What's Affecting Markets Today

Japan Leads Asian Markets as US–China Truce Lifts Sentiment; ASX Flat

Asian equities advanced on Friday, led by Japan, after the US and China reached a limited truce to ease tensions over rare earth exports. The agreement followed a high-stakes meeting between US President Donald Trump and China’s Xi Jinping in South Korea, reducing the risk of a renewed trade war. Analysts noted both sides kept concessions modest, preserving leverage for future negotiations.

Japan’s Nikkei 225 surged more than 2% to a record 52,411.34, while the Topix gained 0.94% to 3,331.83. Panasonic slid over 8% after cutting its full-year operating profit forecast by 13.5%, citing weakness in its energy division, which supplies batteries to Tesla and other automakers.

South Korea’s Kospi rose 0.5% to a fresh high of 4,107.5, with the Kosdaq up 1.07%. Tech stocks rallied as Nvidia unveiled plans to expand South Korea’s AI infrastructure, deploying over 250,000 GPUs with government support. Hyundai jumped 9.6% as Nvidia deepened its partnership across autonomous driving, robotics and smart manufacturing.

Australia’s ASX 200 closed flat at 8,881.9, while Hong Kong’s Hang Seng and China’s CSI 300 fell 1.43% and 1.47% respectively amid weak Chinese manufacturing data.

ASX Stocks

ASX 200 8,891.8 (+0.12%)

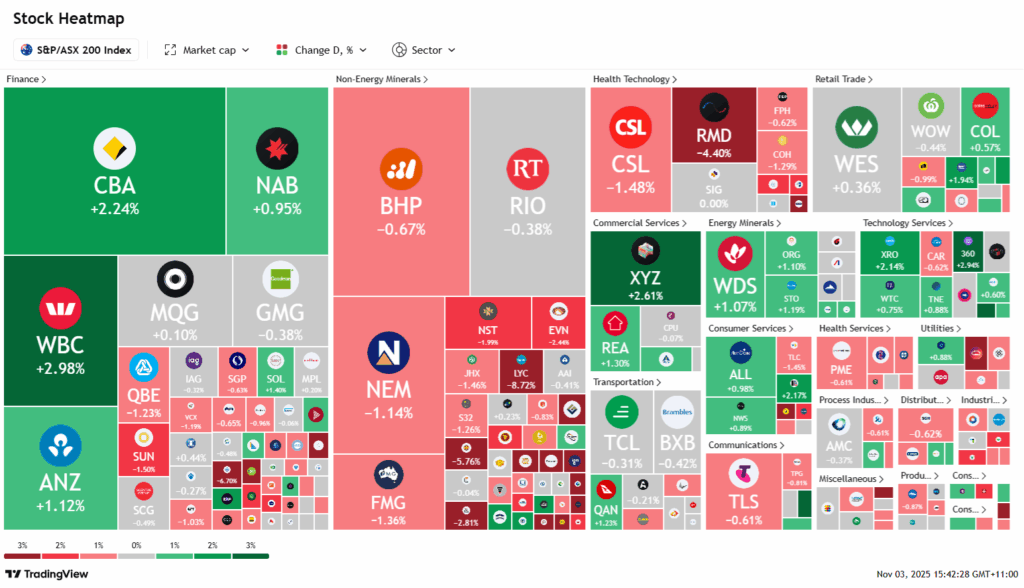

ASX Slips as Healthcare and Property Drag; Westpac Bucks Trend

The Australian sharemarket edged lower on Monday as investors remained cautious ahead of the Reserve Bank of Australia’s policy meeting. The S&P/ASX 200 dipped 0.1%, or 5.2 points, to 8876.7 by 2pm AEDT, with eight of the 11 sectors trading in the red.

Healthcare led losses, weighed down by a 4.1% fall in ResMed, while Cochlear and CSL declined 1.7% and 1.6% respectively. Property stocks also weakened, pressured by rising rate expectations, with Scentre down 0.7%, Goodman Group slipping 0.6% and Stockland falling 1%.

Economists now expect the RBA to revise inflation forecasts higher after a hotter-than-expected September quarter result, effectively ruling out a Melbourne Cup Day rate cut. Core inflation rose 1% for the quarter, above the central bank’s 0.6% forecast.

Energy outperformed as Brent crude rose above US$65 a barrel, lifting Woodside 1.4% and Santos 1.2%.

In company news, Westpac gained 2.2% after posting a slightly better-than-expected $6.97b annual profit. DroneShield rose 0.7% on a $25.3m defence contract, while HealthCo Wellness REIT surged 10% after recovering deferred rent.

Leaders

NGI Navigator Global (+7.83%)

MP1 Megaport Ltd (+6.44%)

PPM Pepper Money Ltd (+5.38%)

CYL Catalyst Metals Ltd (+4.79%)

HMC HMC Capital Ltd (+4.36%)

Laggards

LYC Lynas Rare Earths Ltd (-8.26%)

4DX 4DMedical Ltd (-7.04%)

SDF Steadfast Group Ltd (-6.43%)

MMS McMillan Shakespeare Ltd (-5.63%)