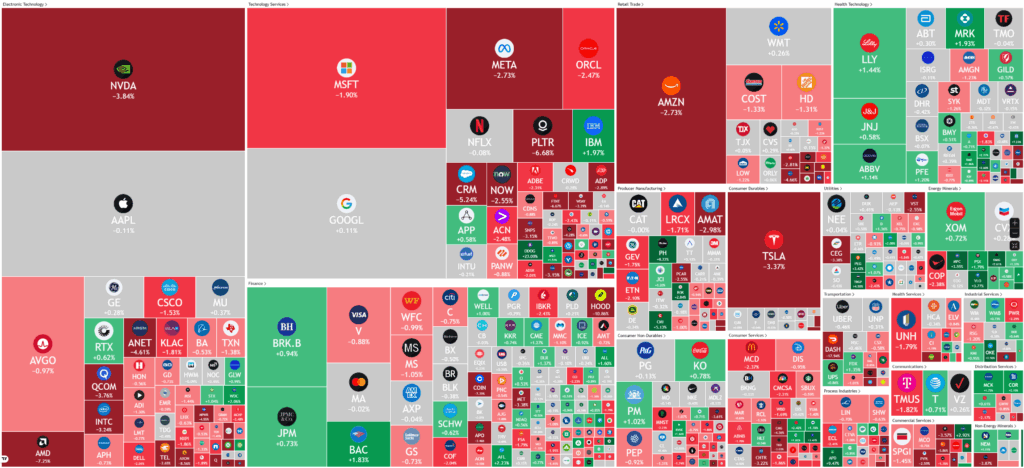

Overnight – Tech leads market lower as Investors take profits in the AI rally

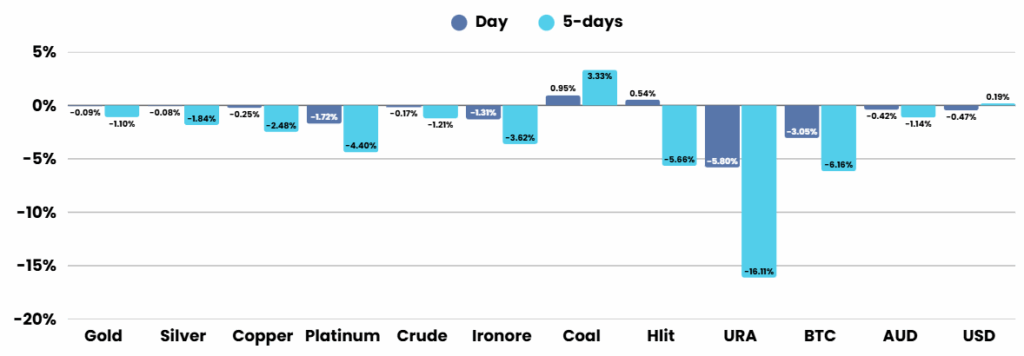

Sellers returned to tech overnight, with AI names including Nvidia the hardest hit amid concerns about valuations while data showing big job cuts stoked concerns about the economy.

Nvidia led a broad sell-off among tech and AI-related stocks, dropping over 4% due to renewed concerns about high market valuations, reversing a brief recovery from the previous day. Other big names like Palantir, Dell, and AMD also moved sharply lower. Meanwhile, Qualcomm’s stock slid after it cautioned about the potential loss of a major customer, Samsung, even as its latest earnings beat Wall Street forecasts, supported by strong demand for premium smartphones.

Contrasting the broader tech declines, Arm Holdings’ shares jumped after issuing a fiscal third-quarter outlook that exceeded analyst expectations, driven by sustained AI industry investment. Other bright spots included Snap, Lyft, Moderna, and Datadog, whose stocks rose on stronger-than-expected quarterly results and improved revenue forecasts. In contrast, Warner Bros Discovery fell after reporting disappointing streaming growth and ongoing declines in cable TV, while Marvell Technology rallied on news of a potential takeover explored by SoftBank with plans to merge it with Arm Holdings.

Outside the corporate arena, U.S. job cuts reached their highest October level in 22 years, raising economic concerns. Meanwhile, legal and policy developments drew investor attention, as the Supreme Court began hearing arguments over the legality of former President Trump’s tariffs, which could set important precedents for presidential trade authority and future U.S.-China relations. Separately, Tesla’s shareholders prepared to vote on a proposed $1 trillion pay package for CEO Elon Musk, adding another focal point for the markets.

Corporate News & Earnings

- Moderna +2.5% – stock jumped after the drugmaker reported a sharp drop in third-quarter revenue, but still topped consensus estimates, while also narrowing its full-year sales forecast.

- Datadog +20% – stock gained after the cloud monitoring company reported third quarter results that exceeded expectations, delivering strong revenue growth and raising its outlook for the remainder of the year.

- Warner Bros Discovery -1.35% – stock fell after the entertainment giant reported disappointing quarterly revenue, squeezed by lackluster growth in its streaming unit and persistent declines in its cable TV business.

ASX Overnight: SPI 8831 (-0.15%)

The Day Ahead:

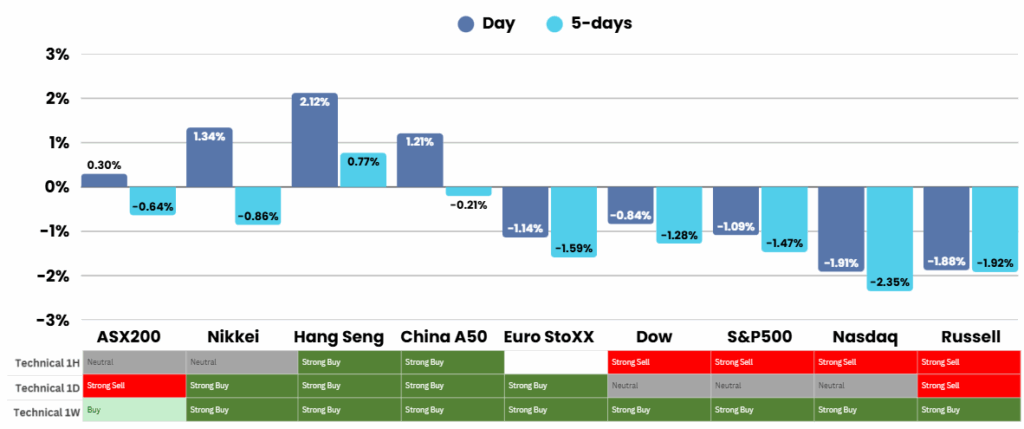

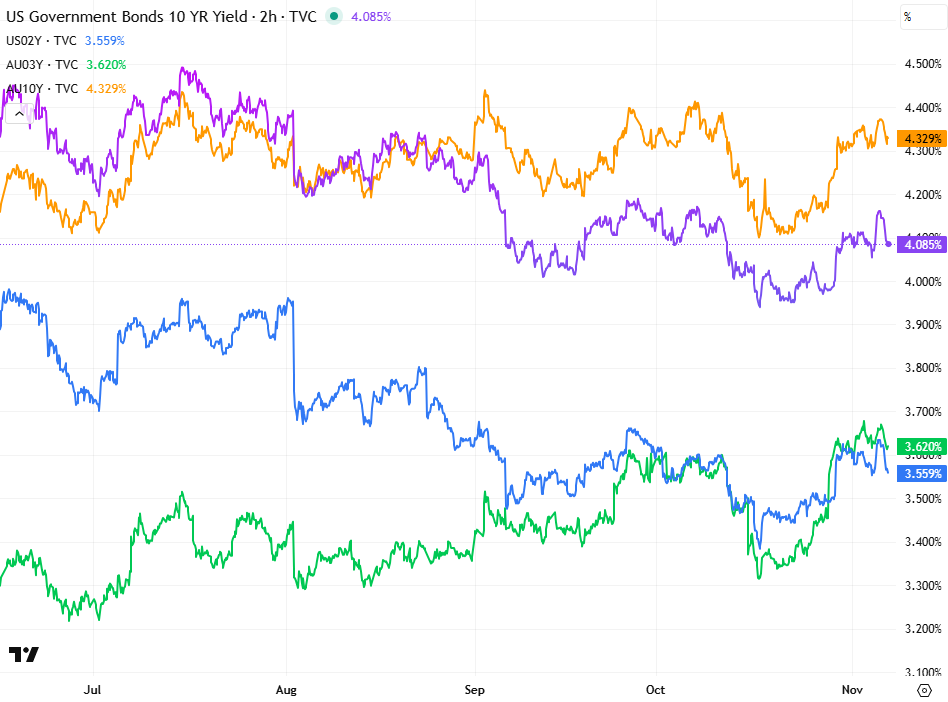

We remain on the sell side as the technical are turning on global indices. Fundamentals have been poor for some time now, without technical momentum supporting prices, we expect a sharp fall.

Yesterdays Session:

The ASX rebounded Thursday, with the S&P/ASX 200 rising 0.3% to 8823.7 by 2pm AEDT, snapping a recent losing streak as higher gold prices and gains in major miners lifted sentiment. Gold producers rallied, led by Newmont, Northern Star, and Evolution Mining, while big iron ore miners also advanced. Bank stocks dragged after NAB’s weaker earnings, though CBA and ANZ posted modest gains. James Hardie slumped 14% after its removal from MSCI’s Australia index. Among standouts, Light & Wonder soared on strong iGaming revenue, Amcor beat earnings expectations, and Domino’s rose after securing new funding, while Neuren Pharmaceuticals dropped on disappointing sales.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.