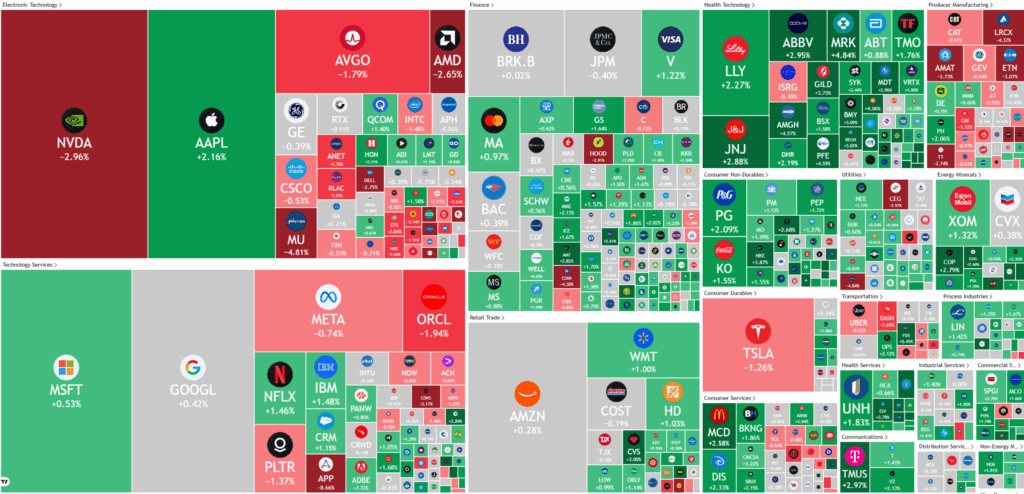

Overnight – Investors switch out of Tech on record valuations, depreciation red flags

Tech fell as the DOW rallied as investors weighed up record valuations, AI Chip depreciation & the long-running government shutdown.

Nvidia shares led a decline in AI stocks after SoftBank sold its entire $5.83 billion stake to pivot its investments toward OpenAI. Nvidia-backed CoreWeave also saw its stock drop due to delays with a third-party data center partner, overshadowing strong quarterly results and major deals with OpenAI and Meta. Meanwhile, Paramount Skydance rose on new cost-cutting plans, Rocket Lab gained after reporting a narrower loss, and TheRealReal surged after raising revenue guidance.

In Washington, the U.S. Senate passed a spending bill to end the record-long federal government shutdown, with bipartisan support paving the way for passage in the House and approval by President Donald Trump. Analysts said the resolution could spark a year-end rally, and Wall Street closed higher previously, led by AI stocks including Nvidia and Palantir.

UBS projected the S&P 500 could reach 7,500 next year from 5,830, driven by 14% earnings growth—around half from technology companies. The bank expects the global economy to accelerate in 2026 but cautioned that advanced economies face short-term challenges due to lingering tariff effects. UBS forecasts U.S. equities will outperform globally with roughly 10% returns in the next year, fueled mainly by earnings strength rather than valuation expansion.

Corporate Earnings

- Paramount Skydance +9.93% – stock rose after the entertainment company said it is looking to cut an additional $1 billion in savings after first outlining $2 billion when it completed its merger in August.

- Rocket Lab -1.25% – stock jumped higher after the space company reported a smaller third-quarter loss than expected.

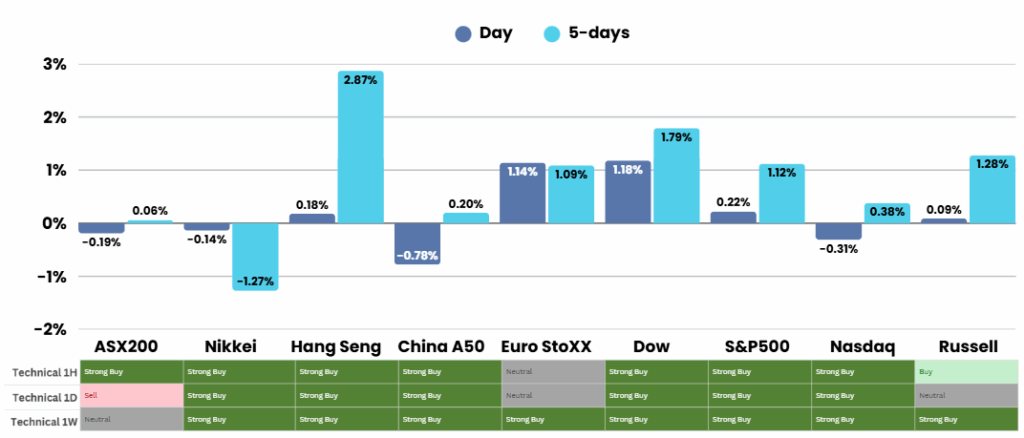

ASX Overnight: SPI 8868 (+0.24%)

The Day Ahead:

- Results are expected on Wednesday from Aristocrat Leisure and Mainfreight. Annual meetings on the schedule include Beach Energy, Flight Centre, Domino’s Pizza, Humm, Inghams and Netwealth.

- At 9.15am AEDT, Reserve Bank of Australia assistant governor (financial system) Brad Jones will participate in a fireside chat at the Association of Superannuation Funds of Australia Conference in Broadbeach.

- The RBA will release a discussion paper on ageing and economic growth in China at 11.30am AEDT.

- Third-quarter home loans value will be released at 11.30am AEDT.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.