Overnight – Stocks saved from mid-session losses on Govt shutdown optimism

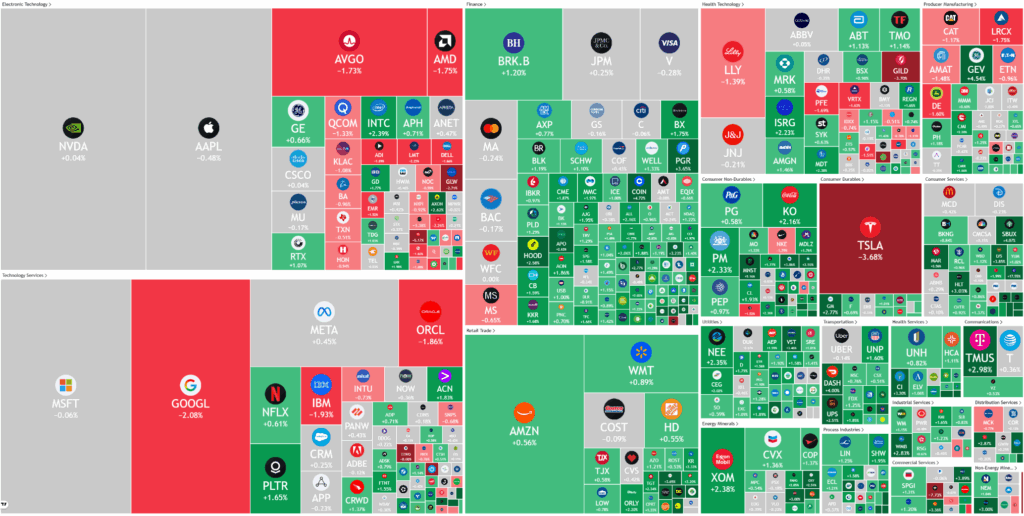

Stocks finished largely on Friday, recovering deep mid-session losses as hopes that the government shutdown could be nearing end were boosted after Senate Minority Leader Chuck Schumer proposed a deal that could re-open the government.

Democratic leaders have proposed a deal to end the ongoing government shutdown, with Senate Minority Leader Chuck Schumer suggesting that the government could reopen rapidly if Republicans accept their compromise. The core of the Democrats’ plan revolves around a one-year extension of health insurance subsidies, which has been the key point of contention. While Republicans previously pushed for separating health care subsidies from the short-term funding bill, Schumer urged them to accept the current agreement, putting pressure on the GOP to end the impasse.

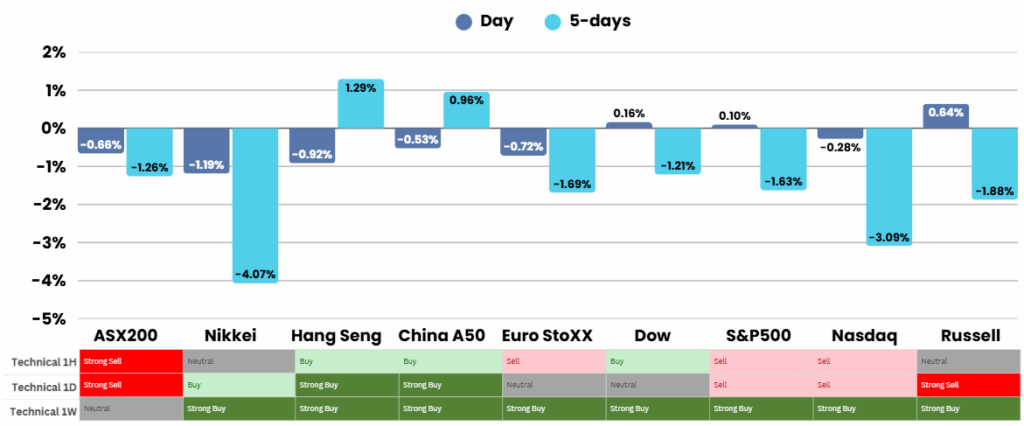

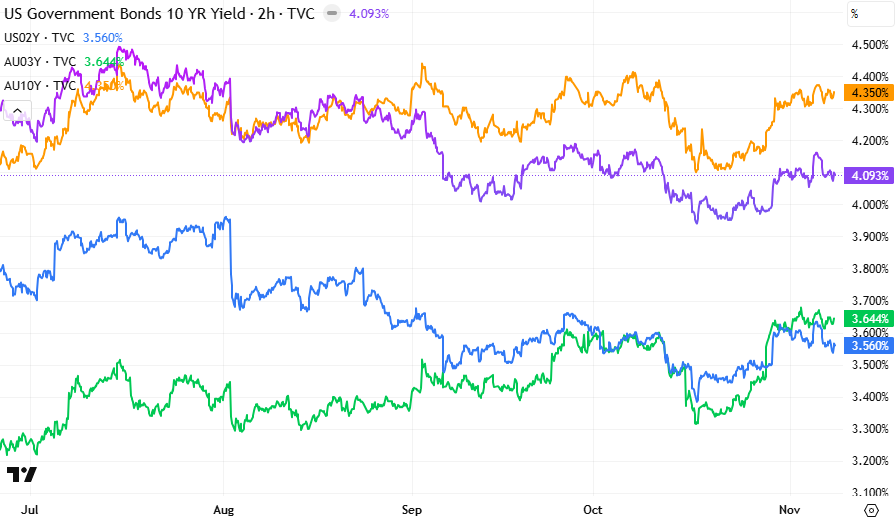

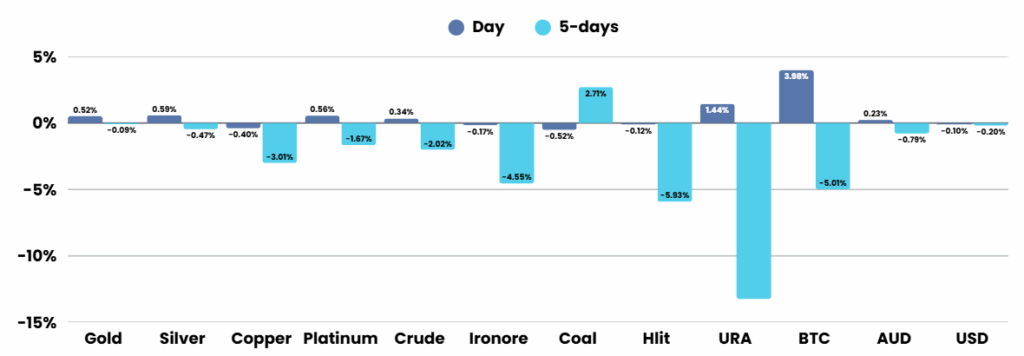

The extended shutdown is having a measurable impact on U.S. consumer confidence and the broader economy. In November, the University of Michigan’s consumer sentiment index dropped to its lowest level since June 2022, with increasing worries about inflation and job security due to government dysfunction. Reports from private firms signal a complicated labor picture: layoffs surged in October, but payroll data also showed a slight recovery in private sector hiring, while economists remain divided over whether the Federal Reserve will continue cutting interest rates to support the economy.

Corporate America also saw major headlines, including a landmark compensation plan at Tesla as shareholders approved a deal for Elon Musk that could pay him up to $1 trillion if ambitious targets are met. Meanwhile, Peloton and Affirm outperformed expectations in their earnings, but Take-Two faced setbacks due to delays in the much-anticipated GTA VI, demonstrating how ongoing economic uncertainty and market shifts continue to influence the performance of major

Corporate News & Earnings

- Airbnb 0.17% – – shares gave up gains even after the vacation rental firm forecast upbeat quarterly revenue after posting higher third-quarter results, aided by strong bookings in markets such as Latin America and Asia Pacific.

- Affirm Holdings +11.61%– shares soared after the buy-now-pay-later provider reported first-quarter fiscal 2026 results that significantly exceeded expectations, and raised its full-year guidance.

- Take-Two Interactive Software -8.08% – stock fell after Rockstar Games, a subsidiary of the video game developer, announced a further delay in the release of Grand Theft Auto VI to November 2026 from May 2026, the second delay for the highly anticipated game.

- DraftKings +8.65% – stock rose despite the gaming company lowering its full-year sales outlook and reported mixed third-quarter results, amid concerns that prediction market services are eating into the sports betting business.

- Peloton Interactive +14.16% – stock gained after the fitness company beat quarterly revenue estimates, buoyed by early traction from its revamped product lineup and price hikes across hardware and subscriptions.

ASX Overnight: SPI 8794 (+0.26%)

The Day Ahead:

Optimism of a resolution of the US Govt shutdown and Trumps $2000 stimulus announcement of a Tariff “Dividend” may provide a bid tone, although this will be short lived given the length of the shutdown and the economic effect.

Yesterdays Session:

The Australian sharemarket slipped 0.5% on Friday, heading for a second weekly loss as the S&P/ASX 200 tracked a 1% decline, with financials weak after Macquarie Group’s 7.4% drop on disappointing profits and most tech stocks also falling, while gains in Newmont’s shares on stronger gold prices helped offset losses in miners; other notable moves included Alliance Aviation plunging 41% after a cost warning, Block dropping 14% on poor U.S. revenue, Qantas sliding 5.7%, and News Corp rising 4% on robust results.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.