What's Affecting Markets Today

Asia-Pacific Markets Retreat as Tech Valuation Concerns Hit Sentiment

Asia-Pacific equities weakened on Wednesday, mirroring overnight declines on Wall Street as investors continued to reassess lofty valuations in the global artificial intelligence sector.

Japan’s Nikkei 225 slipped 0.2 per cent in choppy trade, while the broader Topix was flat. Early pressure in Tokyo came from semiconductor-related names, with Advantest initially sliding more than 4 per cent before trimming losses to 0.9 per cent. Chipmaker Renesas remained under pressure, falling 4.4 per cent.

South Korean markets also declined, with the Kospi down 0.54 per cent and the tech-heavy Kosdaq off 0.58 per cent. Index heavyweights Samsung Electronics and SK Hynix moderated earlier falls but were still trading lower.

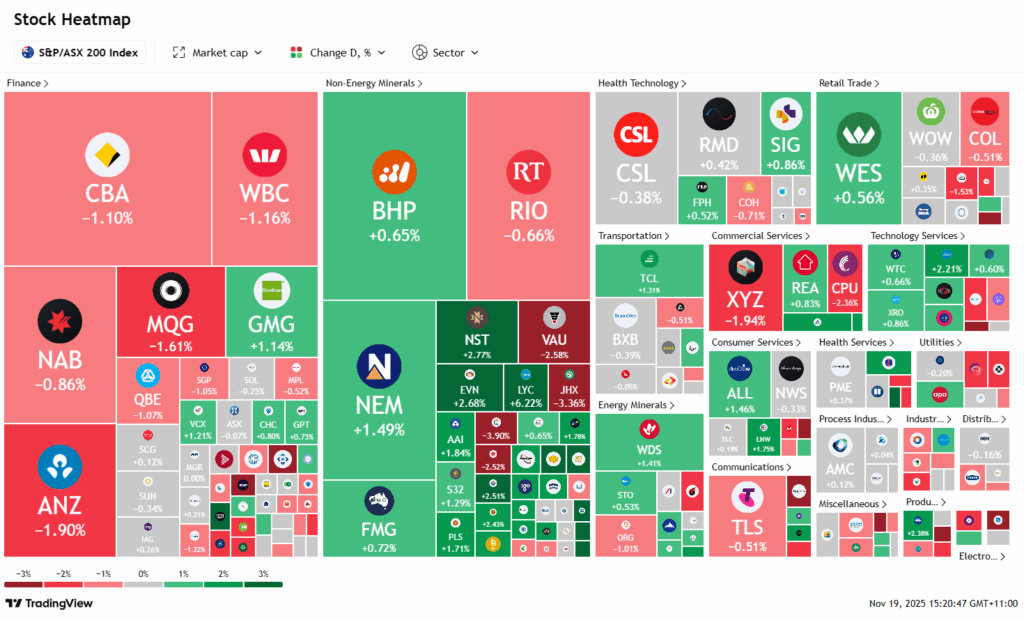

Australia’s S&P/ASX 200 dipped 0.13 per cent as volatility persisted across the region.

Hong Kong’s Hang Seng Index dropped 0.45 per cent, while China’s CSI 300 edged 0.21 per cent higher. Xiaomi shares slumped more than 4 per cent after the company warned it may need to raise smartphone prices in 2026 due to rising memory-chip costs driven by surging AI demand.

India’s Nifty 50 and Sensex opened modestly weaker, down 0.16 per cent and 0.14 per cent respectively.

ASX Stocks

ASX 200 8,457.1 (-0.15%)

ASX Edges Higher but Remains Near Six-Month Low as Banks Drag

The Australian sharemarket steadied near a six-month low on Wednesday, with modest gains in resources offset by continued weakness in the major banks. The S&P/ASX 200 inched up 0.1 per cent, or 5.4 points, to 8474.50 by midday AEDT, as investors remained cautious ahead of Nvidia’s closely watched earnings due Thursday morning.

Materials led the market higher, supported by firmer gold prices and renewed safe-haven demand. Northern Star and Evolution Mining each advanced more than 3 per cent, while BHP added 1 per cent. Energy stocks also strengthened as rising crude prices—driven by expectations of deeper restrictions on Russian supply—lifted Woodside and Beach Energy.

Technology shares attempted a partial rebound following heavy selling in recent sessions, with WiseTech, Xero and Life360 all posting gains. However, the major banks weighed on the broader index, with Commonwealth Bank and ANZ both falling more than 1 per cent amid profit-taking.

Corporate activity drove several notable moves. Webjet surged nearly 18 per cent after Helloworld launched a 90-cent-per-share takeover bid. DroneShield fell sharply following the resignation of its US chief executive, while Lynas, Nufarm and KMD Brands all rallied on positive analyst updates and guidance.

Leaders

GQG GQG Partners Inc (+8.22%)

LYC Lynas Rare EARTHS Ltd (+6.26%)

ARU Arafura Rare EARTHS Ltd (+5.66%)

DTR Dateline Resources Ltd (+4.90%)

RYM Ryman Healthcare Ltd (+4.58%)

Laggards

DRO Droneshield Ltd (-17.96%)

VUL Vulcan Energy Resources Ltd (-7.53%)

SLC Superloop Ltd (-6.20%)

CU6 Clarity Pharmaceuticals Ltd (-5.68%)

CAT Catapult Sports Ltd (-5.50%)