What's Affecting Markets Today

Asia Stocks Rebound as Investors Digest China Inflation, BOJ Signals Rate Shift

Asia-Pacific markets advanced on Monday, rebounding from last week’s declines driven by concerns over lofty artificial intelligence valuations. Investor sentiment improved following stronger-than-expected inflation data from China and signals of potential policy tightening from Japan.

China’s consumer price index rose 0.2% year-on-year in October, beating forecasts of flat growth, while producer prices fell 2.1%, slightly better than expected. The data helped lift regional confidence, though mainland shares underperformed, with the CSI 300 slipping 0.26%.

Japan’s Nikkei 225 gained 0.98% and the Topix rose 0.33% as 10-year government bond yields touched 1.695%, the highest since October. Minutes from the Bank of Japan’s October meeting suggested policymakers were increasingly open to a rate hike, citing improving conditions for policy normalization.

South Korea’s Kospi climbed nearly 3%, led by gains in banking and insurance stocks, while Hong Kong’s Hang Seng index advanced 0.54%, joining the regional recovery trend.

ASX Stocks

ASX 200 8,826.80 (+0.65%)

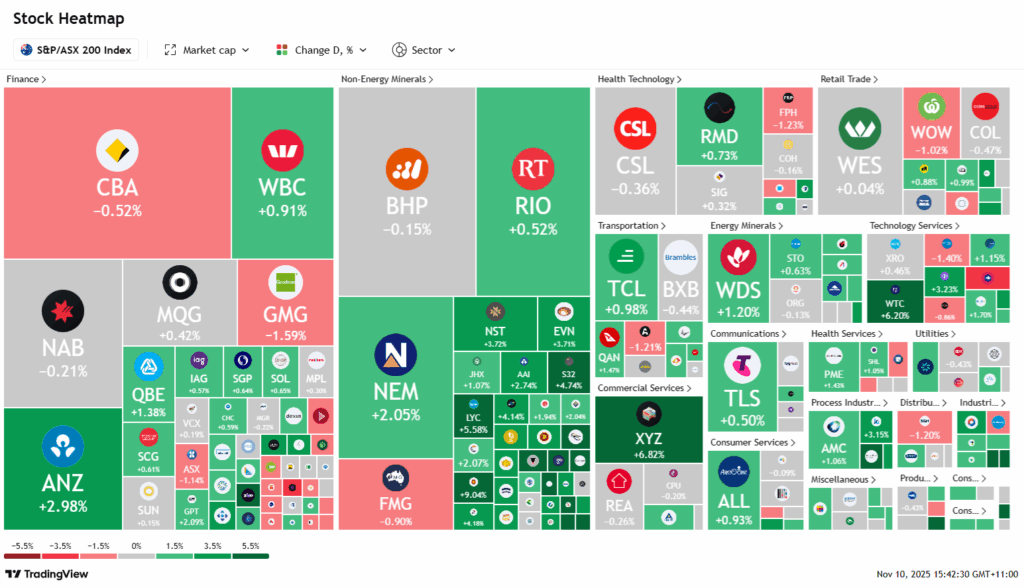

ASX Rallies as Gold and Tech Lead Gains Amid US Shutdown Deal

The ASX surged on Monday, tracking global optimism after US senators reached a deal to reopen the government, lifting investor sentiment. By 2pm AEDT, the S&P/ASX 200 rose 0.6% to 8822.5, on track for its best day in two weeks. Wall Street futures also strengthened, with Nasdaq up 1%.

Gold miners led the rally as bullion climbed 1.1% to US$4043 an ounce on expectations of another Federal Reserve rate cut. Evolution Mining jumped 3.8%, Perseus Mining 3.5%, and Northern Star 0.8%. Technology stocks followed suit, with WiseTech Global up 4.7% and Life360 rising 3.4%.

Banks were mixed — ANZ gained nearly 3% despite weaker profit results, while CBA and NAB slipped. Monadelphous Group soared almost 10% on upbeat revenue guidance, and Iress climbed 6% after outlining a margin improvement plan. DroneShield added 1.2% despite retracting a US contract announcement, while Mayne Pharma tumbled 4.5% as a suitor appealed its takeover ruling.

Leaders

DTR Dateline Resources Ltd (+20.00%)

LTR Liontown Resources Ltd (+12.26%)

FFM Firefly Metals Ltd (+11.27%)

VUL Vulcan Energy Resources Ltd (+9.92%)

DYL Deep Yellow Ltd (+9.60%)

Laggards

PXA Pexa Group Ltd (-3.68%)

SEK Seek Ltd (-2.53%)

PPM Pepper Money Ltd (-2.03%)

RYM Ryman Healthcare Ltd (-1.94%)

EDV Endeavour Group Ltd (-1.79%)