What's Affecting Markets Today

SoftBank Tumbles After $5.8B Nvidia Stake Sale; Asia Markets Mixed

SoftBank Group shares slumped as much as 10% on Wednesday after the Japanese investment giant revealed it had sold its entire $5.83 billion stake in U.S. chipmaker Nvidia. The move, disclosed in its latest earnings report, comes as SoftBank doubles down on its “all in” bet on artificial intelligence through OpenAI and related ventures. The company also trimmed its T-Mobile holdings, raising a total of $9.17 billion in cash.

The sale marks a major shift in SoftBank’s strategy, with analysts viewing it as a profit-taking move amid soaring Nvidia valuations and a bid to free up capital for next-generation AI investments.

Across the Asia-Pacific region, markets were mixed. Japan’s Nikkei 225 slipped 0.26% while the broader Topix gained 0.35%. South Korea’s Kospi was little changed, and the Kosdaq rose 0.62%. Australia’s ASX 200 edged up 0.13%, and Hong Kong’s Hang Seng added 0.25%, as investors weighed signs of progress toward ending the U.S. government shutdown.

ASX Stocks

ASX 200 8,806.80 (-0.14%)

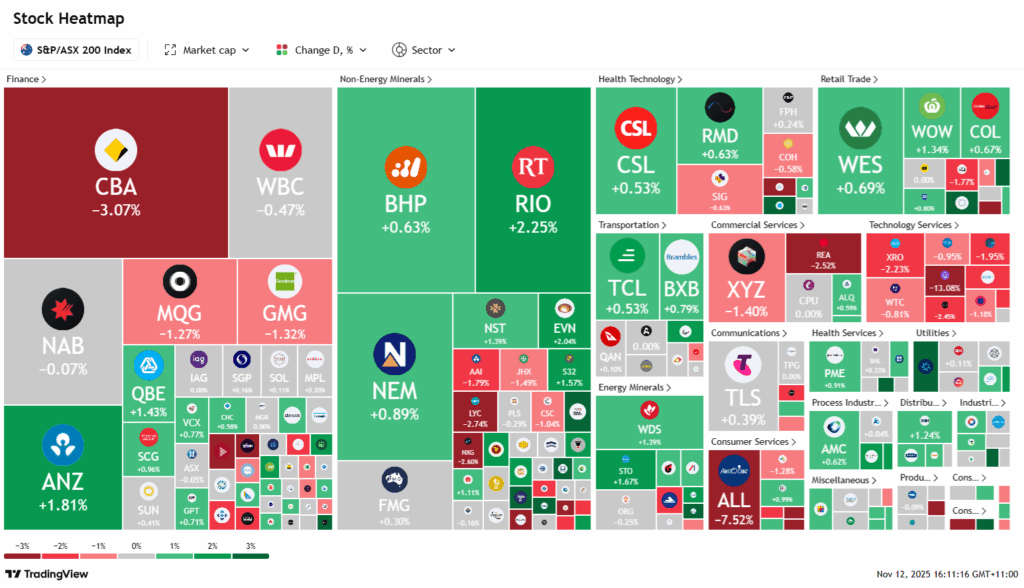

ASX Edges Higher as Rio, MinRes Shine; CBA Drags on Gains

The ASX 200 rose 0.1% to 8833.8 on Wednesday, supported by strength in energy and mining stocks, while losses in tech and financials capped gains. Rio Tinto rallied 2.6% and BHP added 0.8% after a rebound in iron ore prices. Mineral Resources surged 9% after selling a $1.2 billion stake in its lithium business to South Korea’s POSCO, while Liontown jumped 6% on a new digital trading partnership. Gold miners extended their rally as bullion climbed to US$4,134 an ounce, with Evolution up 2.3%.

Oil strength also lifted Woodside and Santos by up to 2%. However, Commonwealth Bank slid another 1.8% after Tuesday’s sharp drop, offsetting gains in NAB, Westpac and ANZ.

Tech stocks fell 3%, led by Life360’s 12% plunge following disappointing user growth. Aristocrat Leisure dropped 7.2% after its interactive unit missed expectations, while ARN Media sank 12.4% on weaker ad revenues. Flight Centre gained 1.5% after forecasting stronger FY26 profits.

Leaders

DTR Dateline Resources Ltd (+9.65%)

MIN Mineral Resources Ltd (+9.61%)

LTR Liontown Resources Ltd (+6.65%)

SNZ Summerset Group Holdings Ltd (+5.00%)

FCL Fineos Corporation Holdings Plc (+4.48%)

Laggards

360 LIFE360 Inc (-12.70%)

ALL Aristocrat Leisure Ltd (-7.53%)

ZIP ZIP Co Ltd (-6.43%)

CU6 Clarity Pharmaceuticals Ltd (-5.30%)

A4N Alpha Hpa Ltd (-4.97%)