Overnight – AI rally continues as AWS joins the OpenAI “pass the parcel”

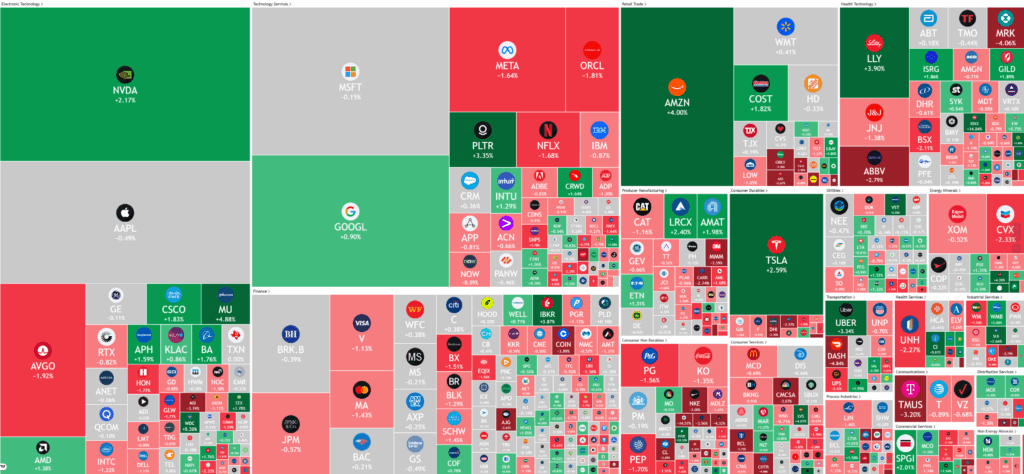

Stocks closed higher overnight as artificial intelligence stocks, led by Nvidia & Amazon as another continued to rack up gains amid recent signs that spending on AI is far from over.

Amazon’s cloud unit made headlines by securing a $US38 billion ($58 billion) deal to provide computing resources to OpenAI, underscoring the soaring demand for AI infrastructure and boosting Amazon shares by 4.1%. This major cloud agreement highlights how leading technology firms are capitalizing on AI’s rapid expansion and seeking strategic partnerships to meet the growing computational needs of large AI models. The move further strengthens Amazon Web Services’ position as a pivotal player in the AI ecosystem, supporting ongoing momentum in the sector alongside other tech giants.

Within the broader AI market, stocks continued their upward climb, with Nvidia at the forefront following a series of new deal announcements that reinforce the sector’s robust demand. Investors are keenly focused on upcoming earnings from key AI companies such as AMD and Palantir, including Palantir’s recently raised revenue forecast for 2025. Other major corporate updates include Kenvue’s surge on news of a $48.7 billion acquisition by Kimberly-Clark, and Berkshire Hathaway’s record $381.7 billion cash reserve after strong quarterly earnings. Over 80% of reporting S&P 500 companies have exceeded earnings expectations, with analysts highlighting an earnings beat rate among the highest on record.

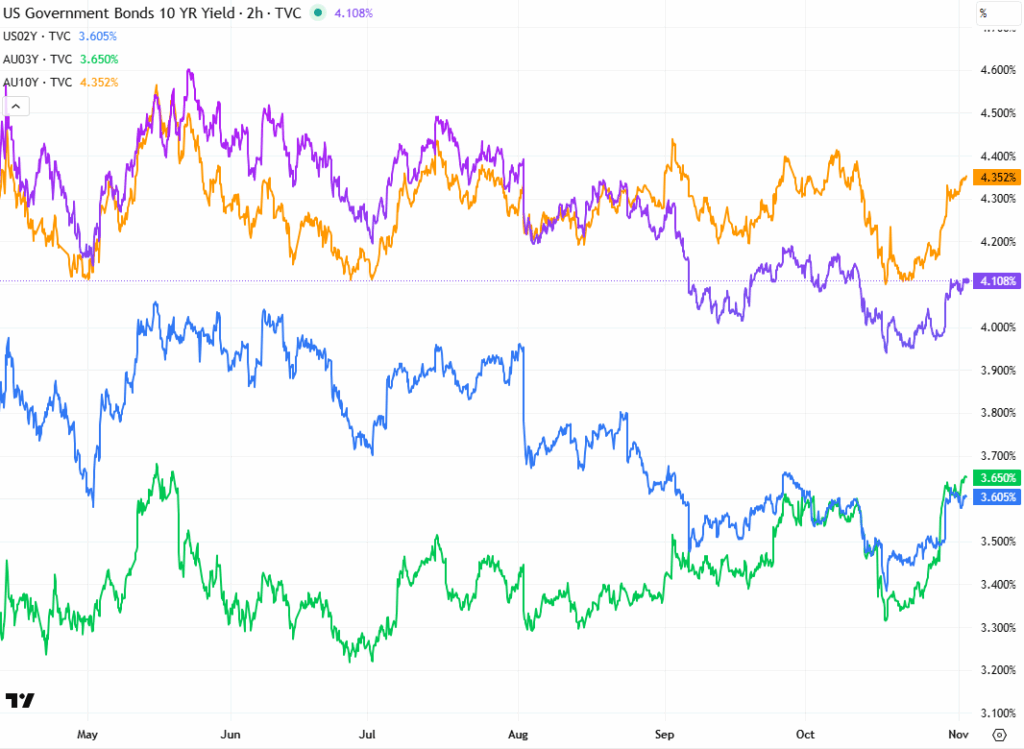

Federal Reserve officials have signaled caution on further interest rate cuts due to persistent inflation concerns, contributing to some uncertainty in markets. Although the central bank recently lowered its benchmark rate, the ongoing U.S. government shutdown has delayed access to key economic data, prompting investors to look to alternative indicators like the ISM manufacturing index and ADP employment report for labor market insights. As the U.S. economy navigates these twin forces of strong corporate earnings and monetary policy uncertainty, the latest moves from Amazon, Nvidia, and other tech leaders reinforce the pivotal role of AI infrastructure investments in shaping market sentiment.

Corporate News & Earnings

- Palantir Technologies+1% – with the data analytics giant set to report its quarterly returns after the closing bell. The company lifted its full-year revenue forecast in August for the second time in 2025, citing strong demand for its AI-linked services from both businesses and governments.

- Berkshire Hathaway +1.3% – The Fund Manager rose after Warren Buffett’s conglomerate reported strong third-quarter results, with its cash pile climbing to a record $381.7 billion, up from $277 billion a year earlier.

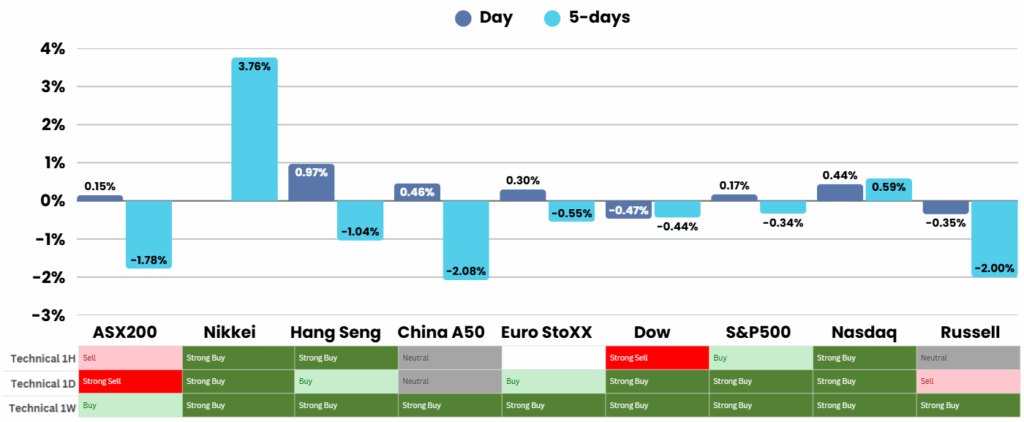

ASX Overnight: SPI 8887 (-0.17%)

The Day Ahead:

Its Melbourne Cup day with an RBA on hold. Unlikely to be eventful

Yesterdays Session:

The Australian sharemarket slipped 0.1% on Monday to 8876.7 as investors turned cautious ahead of the Reserve Bank’s policy meeting, with most sectors in the red. Healthcare stocks led declines, property firms weakened on higher rate expectations, and economists now anticipate the RBA will lift inflation forecasts, ruling out a Melbourne Cup Day rate cut. Energy shares gained on stronger oil prices, while Westpac rose after a solid profit result, and HealthCo Wellness REIT jumped 10% on recovered rent.market analysis, AI stocks, Hindenburg Omen, investment strategies, market breadth, economic indicators, earnings reports, stock market trends, financial news, trading insights

You can now listen & Watch to the Pre Market Pulse

Understanding Training, Inference Chips and the Competitive Landscape

For investors navigating the AI hardware landscape, distinguishing between training chips and inference chips is crucial. This guide breaks down their key differences, explores practical uses across industries, highlights leading players like NVIDIA’s market dominance and emerging challengers such as Qualcomm, and explains why standard CPUs and RAM fall short for handling large language models—equipping you to spot investment opportunities in this evolving sector.