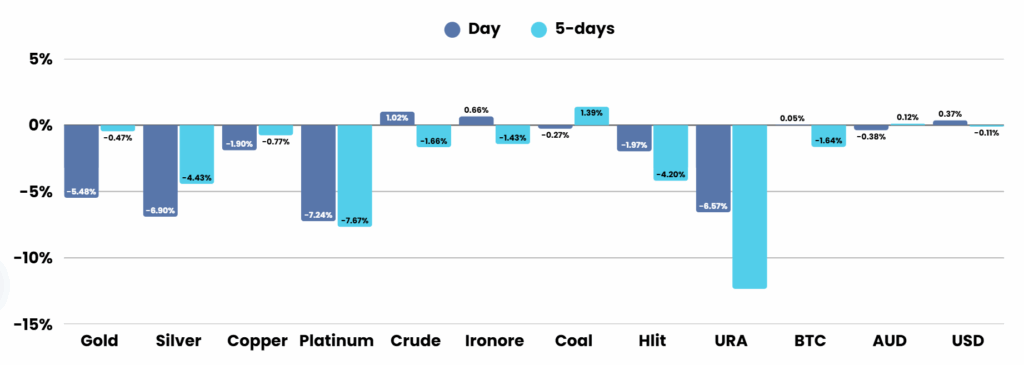

Overnight – Precious metals dumped on US/China Optimism and profit taking

Precious metals were hit 5-6% overnight as investors took profit after a mammoth 4-6 months run, while stocks were buoyed by corporate earnings.

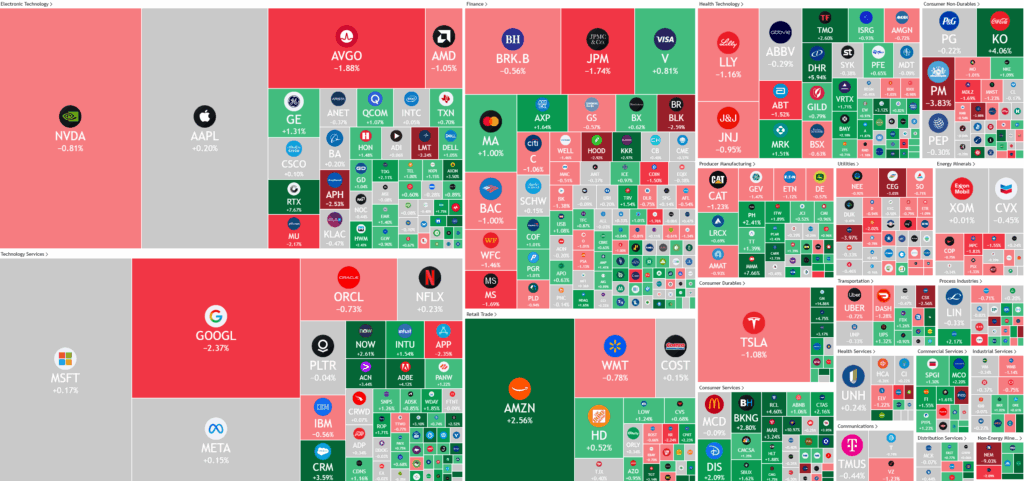

Alphabet’s stock dropped over 3% after OpenAI introduced ChatGPT Atlas, a new AI-driven web browser that intensifies competition in the search and browsing market, following Perplexity’s recent launch of its Comet browser. The development raised investor concerns about Alphabet’s dominance in web services.

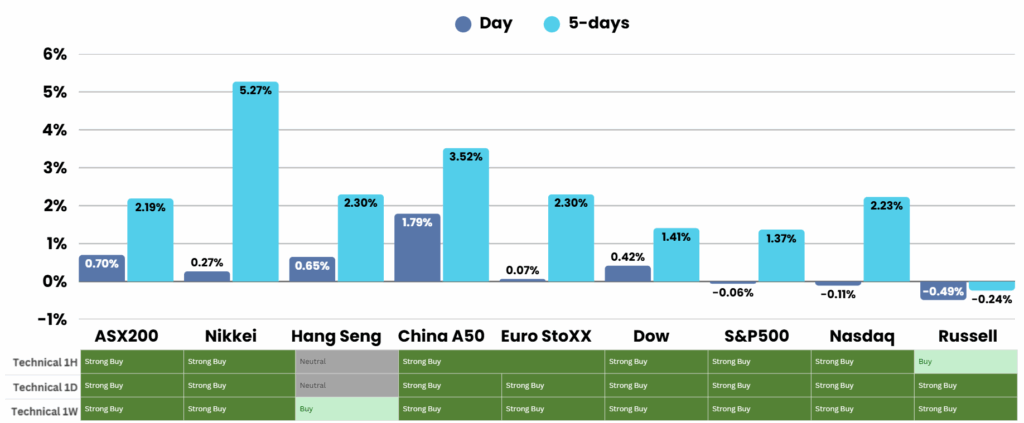

Meanwhile, market sentiment improved due to optimism over a potential resolution to the U.S. government shutdown and renewed progress in U.S.-China trade talks. White House adviser Kevin Hassett suggested the shutdown could end within the week, boosting confidence. Hopes also rose ahead of a planned meeting between President Donald Trump and Chinese President Xi Jinping in South Korea later this month.

Corporate Earnings

- Coca-Cola +4% – stock gained after the soft drinks giant posted third-quarter adjusted profit and revenue ahead of expectations, even as it described the overall operating environment as “challenging.”

- 3M Company +7.6% – hiked its annual earnings, margin guidance after reporting strong quarterly results, sending its share price up more than 5%.

- Rtx Corp +7.5% – stock surged after the U.S. aerospace and defense firm lifted its full-year outlook after reporting third-quarter results that topped market expectations driven by strong demand for its missiles and aftermarket services.

- GE Aerospace +1.3% – stock gained after the aircraft engine supplier raised its 2025 profit forecast, projecting a strong finish to the year on robust demand for aftermarket maintenance services due to a shortage of new jets.

- Halliburton +11% – stock surged after the company beat estimates for third quarter profit, helped by steady demand for its oilfield equipment and services in North America.

- Zions Bancorporation +2.2%- reported stronger-than-expected quarterly earnings after the close Monday, helping to calm nerves around the health of U.S. regional banks.

- Netflix -6.5% – quarterly earnings below Wall Street expectations on Tuesday after booking a charge tied to a tax dispute in Brazil, though the company said the matter will not have a material effect on future results.

ASX Overnight: SPI 9056 (-0.60%)

The Day Ahead:

It will be a rough day for the precious metals and ming sector after a record run.

Yesterdays Session:

Australia’s sharemarket hit new record highs on Tuesday, with the S&P/ASX 200 rising 0.8% to 9103.6, driven by strong gains in mining stocks after a $US3 billion critical minerals funding deal with the US. The materials sector jumped almost 2%, led by Alcoa, Arafura Rare Earths, and BHP, while gold miners rallied as bullion prices surged. Broader sentiment improved thanks to Wall Street’s gains and Apple’s record performance; Hub24 soared nearly 10% on robust fund growth, while Cleanaway dropped 4.1% after AGM backlash and DroneShield rebounded 7.7%.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.