Overnight – Stocks rebound on yet another TACO

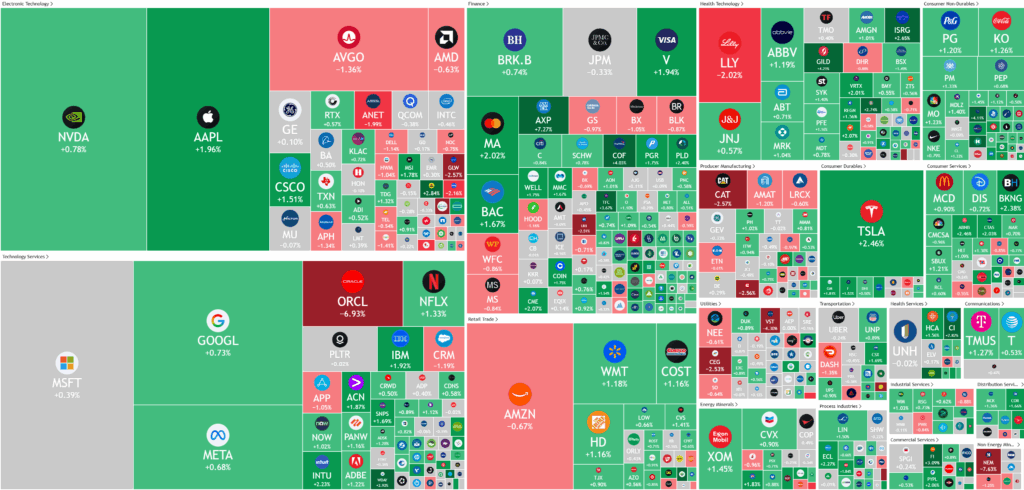

Stocks closed higher after recovering early session losses Friday, as regional banks rebounded following a recent slump on credit risks concerns and U.S.-China trade tensions eased following President Donald Trump’s softer stance on trade negotiations with China, yet another TACO (Trump Always Chickens Out)

The U.S. government shutdown, now in its third week, continued to dampen economic confidence by delaying key data releases and raising short-term growth worries. However, investor sentiment improved after President Donald Trump signaled a softer trade stance toward China. In a Fox Business interview, Trump said current tariffs on Chinese goods were “not sustainable,” hinting at easing tensions ahead of his upcoming meeting with President Xi Jinping in South Korea. His remarks suggested a potential opening for new trade negotiations despite recent threats of additional tariffs imposed in retaliation for China’s rare earth export restrictions.

Regional banks rebounded sharply following a selloff, helped by stronger-than-expected quarterly results. Lenders such as Fifth Third Bancorp, Regions Financial, and Truist Financial posted solid profits driven by healthy loan growth and fee income, though concerns about credit quality remained. Zions Bancorporation and Western Alliance Bancorporation disclosed losses tied to potential loan fraud, reigniting fears of weak credit oversight in smaller banks. Nonetheless, analysts downplayed systemic risk, noting that major bank results indicated resilient credit conditions across the industry.

Wall Street extended its weekly gains as optimism over big bank earnings and Trump’s trade comments lifted markets. The S&P 500 rose 0.53% to 6,664.01, while the Nasdaq and Dow each gained 0.52%. Investor confidence returned to the financial sector, with the S&P Composite 1500 Regional Banks index climbing 1.8% after steep prior losses. Consumer staples led broad market gains, and volatility eased as the CBOE VIX dropped to 21.5. Tech stocks showed mixed results—Tesla and Apple advanced, while Amazon slipped. Overall, strong earnings and stabilizing sentiment helped major indexes post their best week in over a month.

ASX Overnight: SPI 9003 (-0.01%)

The Day Ahead:

Unlikely to see much action today for the index as precious metals take a breather, but banks and tach are likely to make up the difference,

Yesterdays Session:

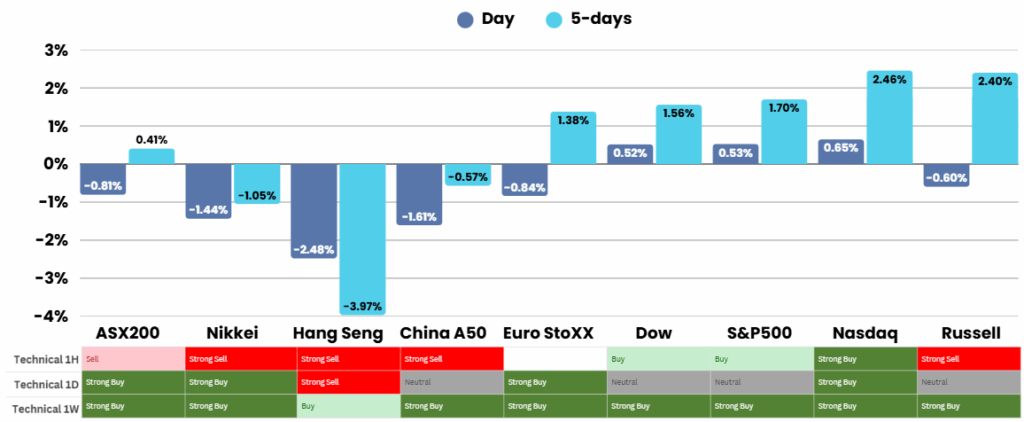

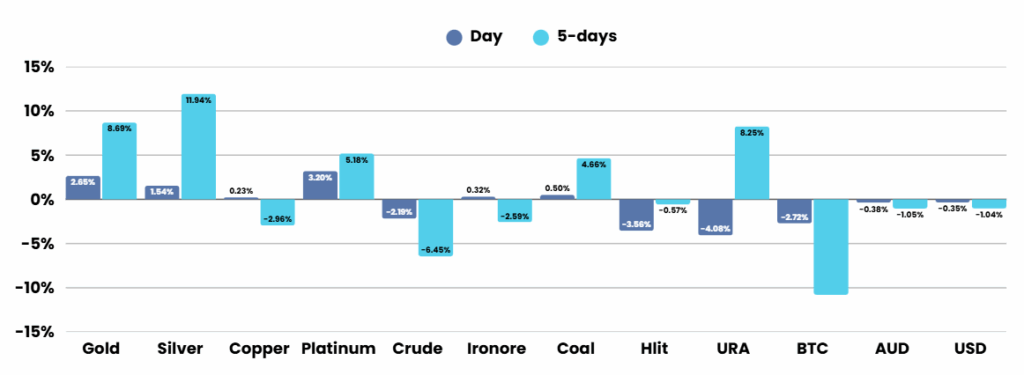

The ASX closed lower on Friday as investors moved to safe-haven assets, pushing gold to a record high amid renewed credit and US–China tariff worries. The S&P/ASX 200 fell 0.8% to 9000.8, led by declines in energy and tech, with Life360 tumbling 6.6% and Lynas plunging 10%. Gold miners gained, while QBE’s 7.8% drop weighed on financials. Across Asia, markets mostly fell on banking and trade concerns, though South Korea’s Kospi bucked the trend, hitting a record high on optimism over US trade talks.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.