Overnight – Rate cuts off the table for 2025, Nvidia Beats

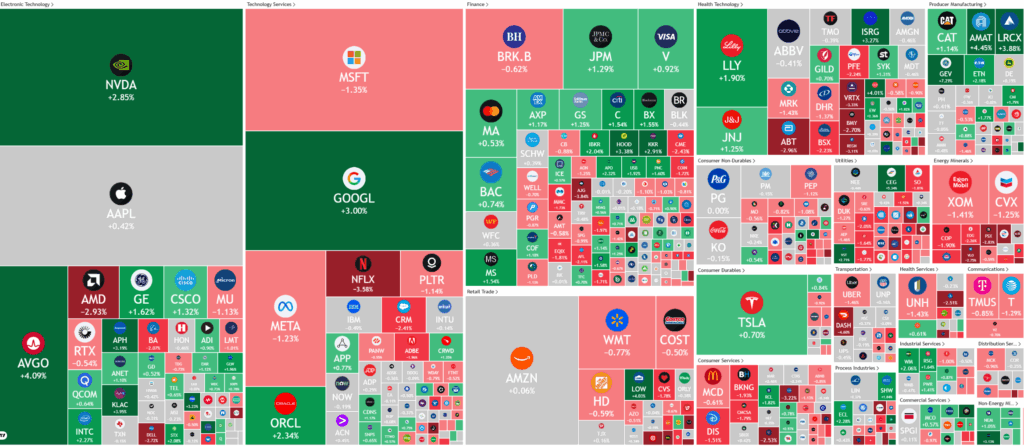

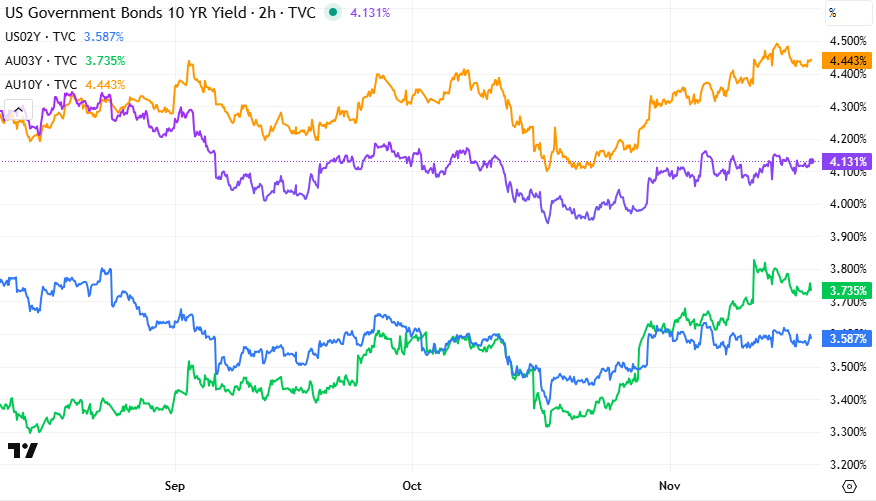

Stocks gave up early gains after the minutes of the Fed’s October meeting cast doubt on a December rate cut, adding to cautious sentiment on risk just ahead of key earnings from bellwether Nvidia.

Nvidia’s upcoming quarterly earnings report stands as a crucial event for the U.S. stock market, given the company’s $4.41 trillion market capitalization and its central role in the recent artificial intelligence (AI) investment surge. Nvidia comprises over 7% of the S&P 500’s weighting, making its performance and outlook highly influential for broader market sentiment. Investors are watching closely to see if Nvidia can deliver strong results that justify its massive valuation and provide guidance that reassures markets about the sustainability of AI-driven spending.

The focus on AI comes as doubts about the sector’s valuations have weighed on technology stocks in recent weeks. Nvidia’s financial results are widely expected to demonstrate continued robust demand for AI chips, with consensus forecasts hovering around $55 billion in revenue and about $1.25 per share in earnings for the quarter. The results could either reinforce confidence in ongoing AI investment or fuel fears of a potential bubble, especially as Nvidia has been at the forefront of a major run-up in tech valuations over the last three years.

The bull is wincing and bracing for the balloon potentially popping

In other sectors, consumer discretionary stocks have shown mixed results: Lowe’s stock rose after raising its annual forecast and beating expectations, while TJX Companies also gained on optimistic sales and profit projections. Conversely, Target’s stock fell following a larger-than-expected decline in sales and a more cautious earnings outlook. Meanwhile, Federal Reserve minutes showed policymakers are divided on whether to pause or cut rates in December, leaving the odds of a rate cut at 26% and adding another layer of uncertainty to the economic outlook.

Corporate Earnings

Nvidia NVDA – NVIDIA Q3 FY2026 Earnings Highlights and Q4 Guidance

NVIDIA reported its fiscal third quarter 2026 (ended October 27, 2025) earnings on November 19, 2025. Here’s a summary of the key metrics relevant to your query, focusing on total revenue, data center performance, and forward guidance:

Q3 FY2026 Results

- Total Revenue: $57.0 billion

- Up 22% quarter-over-quarter (QoQ) from $46.7 billion in Q2 FY2026.

- Up 62% year-over-year (YoY) from Q3 FY2025.

- Data Center Revenue: $51.2 billion

- Up 25% QoQ from $41.1 billion in Q2 FY2026.

- Up 66% YoY from Q3 FY2025.

- This segment accounted for approximately 90% of total revenue, underscoring NVIDIA’s dominance in AI-driven data center demand.

Q4 FY2026 Revenue Guidance

- NVIDIA provided guidance for Q4 FY2026 (ending January 2026) of $65.0 billion ± 2%.

- This implies a potential range of $63.7 billion to $66.3 billion.

- The guidance reflects continued strong demand for AI infrastructure, with no specific breakdown provided for data center in the initial release, but management commentary highlighted sustained growth in this area amid expanding hyperscaler investments.

Data center growth remains the primary driver of NVIDIA’s performance, fueled by AI compute needs. For context, the segment has grown over 150% YoY in the first half of FY2026 combined, with Q3 accelerating that trend. If you’d like deeper analysis (e.g., EPS, margins, or conference call transcripts), let me know!

- Lowe’s +4.62% – stock gained after the home improvement retailer raised its annual sales target and reported third-quarter adjusted earnings that exceeded expectations, showing resilience amid macroeconomic challenges.

- TJX Companies +0.3% – stock also rose after the parent of TJ Maxx raised annual sales and profit forecasts, betting that a wide sourcing network and fresh seasonal assortments will attract bargain-hunting customers to its off-price stores.

- Target -3.15% – stock fell after the big-box retail chain reported a bigger-than-expected drop in quarterly comparable sales and lowered the upper end of its full-year earnings outlook.

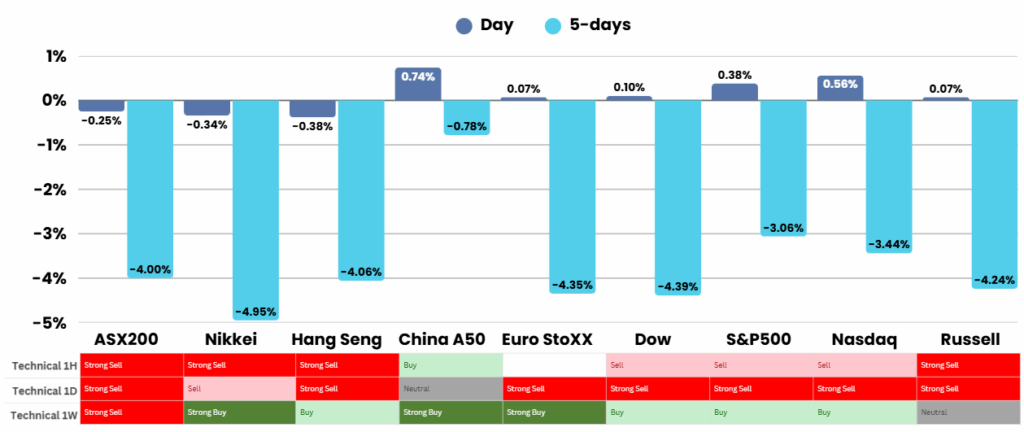

ASX Overnight: SPI 8494 (-0.17%)

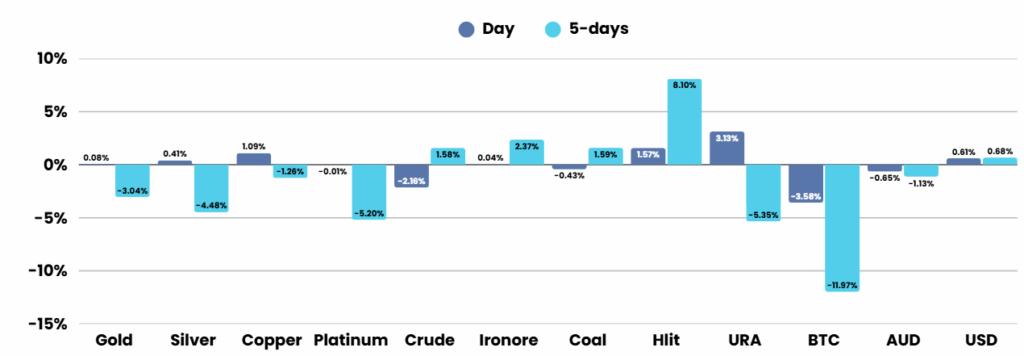

The Day Ahead: Nothing changed from our house view. We have returned to 30%-50% cash and see the risk of a market fall of 20%+ as HIGH

The market is expecting updates from Nufarm. Companies holding annual meetings include KMD Brands, Medibank Private and Nuix.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.