Overnight – Amazon soars on cloud demand

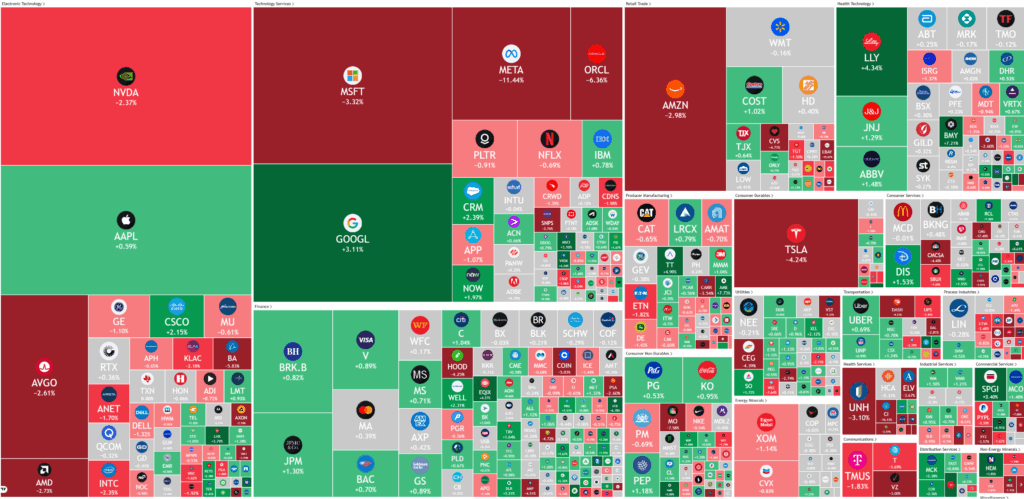

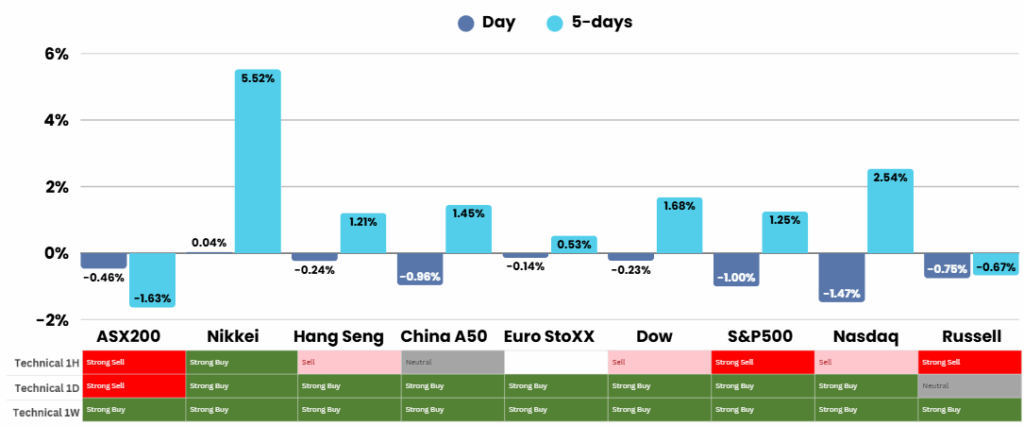

Equities were pressured by dip in tech following mixed earnings from tech just as investors weigh up a de-escalation in U.S.-China trade tensions following the Trump/Xi trade meeting. Meanwhile Amazon delivered bumper earnings beat after the close

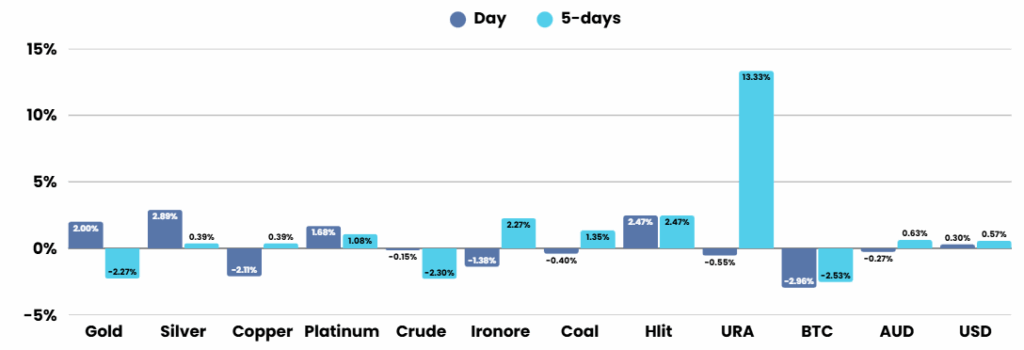

President Trump described his recent meeting with Chinese President Xi Jinping as “amazing and outstanding,” signaling renewed optimism for a trade deal between the United States and China. Trump suggested that an agreement could be reached soon, adding that there were few obstacles left. He announced that Washington and Beijing would sign annual deals to secure supplies of rare earths and confirmed that China would resume purchases of U.S. agricultural products, especially soybeans. The President also said he would immediately reduce tariffs on Chinese fentanyl products to 10% while maintaining other tariffs at roughly 47%. He is expected to visit China in April to continue discussions.

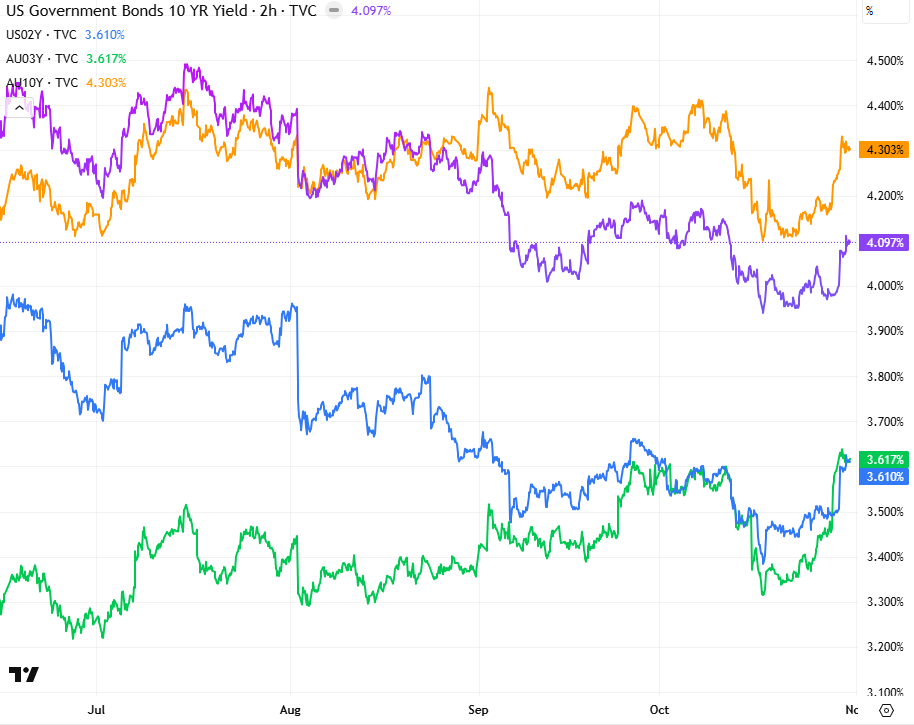

The Federal Reserve trimmed interest rates by 25 basis points to a range of 3.75% to 4.00%, marking its second straight cut, but left markets guessing about its next move. Chair Jerome Powell emphasized that more easing in December was not guaranteed, citing “foggy” economic signals and lingering inflation risks. Analysts from ING noted that inflation pressures remain but the labor market shows weakness, predicting another rate cut in December and further monetary easing next year to sustain growth. Powell’s cautious remarks tempered investor expectations for further immediate reductions.

Major technology stocks showed mixed performances following earnings reports. Meta Platforms’ shares fell after the company pledged to ramp up spending on artificial intelligence projects, sparking investor skepticism about returns on its ambitious investments. In contrast, Alphabet reported record revenue and a 33% spike in profit to around $35 billion, powered by growth in its cloud and advertising divisions. Microsoft also posted strong results, driven by high demand for its cloud and AI services, and announced plans to double its data center capacity within two years to handle surging global demand.

Corporate News & Earnings

- Amazon +14% – delivered robust third-quarter results, surpassing analyst expectations with earnings per share of $1.95 and revenue of $180.2 billion, driven by a 20% jump in its AWS cloud unit and strong AI demand, which helped offset tepid growth in its e-commerce business. AWS, now expanding at its fastest pace since 2022, posted $33 billion in sales and accounted for around 60% of Amazon’s total operating income despite recent outages and job cuts. Net income rose to $21.2 billion aided by a $9.5 billion gain from an investment in Anthropic, while advertising sales also surged 24% to $17.7 billion. Excluding one-off charges, operating income would have reached $21.7 billion. With cloud momentum and rising AI adoption fueling growth, Amazon projected fourth-quarter revenue of $206-213 billion, echoing industry optimism as big tech continues aggressive spending on AI and infrastructure—even as consumer spending softens amid global trade concerns.

- Apple +3.5% – reported fourth-quarter earnings per share of $1.85, beating analyst expectations of $1.76, with revenue rising to $102.5 billion versus the $101.69 billion consensus. Despite iPhone sales missing estimates at $49.03 billion due to weaker demand in China, overall results exceeded Wall Street forecasts, driven by a 15% surge in services revenue to a record $28.75 billion. Sales in Greater China dipped to $14.49 billion from $15.03 billion a year prior. CEO Tim Cook projected double-digit iPhone growth and 10–12% overall revenue growth for the upcoming quarter, signaling optimism for a record-breaking December quarter. Apple shares closed at $271.25, up 34% in the past three months and 20% over the past year, and gained more than 4% in after-hours trading following the earnings release.

- Eli Lilly +3.81% –stock gained after the drugmaker lifted its full-year revenue guidance, thanks in part to strong demand for its Zepbound weight loss treatment.

- Estee Lauder +0.26% –stock soared after the beauty company beat estimates for first-quarter sales and profit, helped by an uptick in China demand.

- Biogen+1.18% – stock fell after the biotech company cut its full-year earnings guidance despite reporting better-than-expected third quarter results, with adjusted earnings and revenue surpassing analyst estimates.

ASX Overnight: SPI 8913 (+0.14%)

The Day Ahead:

sleep device maker ResMed has reported a 9 per cent increase in first quarter earnings to US$1.3 billion ($2 billion) as it announced plans to expand its manufacturing operations in the United States.

Origin Energy has posted flat gas production volumes from its Australia Pacific LNG venture in Queensland in the September quarter as well as steady electricity sales from its energy markets business, but gas sales volumes in the retail arm dropped by 12 per cent compared with the year earlier.

Sales at Endeavour Group’s core retailing chains Dan Murphy’s and BWS fell 1 per cent in the first quarter in the financial year, more than the market expected,

ANZ’s upcoming full-year results will be impacted by major changes under new boss Nuno Matos

Yesterdays Session:

The Australian sharemarket fell slightly on Thursday, extending its recent decline as investors adjusted expectations for interest rates following strong inflation data and cautious signals from the US Federal Reserve. The S&P/ASX 200 slipped 0.2% to 8905.06, with property and consumer discretionary stocks leading losses while major banks gained modestly. Lithium and resource stocks outperformed after favorable forecasts and strong earnings, with Pilbara Minerals, Mineral Resources, and Liontown posting sharp gains.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.