Overnight – Google smashes earnings while Microsoft and Meta disappoint

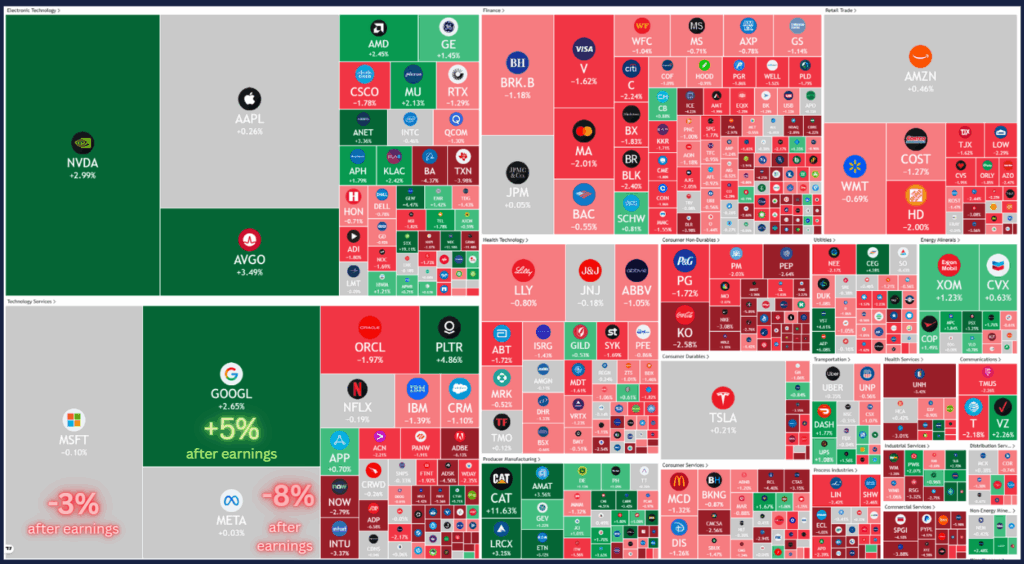

Equites were disappointed with a measured Federal reserve delivering a 25bps rate cut, while 3 mega-caps Microsoft, Google and Meta delivered earnings after the bell

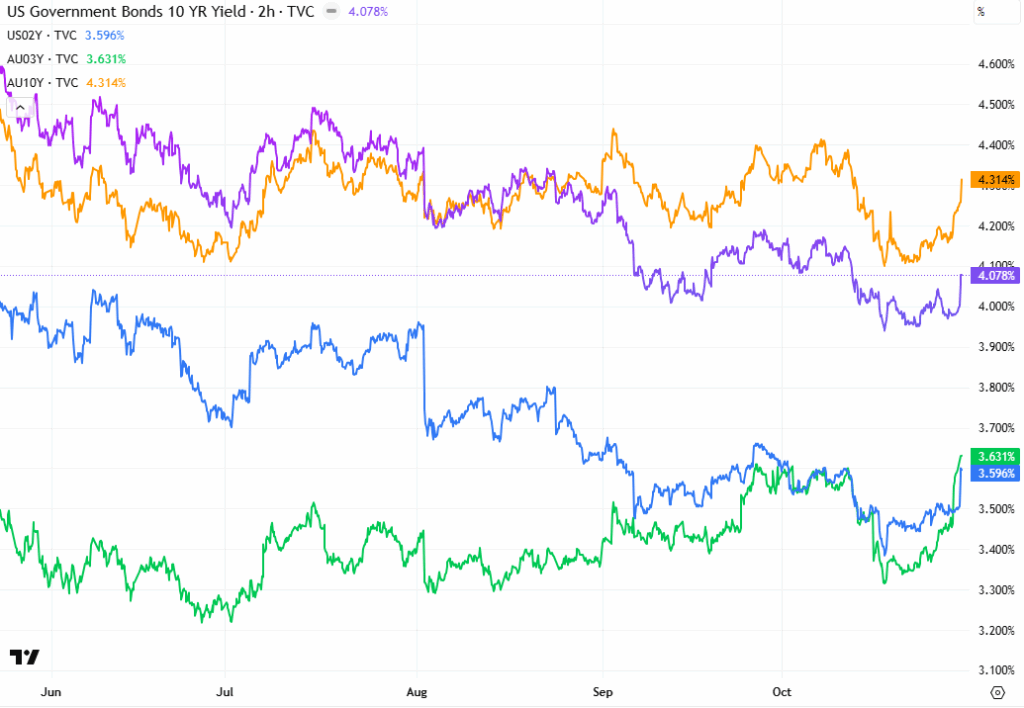

The Federal Reserve reduced interest rates by 25 basis points for the second time this year, amid worries about a cooling labour market. The decision, expected by most analysts, included two dissenting voices—Governor Stephen Miran favoured a deeper 50-basis-point cut, while Kansas City Fed President Jeffrey Schmid supported no change. Alongside the rate cut, the Fed announced plans to end its balance sheet reduction by December, signalling the conclusion of its quantitative tightening program.

At his press conference, Chair Jerome Powell downplayed expectations of an automatic rate cut in December, stressing that future policy decisions will depend on economic data. He noted that though the Fed is halting balance sheet reductions, it will eventually need to expand again to maintain adequate liquidity and ensure stable interest rate control. Powell emphasized that reserves must grow in line with the banking system and broader economy, suggesting a gradual shift toward balance sheet expansion in the coming year.

In corporate news, Nvidia shares surged as President Trump said he plans to discuss the company’s Blackwell AI chips with Chinese leader Xi Jinping, raising hopes of relaxed export restrictions

Corporate News & Earnings

- Google +8.11% – delivered a record-breaking third quarter, posting revenue of $102.35 billion—up 16% year-over-year and above forecasts—while earnings per share reached $2.87 versus the expected $2.29. Driven by strong growth in advertising, cloud, and AI services, the company’s net income rose 33% to $34.98 billion, and operating margin hit 30.5% (33.9% excluding fines). Google Cloud revenue surged 34% to $15.16 billion, supported by booming AI demand, while total ad revenue climbed 13% to $74.18 Shares jumped over 6% after-hours to $275.17, marking gains of 44.9% in three months and 56.2% year-over-year, as Alphabet raised its full-year capital expenditure outlook to $91–93 billion amid escalating competition in AI and search.

- Microsoft -2.5% – Microsoft reported strong fiscal first-quarter results with earnings per share of $4.13, topping estimates of $3.66, and revenue of $77.7 billion, up 18% year over year. Azure’s cloud business surged 40%, surpassing forecasts, and the Intelligent Cloud unit’s revenue climbed 28% to $30.9 billion. Despite these gains, shares dipped 3% in after-hours trading as investors reacted to Microsoft’s massive $34.9 billion AI-related capital spending, well above expectations. The company’s deepening AI investments, including its renewed 27% stake in OpenAI, continue to drive growth, helping it reach a $4 trillion valuation—second only to Nvidia.

- Meta -9.11% reported a sharp decline in quarterly profit due to a $15.9 billion tax charge, sending its shares down 6% in after-hours trading. Excluding the charge, its operating margin was 40%, and revenue rose 22% to $51.24 billion on strong ad demand. Despite surpassing expectations, Meta warned of regulatory and legal risks in the U.S. and Europe. The company raised its 2025 expense and capital spending outlooks to fund AI infrastructure, with CFO Susan Li citing higher cloud and talent costs, while CEO Mark Zuckerberg highlighted progress in its Superintelligence Labs and AI-powered devices.

- Verizon Communications +2.25% – stock rose after the telecom giant beat estimates for quarterly profit and wireless subscriber additions, as promotions around the recent iPhone launches helped the U.S. wireless service provider attract more customers

- Caterpillar +11.51% – stock gained after the heavy equipment manufacturer reported better-than-expected third-quarter results, with sales helped by resilient demand across its business segments.

- CVS Health -1.81% – initially rose after the pharmacy chain lifted its annual profit outlook, but flagged a $5.7 billion charge linked to an impairment test which showed that the fair value of its struggling health care delivery division was below its carrying value.

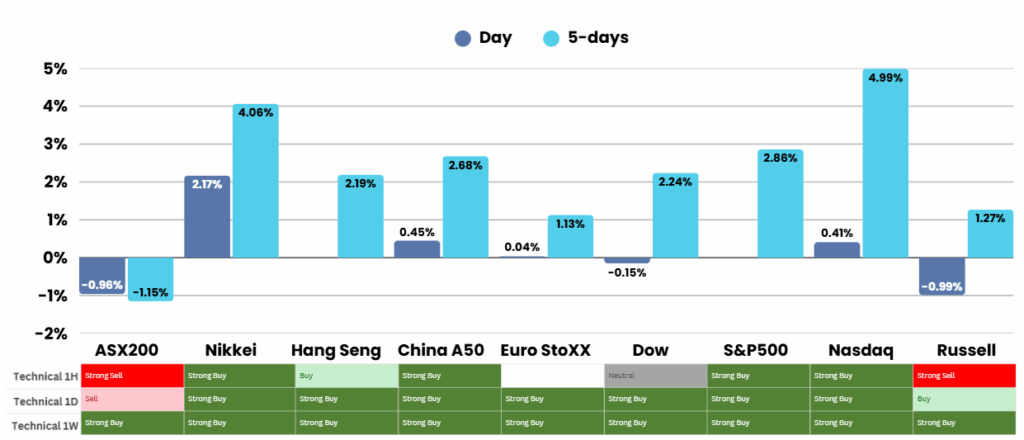

ASX Overnight: SPI 8908 (-0.35%)

The Day Ahead:

Quarterly results or updates expected on Thursday from Coles Group, IGO, Lynas Rare Earths and Mineral Resources.

Companies scheduled to hold annual meetings include Challenger, Charter Hall Retail REIT, EQT Holdings, Healius, JB Hi-Fi, James Hardie, Kelsian Group and PWR Holdings. Two companies are set to host investor day events: Alcoa and Suncorp Group.

Yesterdays Session:

The Australian sharemarket fell on Wednesday as stronger-than-expected inflation dampened hopes of an interest rate cut. The S&P/ASX 200 dropped 0.9 percent to 8931.2, led lower by property, banking, and healthcare stocks after core inflation rose 1 percent for the September quarter, exceeding forecasts. Real estate and major banks each lost around 2 percent, while CSL’s 3.8 percent fall dragged healthcare down. However, strong results from Nick Scali, Boss Energy, Woolworths, SiteMinder, and Ansell provided some support.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.