Overnight – Stocks jump on US/China Trade peace optimism

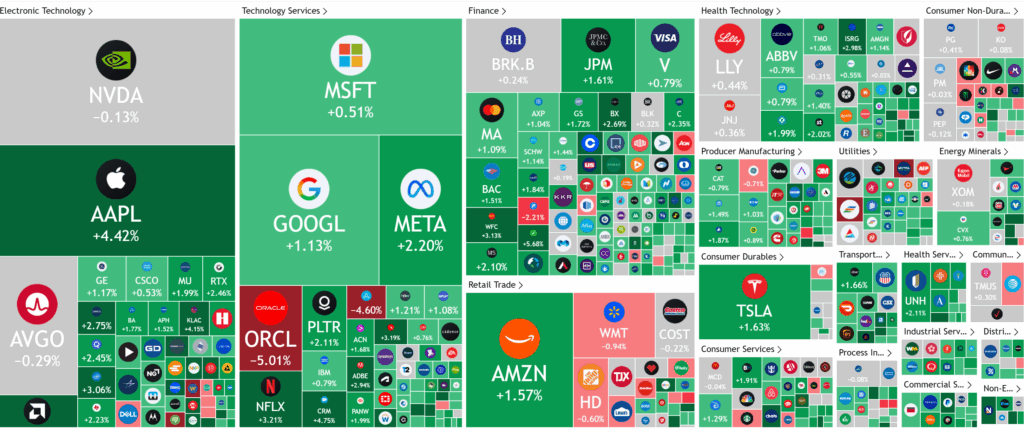

Stocks jumped overnight as investors looked ahead to week of major quarterly earnings reports and hopes grew for the the end of U.S. shutdown as well as the prospect of a U.S.-China trade deal.

Investor sentiment improved after President Donald Trump signaled that the U.S. might reconsider steep tariffs on China, hinting at a more constructive trade outlook. He confirmed an upcoming meeting with President Xi Jinping in South Korea, while Treasury Secretary Scott Bessent met with Vice Premier He Lifeng for talks that both sides described as “constructive.” The news helped calm markets that had fallen earlier in the month following threats of 100% tariffs, even as China’s economic growth slowed to its weakest pace in a year.

Attention is turning to a packed week of U.S. corporate earnings, with Netflix and Tesla leading a lineup that includes GE Aerospace, Coca-Cola, Philip Morris, RTX, GM, Lockheed Martin, and Texas Instruments. Investors will watch to see how companies are managing profits amid tariff disruptions and a softer labor market. The delayed September consumer price index, due Friday, will provide a key read on inflation as the prolonged federal government shutdown nears resolution.

Meanwhile, major banks’ strong earnings last week lent some optimism to markets. In corporate updates, Apple’s iPhone 17 has outperformed early sales expectations, Amazon faces scrutiny after a Web Services outage, and Adobe unveiled a new AI development platform. Molson Coors announced plans to cut 400 jobs in the Americas as part of a restructuring effort.

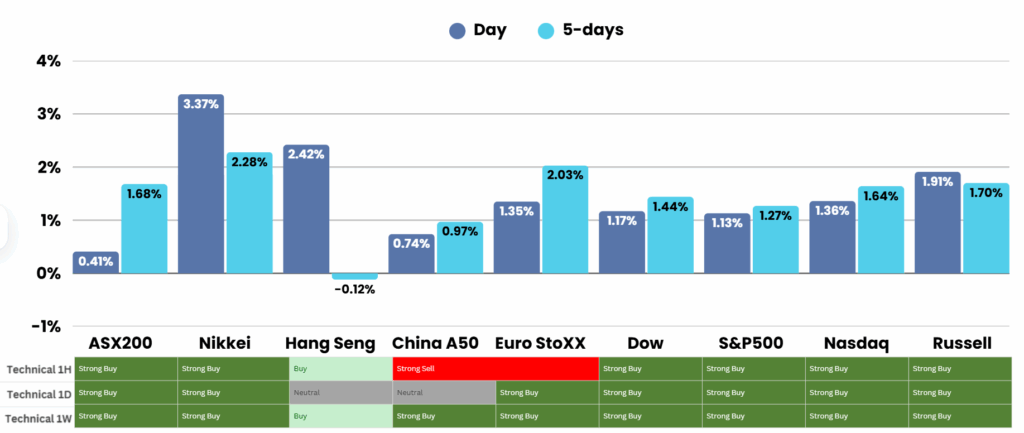

ASX Overnight: SPI 9089 (+0.52%)

The Day Ahead:

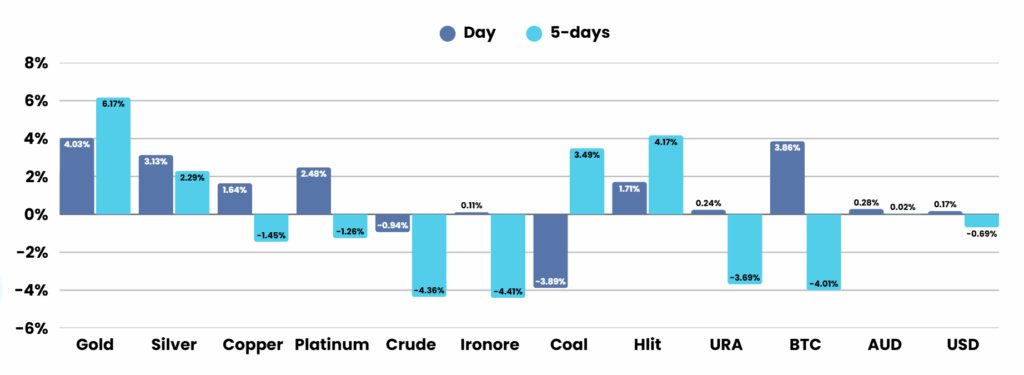

Expect XJO to test recent highs today led by the resources sector. Albo and Trump have just announced a critical minerals deal so happy days to anyone long ASX names in that sector. Banks in particular CBA looked to have bottomed out, so if that catches a bid then expect new highs by the end of todays session

Yesterdays Session:

The Australian sharemarket rebounded from a weak start on Monday, with the S&P/ASX 200 up 0.1% to 9005.9 as gains in technology offset heavy losses in materials. Most sectors advanced, but gold and critical minerals stocks fell sharply, dragging major miners lower. Deep Yellow and Bapcor plunged after corporate setbacks, while Beach Energy, DroneShield, and Zip rose on stronger performance updates.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.