record bullion prices. Silver and rare-earths shares surged, led by Sun Silver and Lynas. In corporate news, Treasury Wines plunged after withdrawing guidance, Qantas fell on a data breach, and Toro Energy jumped on a takeover offer.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.