What's Affecting Markets Today

Asia-Pacific Stocks Rise as AMD Earnings Boost AI Sentiment

Asia-Pacific equity markets strengthened on Thursday, mirroring Wall Street’s gains after a strong earnings beat from AMD lifted investor confidence in artificial intelligence–linked stocks.

Japan’s Nikkei 225 rose 1.45%, while the Topix gained 1.11%. SoftBank rebounded 1.5% after a steep 10% slump in the prior session. AI-related names outperformed, with chip-testing supplier Advantest up 3.73% and semiconductor equipment maker Disco Corp advancing 4.59%.

South Korea’s Kospi pared early gains to trade flat after Wednesday’s decline, though SK Hynix, a key supplier to Nvidia, rose 3.11%. The tech-heavy Kosdaq slipped 0.52%.

Australia’s S&P/ASX 200 climbed 0.28%, while Hong Kong’s Hang Seng added 0.72%. Mainland China’s CSI 300 was steady in early trade.

In Hong Kong listings, autonomous driving firms WeRide and Pony.ai slumped on debut, falling more than 12% and nearly 8% respectively. Pony.ai raised HK$6.7 billion (US$860 million) through its IPO, while WeRide secured HK$2.4 billion.

ASX Stocks

ASX 200 8,820.8 (+0.21%)

ASX Edges Higher as Miners Lead; James Hardie Slumps on MSCI Exit

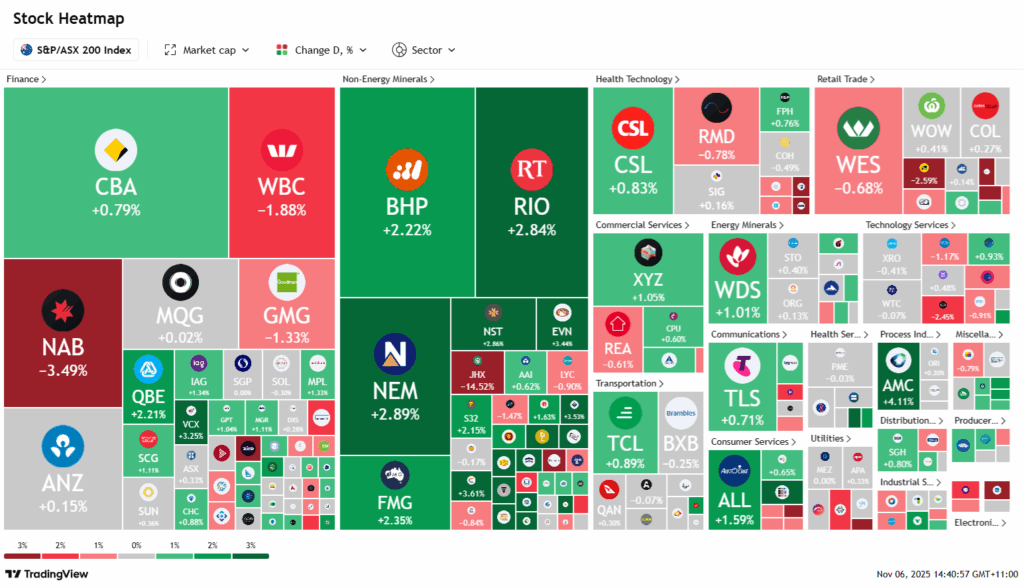

The ASX rebounded on Thursday, with the S&P/ASX 200 up 0.3% to 8823.7 by 2pm AEDT, snapping a multi-day decline as stronger gold prices and gains in major miners lifted the market. Gold stocks rallied after bullion rose 1.2% overnight to hold above US$3970 an ounce. Newmont climbed 2.6%, Northern Star 2.9% and Evolution Mining 3%.

Large iron ore miners also advanced despite softer ore prices, with BHP up 2.1%, Rio Tinto 2.6% and Fortescue 2.3%.

Bank stocks weighed on the index after National Australia Bank fell 3.7% on full-year cash earnings of $7.09b, missing expectations. Westpac slipped 1.9%, while CBA gained 1.2% and ANZ edged higher.

The sharpest decline came from James Hardie, plunging up to 17% before a trading halt, and trading 14% lower post-halt after its removal from MSCI’s Australia index.

Elsewhere, Light & Wonder jumped 11.1% on surging iGaming revenue, Amcor rose 5.1% on an earnings beat, Domino’s added 4.5% after securing $1.05b in new debt facilities, while Neuren Pharmaceuticals fell 8.9% on softer-than-expected sales.

Leaders

LNW Light & Wonder Inc (+10.19%)

EMR Emerald Resources NL (+5.63%)

RMS Ramelius Resources Ltd (+5.16%)

ALK Alkane Resources Ltd (+5.05%)

HSN Hansen Technologies Ltd (+4.97%)

Laggards

JHX James Hardie Industries Plc (-14.08%)

DRO Droneshield Ltd (-11.43%)

NEU Neuren Pharmaceuticals Ltd (-9.00%)

SX2 Southern Cross Gold (-6.90%)

EOS Electro Optic Systems (-6.13%)