What's Affecting Markets Today

Asian Markets Mixed as Investors Eye Trump–Xi Meeting and Fed Caution

Asian equities traded mixed on Thursday as investors awaited signals from the first in-person meeting between U.S. President Donald Trump and Chinese President Xi Jinping since the start of Trump’s second term. Hong Kong’s Hang Seng Index rose 0.39%, while mainland China’s CSI 300 hovered just above the flatline, reflecting a cautious tone ahead of the high-stakes diplomatic talks.

Broader Asia-Pacific sentiment was subdued after U.S. Federal Reserve Chair Jerome Powell pushed back on expectations of a December rate cut, stressing it was “far from a foregone conclusion.” The Fed cut interest rates by 25 basis points overnight to 3.75%–4%, in line with forecasts.

South Korea drew market attention following reports that chief policy adviser Kim Yong-beom outlined details of a new U.S.–South Korea trade agreement. Seoul will invest US$200 billion in the U.S., capped at US$20 billion annually, while the remaining US$150 billion of its US$350 billion pledge will support shipbuilding cooperation.

The Kospi opened 0.49% higher, led by gains in auto and shipbuilding stocks, while the Kosdaq slipped 0.92%. Japan’s Nikkei 225 edged slightly lower and the Topix rose 0.38%. Australia’s ASX 200 opened 0.18% weaker.

ASX Stocks

ASX 200 8,885.5 (-0.46%)

ASX Slides as Property Stocks Sink; Lithium Miners Surge on Upgrades

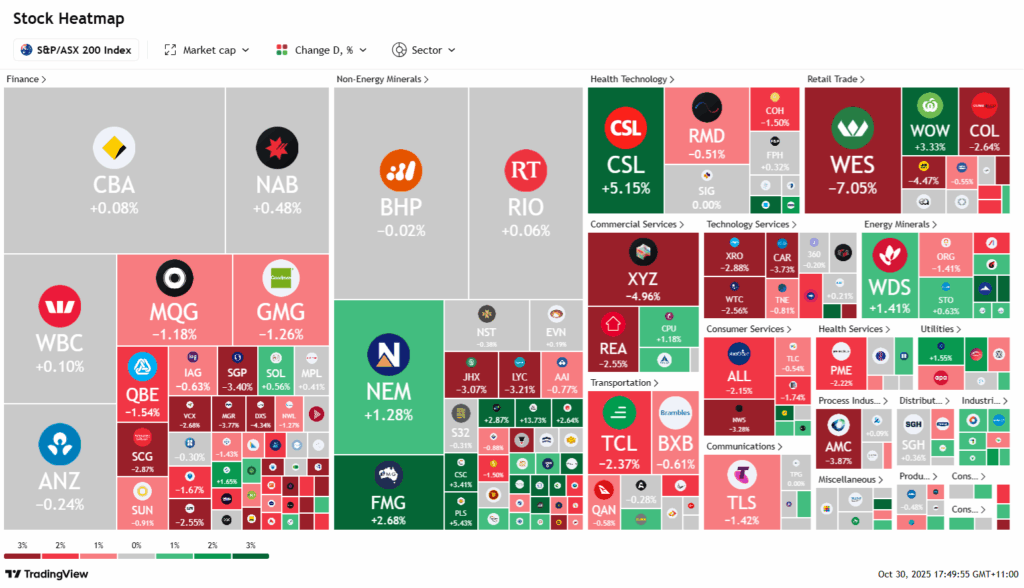

The Australian sharemarket edged lower on Thursday, extending the previous session’s steep sell-off as investors reassessed interest rate expectations. The S&P/ASX 200 dipped 0.2% to 8905.06 by 2:04pm AEDT, with six of 11 sectors in the red. Sentiment remained fragile after Australia’s hotter-than-expected inflation print on Wednesday and a cautious Federal Reserve tone overnight, which cooled hopes of further rate cuts this year.

Rate-sensitive property stocks again led declines, with Mirvac, Dexus and Stockland falling between 2% and 5%. Consumer discretionary shares also weighed, highlighted by Wesfarmers’ 6% pullback and a 5.1% drop in JB Hi-Fi despite solid quarterly sales. By contrast, bargain hunters supported the major banks, which traded modestly higher.

Lithium miners defied the weakness after JPMorgan upgraded its long-term spodumene price forecasts and lifted Pilbara Minerals to “overweight”, sending PLS up 5.8%. Mineral Resources surged 13.9% on stronger-than-expected earnings and record iron ore shipments, while Liontown gained 10.7%.

Among individual moves, Coles eased 3%, James Hardie lost 3% after board removals, and Ampol slipped 2.6% despite stronger refining margins. Appen dropped 4.9% amid ongoing US market volatility.

Leaders

L1G L1 Group Ltd (+13.84%)

MIN Mineral Resources Ltd (+13.57%)

LTR Liontown Resources Ltd (+10.92%)

CIA Champion Iron Ltd (+10.71%)

PDN Paladin Energy Ltd (+6.82%)

Laggards

DTR Dateline Resources Ltd (-11.91%)

DRO Droneshield Ltd (-7.67%)

DTL Data#3 Ltd (-6.82%)

WES Wesfarmers Ltd (-5.83%)

JBH JB Hi-Fi Ltd (-5.01%)