What's Affecting Markets Today

Asia-Pacific Markets Mixed as Japan–China Tensions Weigh on Sentiment

Asia-Pacific equities traded mixed on Monday as investors assessed rising geopolitical friction between Japan and China, following Beijing’s warning for citizens to reconsider travel and study in Japan. The heightened tension triggered sharp declines in Japanese tourism-linked stocks.

Japan’s Nikkei fell 0.63% and the Topix slid 0.44%, led by steep losses in consumer-facing sectors. Shiseido plunged 11% amid concerns over reduced Chinese spending, while department-store operator Isetan Mitsukoshi dropped more than 10%. Tokyo Disney Resort operator Oriental Land declined 4.74%, and ANA Holdings lost 3.48% as travel sentiment weakened. Japan’s economy also contracted 0.4% in the September quarter, though the figure was better than expected.

Elsewhere in the region, South Korea’s Kospi outperformed with a 1.78% gain, supported by strength in technology shares, while the Kosdaq rose 0.68%. Hong Kong’s Hang Seng dipped 0.51%, and China’s CSI 300 traded flat amid muted investor appetite.

Australia’s S&P/ASX 200 slipped 0.26% as traders looked ahead to Thailand’s third-quarter GDP data and Singapore’s trade figures due later in the day.

ASX Stocks

ASX 200 8,634.6 (+0.001%)

ASX Extends Losing Streak as Financials and Miners Weigh on the Market

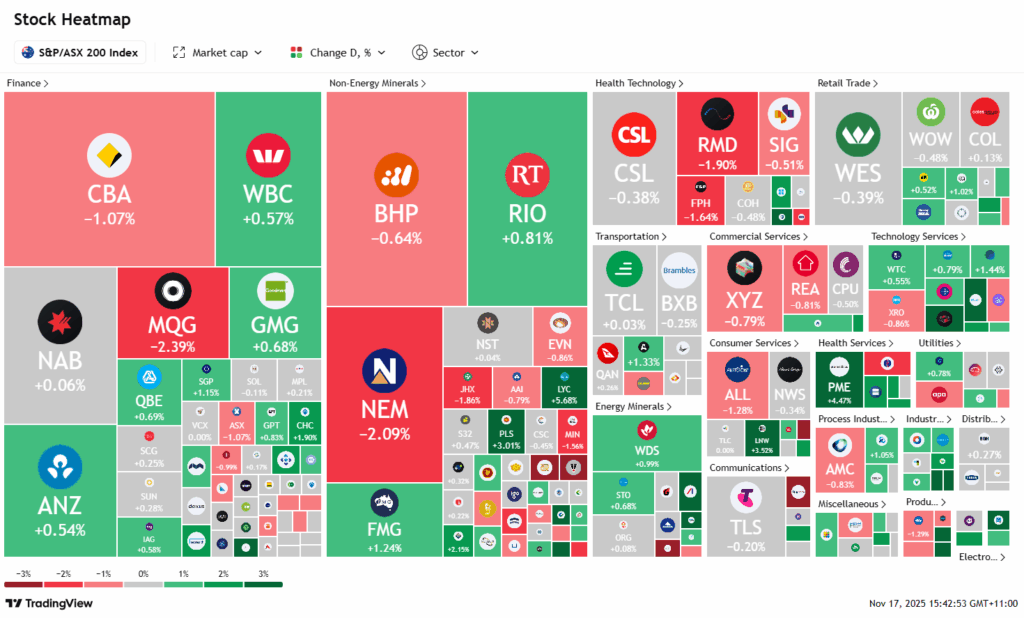

The Australian sharemarket edged lower on Monday, positioning the ASX 200 for its fifth straight decline — the longest losing run since June — as investors await the return of key US economic data following the government shutdown. By 2pm AEDT, the benchmark slipped 0.2 per cent to 8619.70, with seven of 11 sectors in negative territory, extending a 2.4 per cent slide across the current downturn.

Financials led the weakness, with Commonwealth Bank down 1.3 per cent, while NAB held steady and ANZ and Westpac each added 0.4 per cent. Materials also dragged as BHP fell 0.7 per cent after a UK High Court ruling on the 2015 Samarco dam collapse. Fortescue firmed 0.9 per cent alongside stronger iron ore prices.

Gold miners were mixed, and Woodside rose 1.3 per cent despite softer crude oil.

Corporate updates drove notable moves: Elders surged 5.2 per cent on a 12 per cent profit rise, Pro Medicus gained 4.4 per cent on a new US contract, and FleetPartners climbed 6.6 per cent following its Remunerator acquisition. Ramsay Health Care and Mesoblast also advanced.

Leaders

DRO Droneshield Ltd (+9.87%)

EOS Electro Optic Systems (+6.59%)

DPM DPM Metals Inc (+5.97%)

ELD Elders Ltd (+5.81%)

MAH Macmahon Holdings Ltd (+5.71%)

Laggards

KCN Kingsgate Consolidated Ltd (-8.84%)

IPX Iperionx Ltd (-5.08%)

GYG Guzman Y GOMEZ Ltd (-4.32%)

GNP Genusplus Group Ltd (-3.82%)

VSL Vulcan Steel Ltd (-3.33%)