What's Affecting Markets Today

Japan’s Export Rebound Fails to Lift Asia-Pacific Markets

Asia-Pacific markets traded mostly lower on Wednesday as investors weighed Japan’s trade data and the formation of Prime Minister Sanae Takaichi’s new cabinet. Japan’s exports rose 4.2 per cent in September, ending a four-month decline, driven by stronger shipments to Asia. However, the result fell short of economists’ expectations for a 4.6 per cent increase, tempering optimism about the recovery.

The Nikkei 225 slipped 0.48 per cent after briefly touching a record high earlier in the week, while the Topix index edged up 0.33 per cent. Shares of SoftBank dropped more than 5 per cent following a sharp two-day rally.

Takaichi’s appointment as Japan’s first female prime minister was followed by key cabinet changes, including Satsuki Katayama as finance minister and Shinjiro Koizumi as defense minister.

Elsewhere, South Korea’s Kospi gained 0.3 per cent and Kosdaq rose 0.1 per cent, helped by a 10 per cent surge in LG Chem. Hong Kong’s Hang Seng slipped 0.83 per cent, while China’s CSI 300 fell 0.69 per cent. Indian markets were closed for a holiday.

ASX Stocks

ASX 200 9,003.3 (-1.01%)

ASX Retreats from Record as Gold Miners Slide

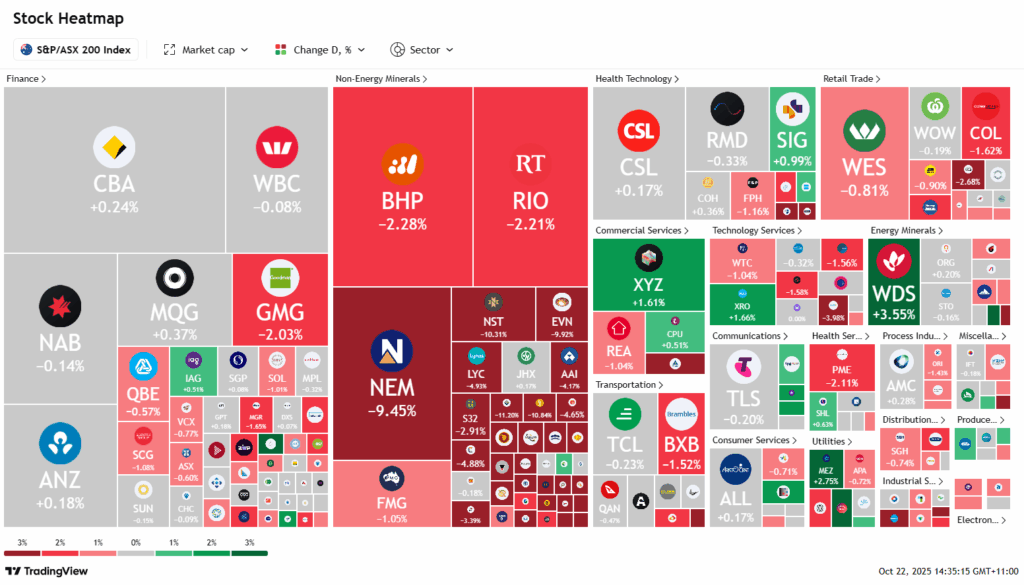

The Australian sharemarket retreated from record highs on Wednesday as a sharp correction in precious metals triggered a broad sell-off in mining stocks. The S&P/ASX 200 fell 0.9 per cent, or 85.1 points, to 9009 by mid-afternoon, reversing gains from the previous session’s rally sparked by Australia’s critical minerals deal with the United States.

Gold plunged as much as 6.3 per cent overnight—the steepest fall in 12 years—while silver tumbled up to 8.7 per cent as investors took profits after a stellar run. Heavyweights BHP dropped 2.2 per cent, Newmont sank 9.8 per cent and Bellevue Gold shed 10.4 per cent.

Energy stocks provided support, with Woodside gaining 3.8 per cent after lifting quarterly output and guidance. Financials also firmed, led by Pinnacle Investment Management’s 3 per cent rise on a strategic investment in Japan’s Advantage Partners.

Among movers, 4DMedical advanced 6.1 per cent on a US rollout milestone, while Adairs rose 8 per cent despite softer sales guidance.

Leaders

4DX 4DMEDICAL Ltd (+5.83%)

DTR Dateline Resources Ltd (+4.00%)

WDS Woodside Energy Group Ltd (+3.98%)

CEN Contact Energy Ltd (+3.95%)

QAL Qualitas Ltd (+3.91%)

Laggards

ARU Arafura Rare EARTHS Ltd (-12.50%)

RMS Ramelius Resources Ltd (-11.22%)

GMD Genesis Minerals Ltd (-11.20%)

VAU Vault Minerals Ltd (-10.78%)

NST Northern Star Resources Ltd (-10.57%)