What's Affecting Markets Today

Nikkei Breaks 50,000 as Trade Optimism Lifts Asian Markets

Asian equities surged Monday as progress in U.S.-China trade talks and strength on Wall Street lifted sentiment across the region. Japan’s Nikkei 225 jumped over 2% to breach the 50,000 mark for the first time, while the broader Topix gained 1.61%.

The rally came ahead of Prime Minister Sanae Takaichi’s meeting with U.S. President Donald Trump this week. Analysts at Crédit Agricole CIB said Japan’s focus on boosting domestic demand could finally lift the economy out of its “deflationary stagnation” and help narrow the U.S. trade deficit.

In South Korea, the Kospi surged 2.1% to cross 4,000 for the first time, while the Kosdaq rose 1.45%. Hong Kong’s Hang Seng Index advanced 1.15%, and China’s CSI 300 added 0.83%. K-pop agency Hybe soared nearly 10% following reports of a global BTS tour.

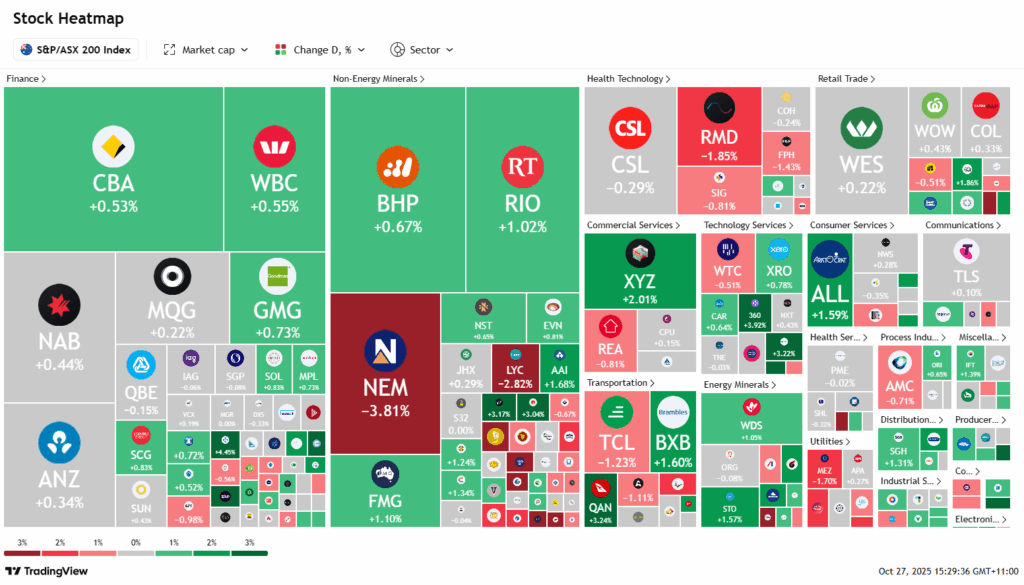

Australia’s ASX 200 gained 0.54% in early trade, as investors welcomed signs that Washington and Beijing may soon finalise a trade framework, with U.S. officials confirming Trump’s proposed tariffs are “off the table.”

ASX Stocks

ASX 200 9,051.2 (+0.36%)

ASX Rises on Fed Cut Hopes, Rare Earths Miners Slide

The Australian sharemarket advanced on Monday, buoyed by expectations of a U.S. Federal Reserve rate cut and optimism over renewed U.S.-China trade talks. The S&P/ASX 200 rose 39.4 points, or 0.4%, to 9058.4 by mid-afternoon, with 10 of 11 sectors higher, led by industrials, financials and technology.

Banking stocks supported the rally, with Commonwealth Bank, NAB and Westpac each up about 1%, while ANZ gained 0.6%. Tech shares also climbed, boosted by upbeat sentiment from Silicon Valley—Life360 and Zip rose 4%, while Block added 1.8%. Industrials outperformed as Qantas surged 3.5%, joined by gains in Brambles, Worley and Reece.

However, rare earths producers tumbled as investors took profits after last week’s Australia-U.S. critical minerals deal. Arafura fell 10.8% and Australian Strategic Minerals slid 12.4%. Elsewhere, Nuix plunged 16.4% following its CEO’s resignation, Ramelius Resources lost 6.7% on weaker quarterly output, while PolyNovo rose 3.2% after its chairman’s sudden departure.

Leaders

FFM Firefly Metals Ltd (+11.56%)

AUB AUB Group Ltd (+10.03%)

EOS Electro Optic Systems (+8.42%)

SLX SILEX Systems Ltd (+7.38%)

BRG Breville Group Ltd (+4.66%)

Laggards

NXL NUIX Ltd (-15.75%)

ARU Arafura Rare EARTHS Ltd (-11.45%)

ILU Iluka Resources Ltd (-6.94%)

RMS Ramelius Resources Ltd (-5.86%)

VEA Viva Energy Group Ltd (-4.07%)