Overnight – Investors rejoice as longest shutdown in US history ends (Maybe)

In what could possibly be the dumbest rally in history, investors rejoiced, as the Senate voted in favour of the first step towards ending the longest ever government shutdown in the country’s history.

The Senate moved closer to ending the record-breaking 40-day government shutdown after a 60–40 test vote signaled growing bipartisan support for a temporary funding bill through January 30, 2026. The agreement followed a compromise that secured Democratic backing in exchange for a later vote on healthcare subsidies and guarantees that dismissed federal workers would be rehired. The bill still faces a final Senate vote and consideration in the House before reaching President Donald Trump for approval. Although this development lifted investor sentiment, the shutdown has already inflicted widespread economic disruptions, particularly in air travel, where thousands of flights have been canceled due to staffing shortages.

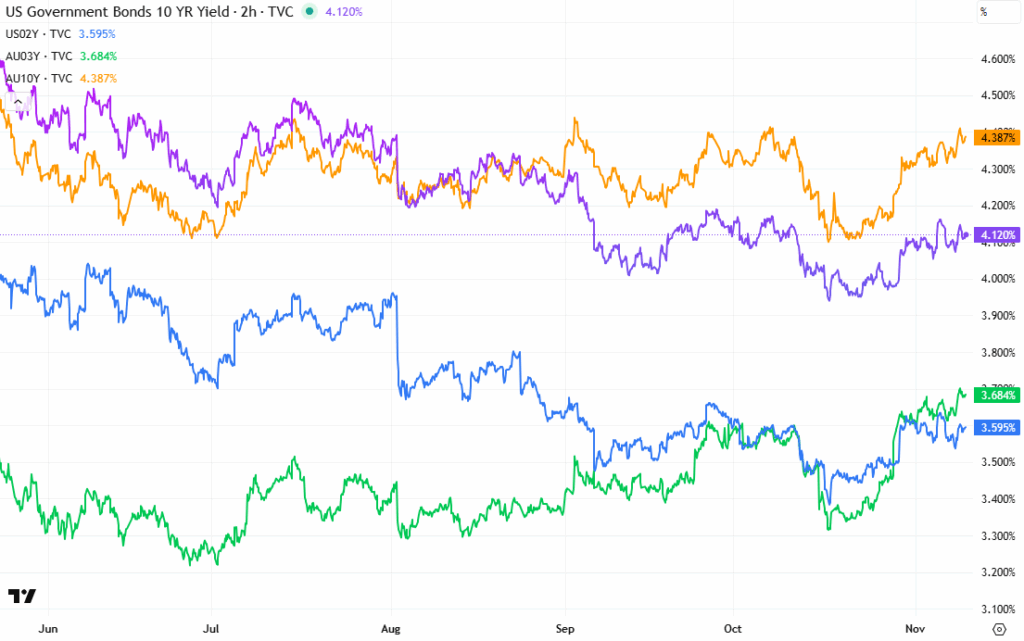

Even with progress toward reopening the government, economists caution that restoring normal operations will not immediately repair the economic damage. The shutdown delayed vital economic data releases, obscuring the real-time assessment of growth and employment conditions. Consumer sentiment has dropped to its lowest level in nearly three and a half years, and analysts warn that fourth-quarter growth could contract despite a rebound once data collection resumes. Morgan Stanley projected that key indicators like the September jobs report and inflation data could take weeks to compile, delaying the full picture of post-shutdown performance.

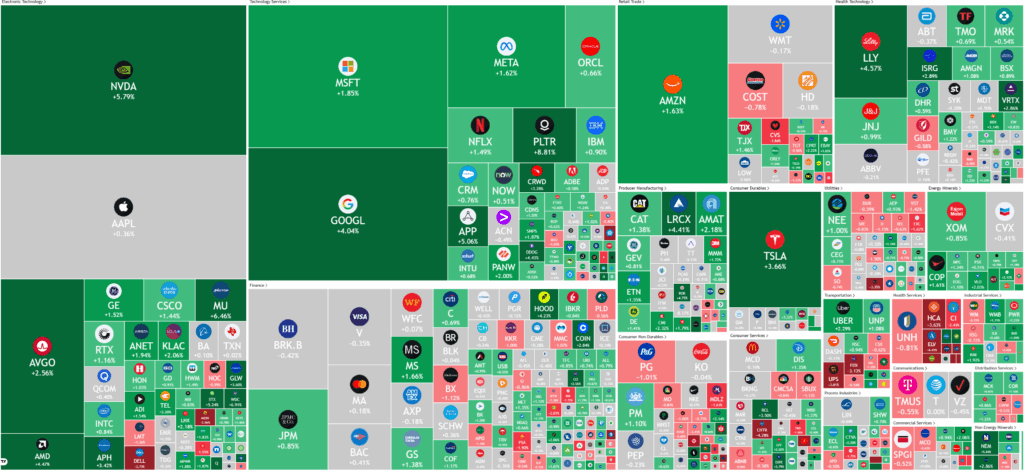

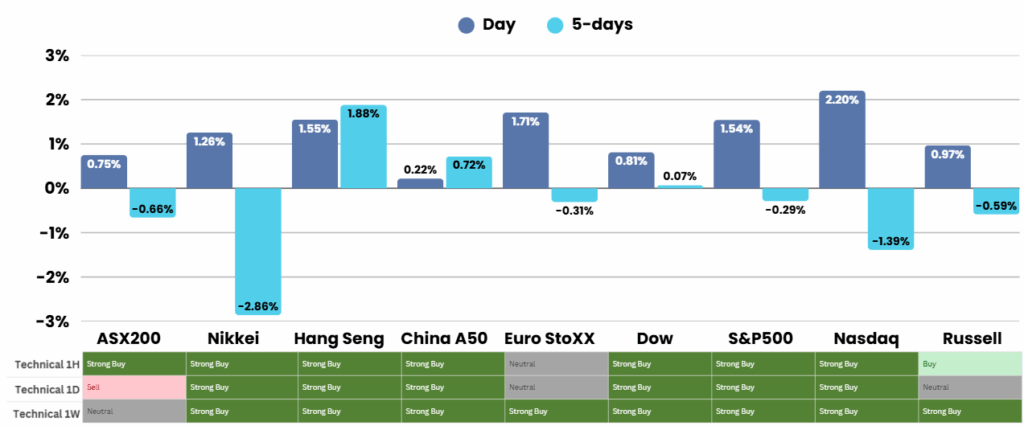

Markets began the week on a modestly positive note as investors balanced political developments with mixed corporate and sectoral news. Technology stocks, which suffered steep losses the previous week, saw limited recovery after strong performance results from Taiwan Semiconductor Manufacturing Co, reflecting sustained global demand for AI-related infrastructure. Meanwhile, Pfizer’s $10 billion acquisition of Metsera highlighted ongoing activity in the biotech sector, while Tyson Foods’ optimistic revenue forecast eased concerns about food industry volatility. Still, uncertainty remains over whether the Federal Reserve will cut rates in December, as data delays blur the outlook. Even with the shutdown’s end in sight, its lingering economic toll and data disruptions suggest the path to recovery will be uneven.

Corporate Earnings

- Coreweave -1.5% – the stock fell despite third-quarter results that topped Wall Street estimates as the artificial intelligence infrastructure provider’s revenue backlog was bolstered by a flurry of new business wins amid growing demand for AI-related hardware. Decreased margins were the concern from analysts

ASX Overnight: SPI 8891 (+0.48%)

The Day Ahead:

The habit of investors rejoicing the Government and the Trump administration, breaks something, then “fixes it” seems irrational, we remain cautious and will fade this optimism of the shutdown being resolved.

Yesterdays Session:

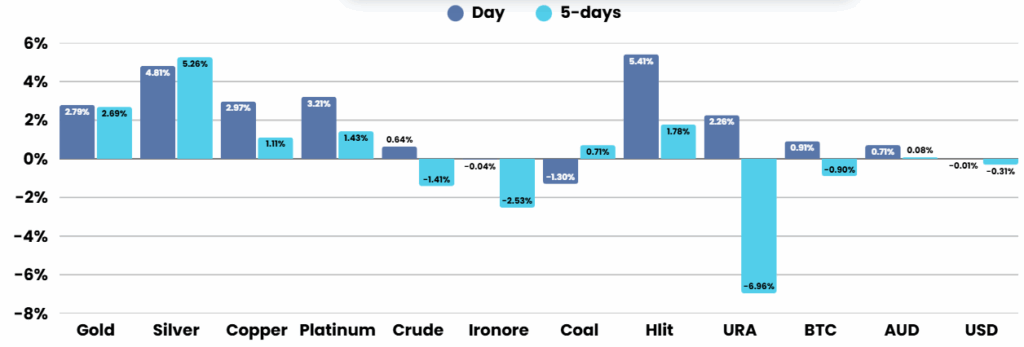

The ASX climbed on Monday, buoyed by global optimism after US senators struck a deal to reopen the government. The S&P/ASX 200 gained 0.6% by mid-afternoon, led by gold and technology stocks as gold prices rose and rate cut expectations strengthened. Miners like Evolution and Perseus advanced sharply, while WiseTech and Life360 also surged. Banks were mixed, with ANZ up and CBA and NAB down. Monadelphous and Iress rallied on strong forecasts, whereas Mayne Pharma fell after a takeover appeal.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.