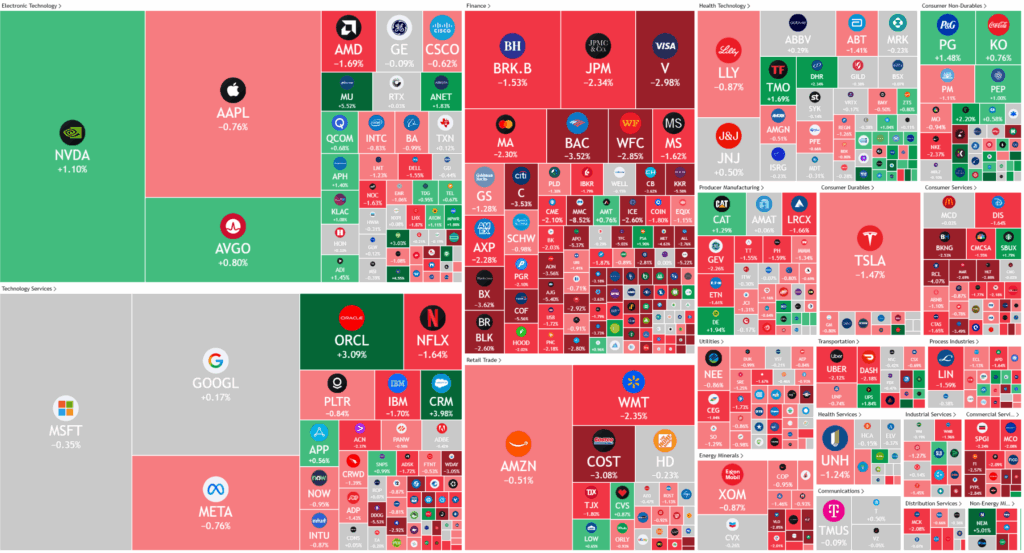

Overnight – Regional banks lead market lower on Credit default issues

Stocks headed lower overnight, led by the banking stocks as regional banks Zions and Western Alliance revealed two problematic loans on the back of the first brands collapse. See my article on this from last week Is the First Brands Collapse a Warning Sign?

US regional banks have experienced notable turmoil over the last 24 hours, with investor confidence shaken due to fresh concerns about poor loan quality and possible credit problems at several institutions. This was triggered by Zions Bancorporation’s announcement of a $50 million charge-off associated with two problematic commercial loans, sparking fears of broader issues within the sector. As a result, regional bank stocks—including Zions and Western Alliance—experienced sharp declines of over 10% in midday trading, while a regional bank ETF dropped about 4%, reflecting widespread market anxiety

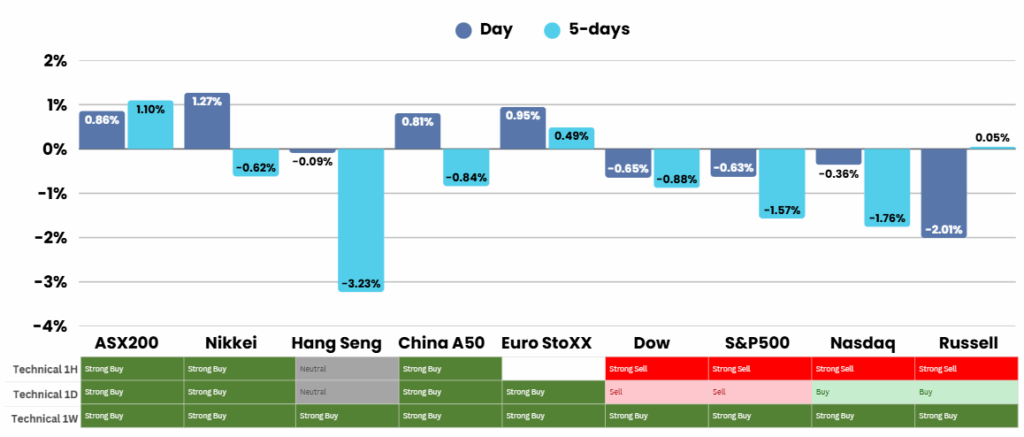

Political and economic uncertainties weighed heavily on markets this week as efforts to end the U.S. government shutdown faltered. A Senate vote to extend government funding failed Wednesday, sparking fears that the prolonged closure could inflict lasting damage on the economy. Analysts warn of potential layoffs among federal workers and delays in key economic data, which could make this six-year high shutdown more damaging than prior ones. At the same time, trade tensions between Washington and Beijing have intensified, with Treasury Secretary Scott Bessent reaffirming the administration’s firm stance on negotiations and President Trump threatening to sever certain trade ties with China over alleged soybean purchase disruptions.

On the foreign policy front, renewed diplomatic activity provided a slight counterbalance. President Trump and Russian President Vladimir Putin held what the White House described as a “good and productive” call, setting the stage for the resumption of U.S.-Russia talks aimed at ending the war in Ukraine. The discussions are expected to begin next week, led by Secretary of State Marco Rubio and his team. Meanwhile, corporate earnings continued to drive individual stock movements. United Airlines shares slipped despite strong results, Salesforce rose after lifting its long-term targets and initiating a hefty buyback plan, and Taiwan Semiconductor posted record profits driven by AI demand. Oracle is also set to conclude its AI-focused event in Las Vegas with key financial updates.

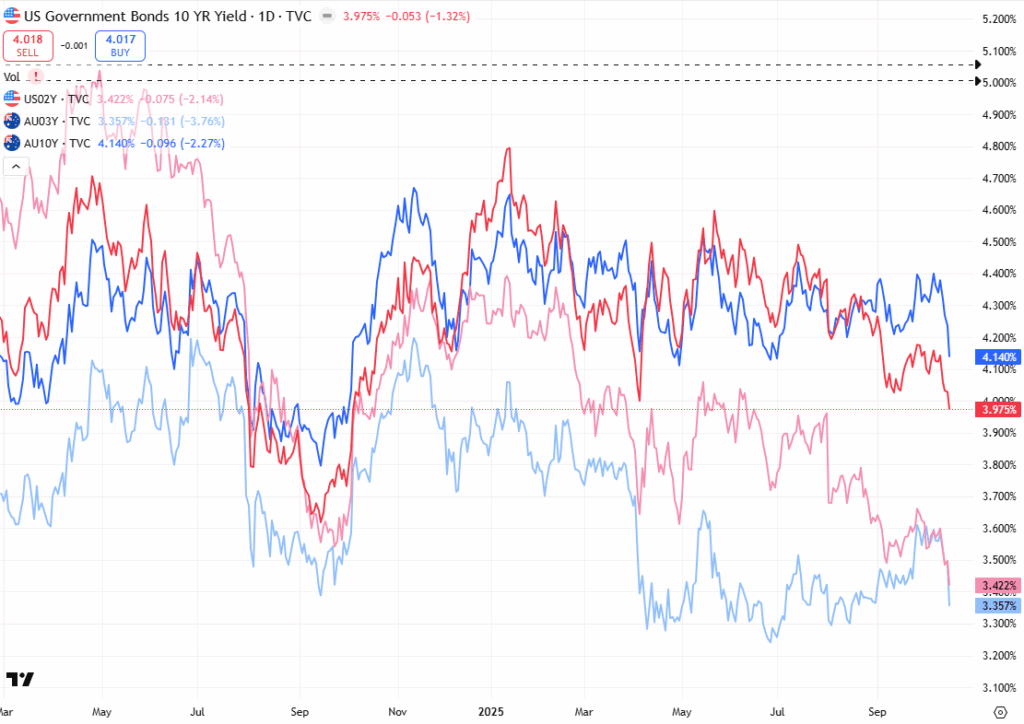

Monetary policy developments added further nuance to an already complex environment. Federal Reserve Governor Christopher Waller signaled support for another quarter-point cut at the Fed’s upcoming meeting, citing uncertainties in labor market data. His comments contributed to a decline in 2-year Treasury yields, which fell to their lowest level in two years. Economic indicators reinforced the narrative of a cooling economy, as factory activity in the mid-Atlantic unexpectedly contracted in October, according to the Philadelphia Federal Reserve’s index, which dropped sharply from September’s strong reading into negative territory.

ASX Overnight: SPI 9068 (-0.25%)

The Day Ahead:

Credit issues are a worry, highly recommend portfolio trims. Banks will suffer

Yesterdays Session:

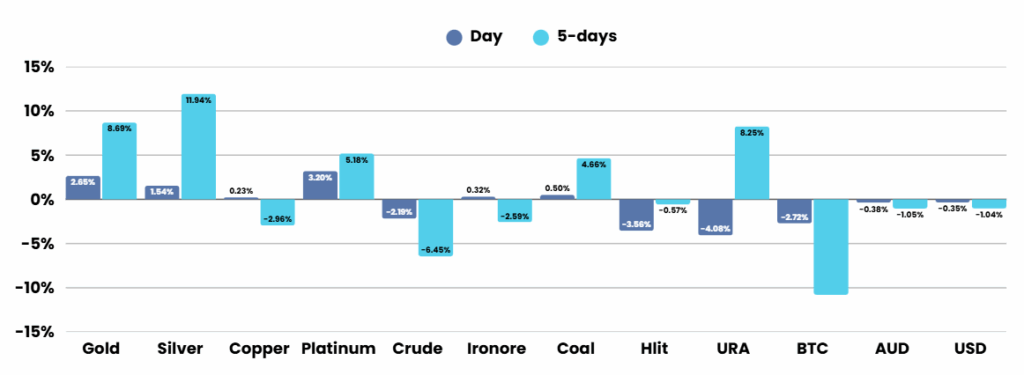

The Australian sharemarket hit a record intraday high on Thursday, with the S&P/ASX 200 closing up 1% at 9077.8 as financial and property stocks rallied on hopes of a November rate cut after unemployment rose to 4.5%. Strong gains came from ANZ, Commonwealth Bank, and Macquarie Group, which soared after a $61 billion asset sale, while real estate firms climbed 3–4%. Gold miners outperformed as bullion reached US$4200/oz, though rare earth stocks fell. AMP and Mayne Pharma surged on positive news, whereas DroneShield dipped amid profit-taking.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.