Overnight – “Buy the Dip” Tech stocks default market back to the trend

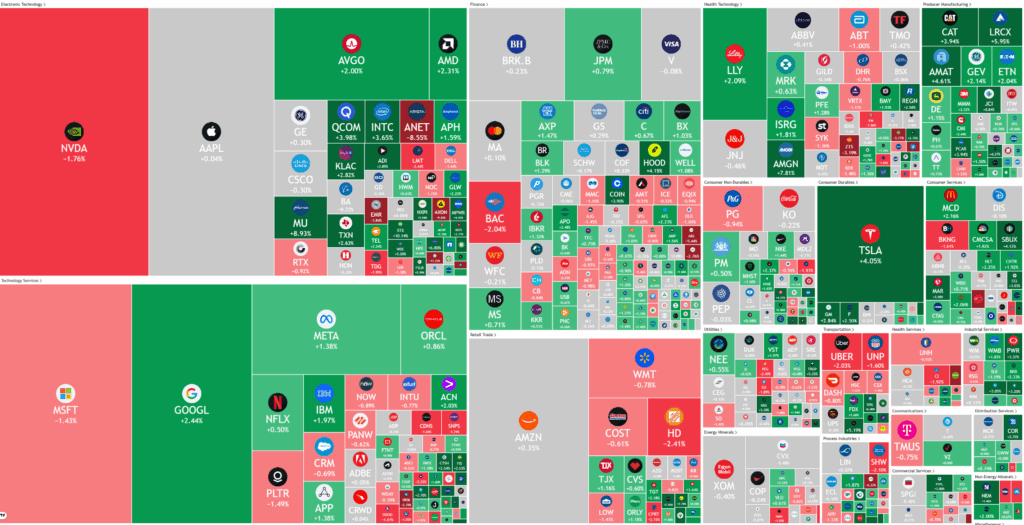

Stock bounced overnight as the “Bull market default” of buying the dip saw investors pile back into tech following recent weakness just as President Donald Trump’s IEEPA tariffs* go on trial.

The tech sector remained under close watch Wednesday, with company earnings driving sharp moves in notable stocks. AMD shares reversed initial losses to trade higher after reporting record sales and profit, thanks to robust demand for its AI chips, while Pinterest stock fell steeply on weaker-than-forecast revenue guidance, stoking concerns about a cooling digital ad market. Elsewhere, McDonald’s outperformed expectations for US same-store sales, Novo Nordisk slipped following dampened profit and sales forecasts, and Humana sank after lowering its full-year earnings outlook due to rising medical costs.

Investor anxiety was further heightened as leading bank CEOs warned of high-tech valuations and speculative trading, casting doubt on the sustainability of Wall Street’s rally led by a handful of tech giants. With US equities now composing 72% of the global equity benchmark and several major firms trading at record highs, concerns over market concentration and a possible bubble have grown. Analysts warn that historically, high valuations reduce the chances of generating attractive long-term returns, and there’s increasing discussion about whether global investors should look beyond the US for opportunity.

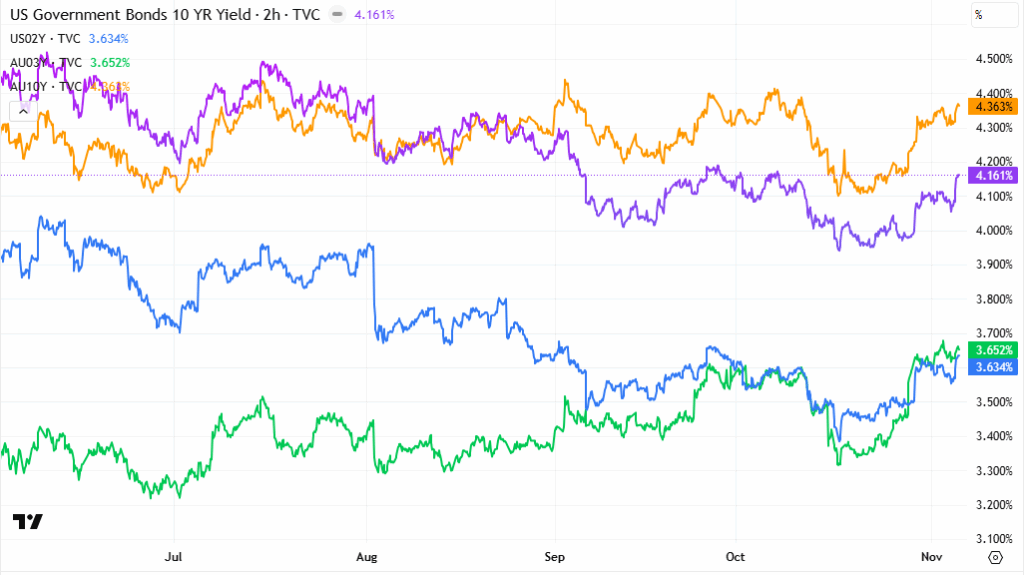

In macroeconomic developments, US labour market strength was confirmed by upbeat ADP employment data, even as further clarity awaits delayed government reporting due to a shutdown. Meanwhile, the Supreme Court began hearing arguments over the legality of President Trump’s use of the IEEPA to impose sweeping tariffs, with early indications suggesting scepticism from the justices about presidential authority on tariffs; the outcome could force the US to repay billions in tariff revenue and trigger major economic consequences

Corporate News & Earnings

- ARM Holdings +4% – the chip architecture firm topped quarterly earnings expectations and offered upbeat guidance, buoyed by robust licensing activity and royalty gains.

- Pinterest -22% –stock tumbled after its quarterly revenue guidance fell short of expectations, stoking worries about a slowdown in digital advertising.

- McDonald’s +2.2% – stock gained after the burger giant’s U.S. restaurants reported better-than-expected same-store sales growth, even as quarterly earnings fell short of expectations.

- Novo Nordisk -1% – despite the drugmaker announced a better-than-expected Medicare pricing deal, even after it trimmed its full-year profit and sales forecasts as sales growth slows.

- Humana -6%- stock slumped after the insurer reported reported lower third-quarter profit and slashed its full-year earnings guidance as medical costs continue to rise.

* Trump’s IEEPA tariffs are sweeping import taxes imposed by President Trump in 2025 using emergency powers, applying a flat 10% tariff to most imported goods from nearly all countries, with higher rates for major trade deficit partners; this unprecedented move sparked global trade tensions, drove prices up, and is being challenged in US courts as possibly illegal.

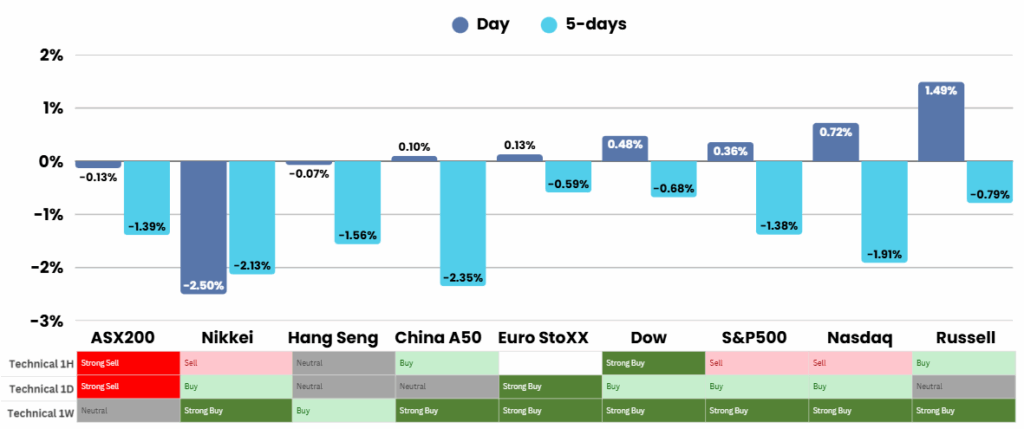

ASX Overnight: SPI 8871 (+0.75%)

The Day Ahead:

We remain cautious and are in profit taking mode after a very good year at MPC, out performing the ASX200 by 18%*

*High conviction watchlist stats 1st November 2025 to 31st October 2025

Yesterdays Session:

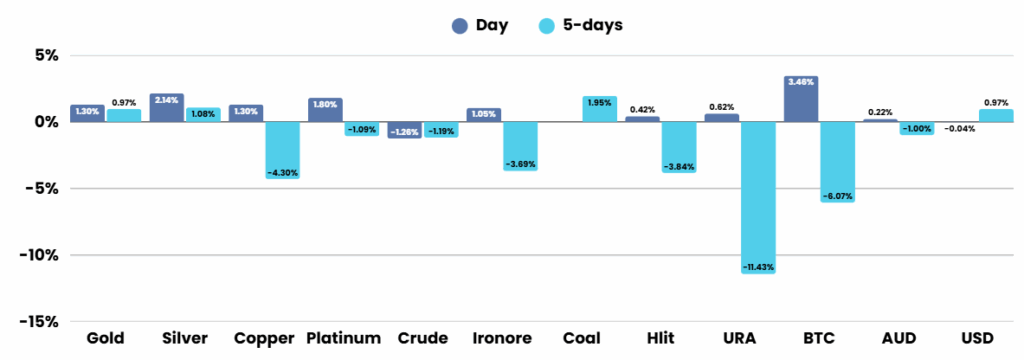

The Australian sharemarket fell 0.3% on Wednesday to 8790.1, marking its sixth drop in seven sessions as weakness in mining and technology stocks weighed on sentiment. Investors grew cautious after RBA governor Michele Bullock warned that inflation may remain stubborn, dampening hopes for more rate cuts. Tech giants like NextDC, Codan, and Life360 led declines, while miners such as BHP, Fortescue, and Rio Tinto slipped with falling iron ore prices. Woodside bucked the trend with a 0.8% gain, and Medibank rose 1.5% after announcing a $159 million acquisition.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.