The Geopolitical Race for Critical Minerals: A Boom for ASX Investors?

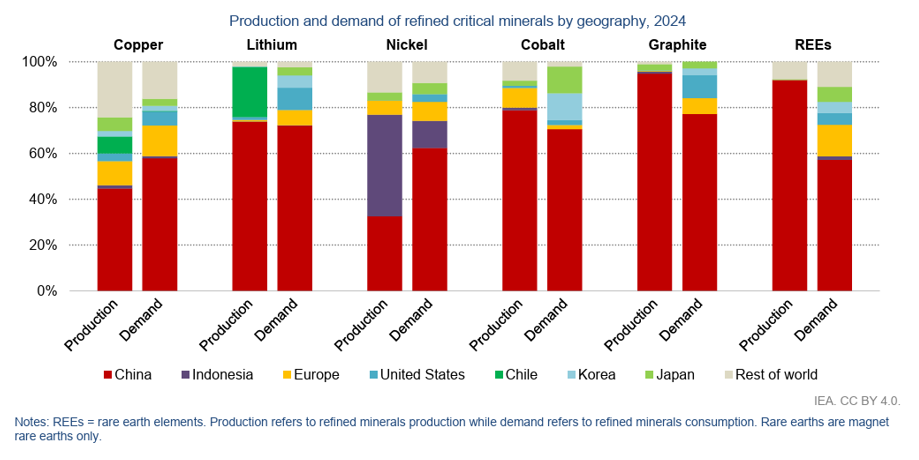

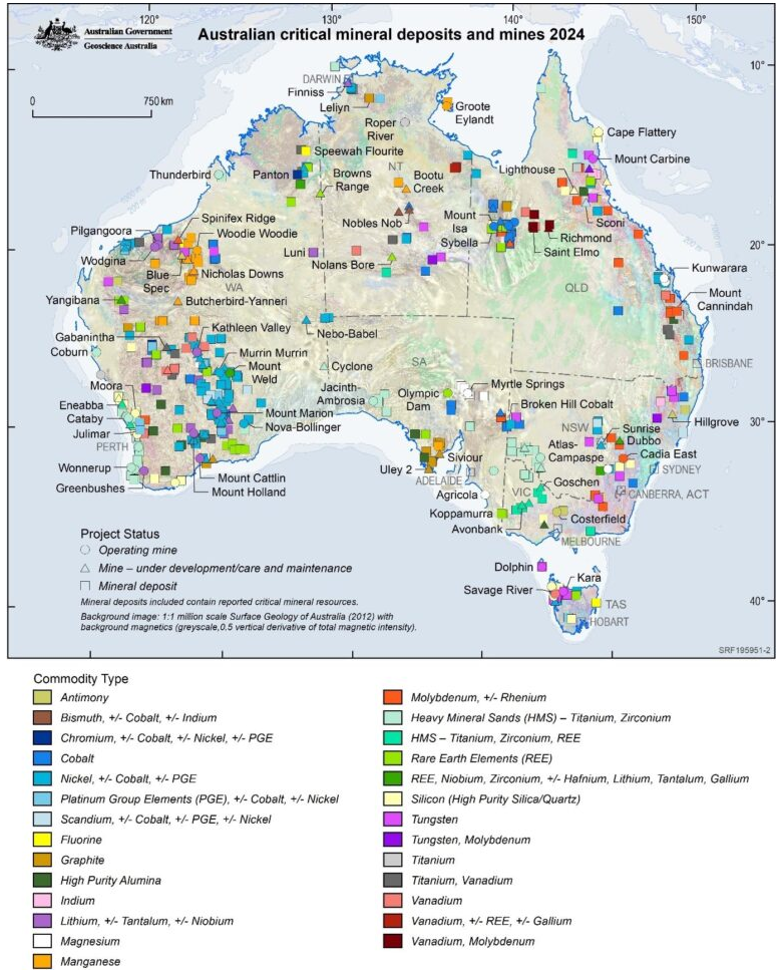

In the high-stakes world of global commodities, a new scramble is underway—one that could redefine supply chains and spark massive investment opportunities. As of October 2025, the geopolitical tussle over “critical minerals” is heating up, driven by surging demand from electric vehicles (EVs), data centers, and cutting-edge defense technologies. This isn’t just another market cycle; it’s a catalyst for potential supply crunches in already strained commodities like copper, antimony, and cobalt. With nations jockeying for control, investors are eyeing the Australian Stock Exchange (ASX) as a prime beneficiary.

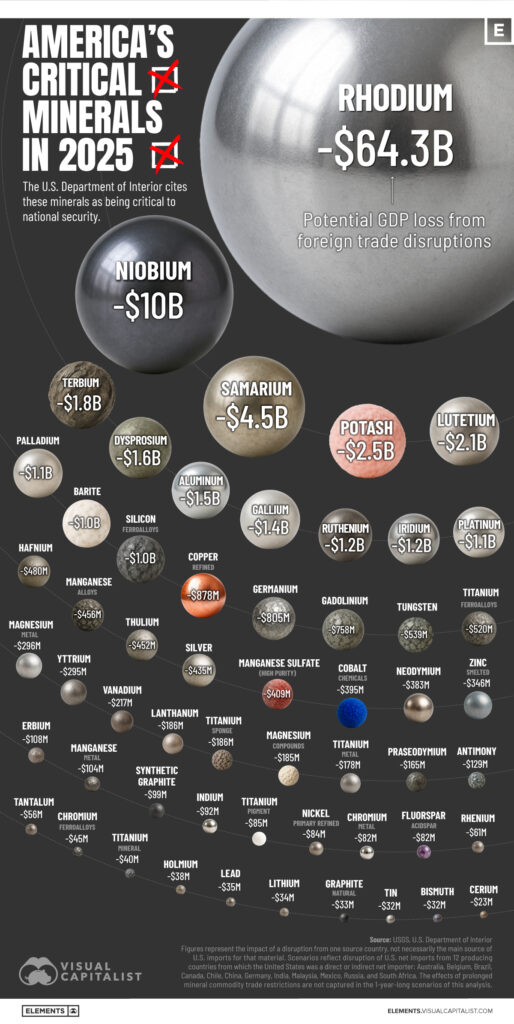

The flashpoint? China’s recent tightening of rare earth export controls, a move that’s sent shockwaves through international markets. In response, the United States has ramped up its stockpiling efforts, allocating a whopping US$500 million for cobalt, US$245 million for antimony, and US$100 million for tantalum. These minerals are vital for everything from batteries to military hardware, and the U.S. isn’t alone in its preparations. Australia is gearing up with its own A$1.2 billion strategic reserve, underscoring a broader push to secure resources amid escalating trade tensions.

This dynamic is breathing new life into the mining sector, particularly for junior miners that have languished over the past year. Battered by volatile prices and economic headwinds, many of these smaller players are now attracting fresh capital from fund managers, traders, and savvy investors. The revival is fueled by the recognition that these companies hold key assets in a world desperate for diversified supply sources. As global demand converges on these minerals, previously dormant projects could suddenly become hot commodities.

At the heart of this strategy is the U.S. critical minerals list, which now encompasses 54 commodities. The focus is squarely on those essential for battery and defense applications—think lithium-ion cells powering EVs or advanced alloys in aerospace. To bolster its position, the U.S. is actively pursuing equity stakes in allied projects, such as Trigg Minerals (TMG:ASX)’s Nevada antimony venture. This cross-border collaboration highlights how Australia, with its stable political environment and rich deposits, is emerging as a trusted partner in reshaping global supply chains away from Chinese dominance.

For investors, the rally in critical mineral stocks is already in motion, but it’s not too late to join. Opportunities abound, tailored to different risk appetites. High-risk enthusiasts might look to AusQuest (AQD:ASX), a copper explorer with a strategic partnership with South32. This “high-octane” pick leverages exploration upside in a metal facing chronic undersupply due to mine delays and electrification demands. For a more balanced approach, Trigg Minerals (TMG:ASX) offers mid-tier appeal as a developer with U.S.-based operations, positioning it directly in the path of American stockpiling initiatives.

On the conservative side, blue-chip giant Rio Tinto (RIO:ASX) stands out as a value play. With its diversified portfolio spanning copper, lithium, and more, Rio provides stability amid the volatility, backed by recent expansions and a track record of navigating geopolitical shifts. These picks aren’t random; they’re grounded in the ongoing trade war that’s forcing a reevaluation of where and how critical minerals are sourced.

As this reshuffling unfolds, the ASX is uniquely positioned to capitalize. Australian miners benefit from proximity to Asia-Pacific markets, robust regulatory frameworks, and increasing Western investment. Yet, risks remain—commodity prices can swing wildly, and further export restrictions from China could exacerbate shortages. Still, for those willing to bet on the energy transition and national security imperatives, the critical minerals boom represents a generational opportunity.

In summary, this scramble isn’t just about metals; it’s about power, innovation, and economic resilience. Whether you’re a speculative trader or a long-term holder, keeping an eye on ASX-listed plays like AusQuest, Trigg, and Rio Tinto could pay dividends as the world races to secure its future.

THE TOP PICK OF LAST MONTHS WEBINAR IS +96% IN JUST 4 WEEKS!

DONT MISS OUT

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.