What's Affecting Markets Today

ASX Slips as Investors Flock to Safe Havens; Life360 and Lynas Tumble

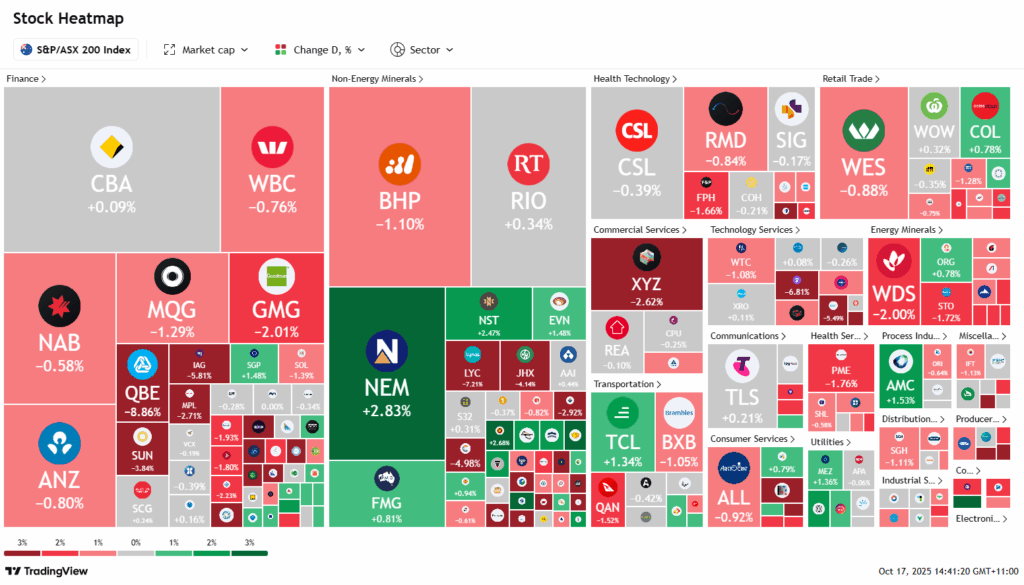

The Australian sharemarket eased on Friday as investors shifted to safe-haven assets, sending gold to a record high of US$4378.69 amid renewed concerns over credit stress and US–China tariff tensions. The S&P/ASX 200 Index fell 0.8 per cent to 9000.8, retreating from Thursday’s record peak.

Energy and tech led sector declines, with Life360 plunging 6.6 per cent in its worst session since April. Gold miners outperformed—Newmont rose 3 per cent, Northern Star gained 2.4 per cent, and Evolution added 1.8 per cent—while critical mineral stocks slumped ahead of Prime Minister Albanese’s White House meeting. Lynas Rare Earths dived nearly 10 per cent, Iluka fell 6.6 per cent, and Paladin slid 5.8 per cent.

QBE sank 7.8 per cent, weighing on the financials, while NAB dropped 0.8 per cent. Among individual movers, Iress rose 3.9 per cent on acquisition interest, EROAD collapsed 36 per cent after an impairment warning, and Adore Beauty gained 6.5 per cent on board changes.

ASX Stocks

ASX 200 8,996.90 (-0.83%)

Kospi Extends Record Run as Asia Markets Slip on Banking and Trade Worries

South Korea’s Kospi index climbed for a third consecutive session on Friday, defying regional weakness as ongoing trade discussions with the United States buoyed sentiment. The benchmark touched a fresh intraday record of 3,794.87, standing out as the only major Asian market in positive territory, while the smaller Kosdaq erased earlier gains to trade flat.

Elsewhere, Asia-Pacific markets followed Wall Street lower amid renewed concerns over U.S. banking sector stability and trade tensions. Shares of regional banks and investment firm Jefferies slumped overnight as investors fretted about potential loan exposures. In tech, Taiwan Semiconductor Manufacturing Co. slipped 1.68 per cent despite reporting stronger-than-expected third-quarter earnings.

Hong Kong’s Hang Seng Index led losses, down 1.18 per cent, with China’s CSI 300 off 1.15 per cent. Japan’s Nikkei 225 fell 0.93 per cent, while the Topix dropped 0.7 per cent. Australia’s S&P/ASX 200 slid 0.78 per cent. In a bright spot, Singapore’s non-oil domestic exports surged 6.9 per cent year-on-year in September, sharply beating forecasts.

Leaders

TWE Treasury Wine Estates Ltd (+4.31%)

SX2 Southern Cross Gold (+4.09%)

EMR Emerald Resources NL (+4.03%)

IRE Iress Ltd (+3.63%)

WGX Westgold Resources Ltd (+3.37%)

Laggards

ARU Arafura Rare EARTHS Ltd (-9.09%)

EOS Electro Optic Systems Holdings Ltd (-8.82%)

LYC Lynas Rare EARTHS Ltd (-8.36%)

QBE QBE Insurance Group Ltd (-8.35%)

4DX 4DMEDICAL Ltd (-7.77%)