Overnight – Tech Stocks smashed as Investors dig deeper into Nvidia results

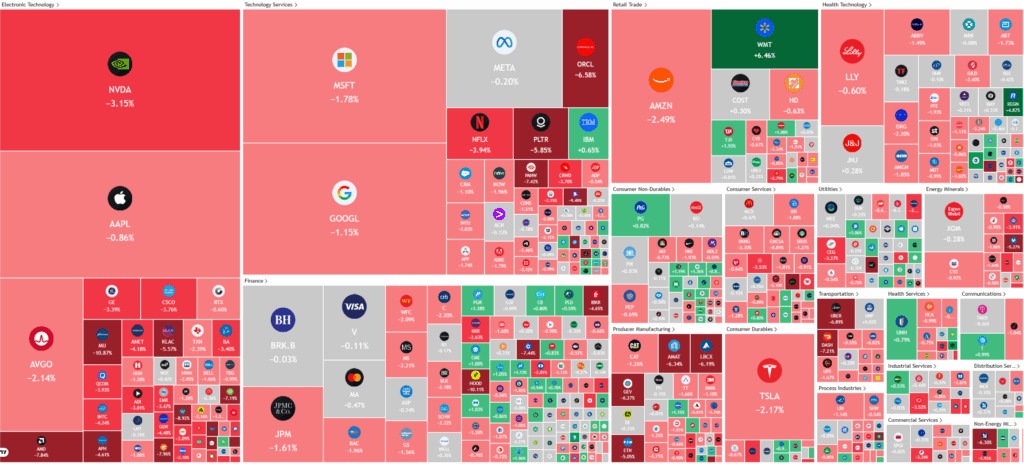

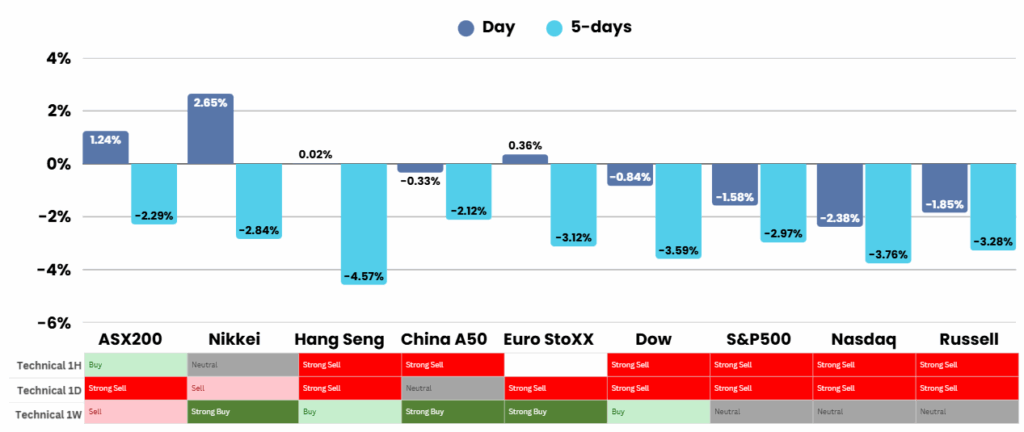

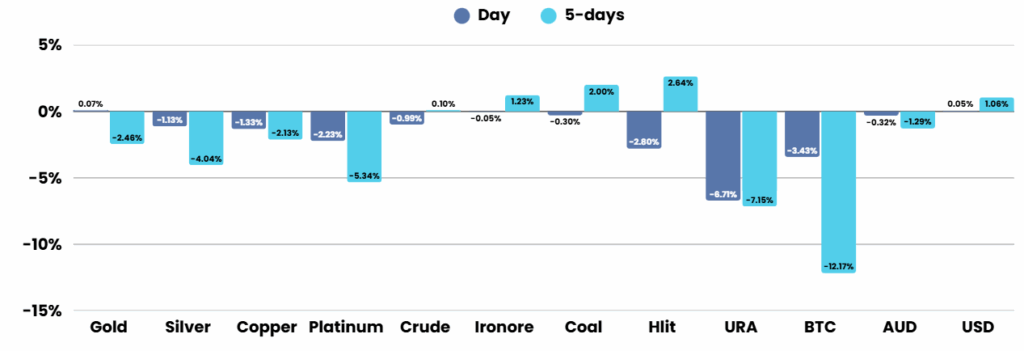

Stocks were smashed overnight as an Nvidia led rout of the AI stocks, as rate cuts were taken off the table due to better than expected Payrolls.

Nvidia experienced volatile trading, initially surging on its impressive quarterly earnings, but ultimately giving up those gains as concerns resurfaced about potentially overstretched valuations and questions around the credibility of some of the numbers. Ray Dalio, founder of Bridgewater, contributed to these worries by warning of an AI bubble, though he advised investors against selling outright. Nvidia’s CEO Jensen Huang pushed back against these concerns during the company’s post-earnings call, emphasizing that the AI-driven demand for its chips was expanding beyond traditional data centers to a broader market and defending the company’s strategic investment in OpenAI as a move to support the wider AI ecosystem.

The strong performance from Nvidia, often seen as a gauge for broader AI demand, lifted sentiment across the tech sector, which had struggled lately. Meanwhile, the retail sector delivered mixed results as Walmart posted better-than-expected third-quarter earnings and noted a reduced impact from tariffs, contrasting with weaker showings from Target and Home Depot , while Lowe’s Companies impressed investors. This divergence highlights ongoing uncertainty in consumer-related industries despite some resilience from leading retailers.

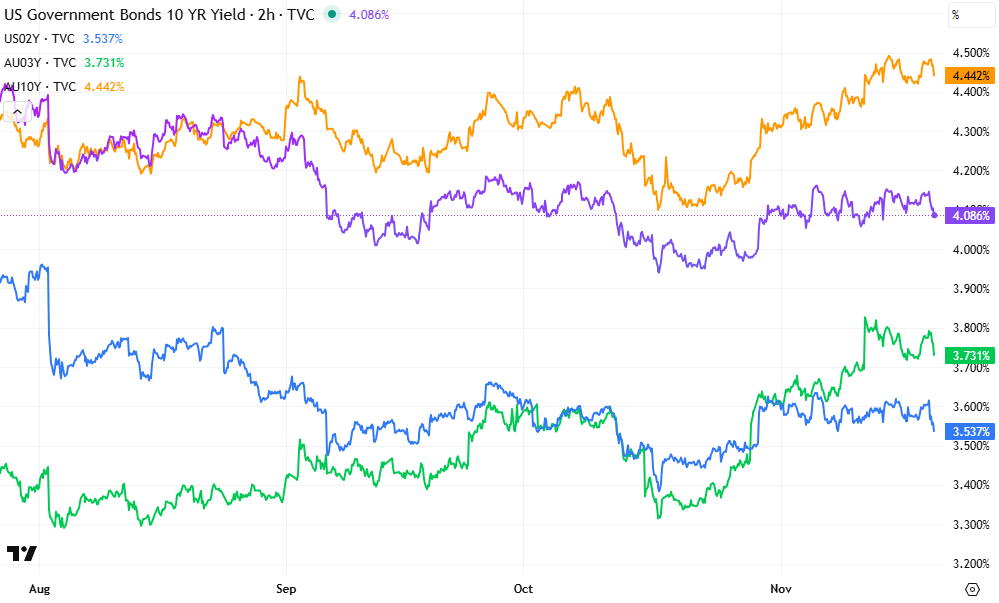

On the macroeconomic front, U.S. nonfarm payrolls rose by 119,000 in September, beating expectations, but the labor market still showed signs of weakness as August payrolls were revised lower and unemployment climbed to a four-year high of 4.4%.

Wall Street analysts are split on whether the Federal Reserve will cut rates in December after a stronger-than-expected September jobs report showed payroll growth but also rising unemployment; some, like Wolfe Research, cite weak wages and negative job revisions as reasons to expect a December cut, while others, such as Morgan Stanley, believe the robust hiring rebound reduces the urgency, pushing possible cuts to next year amid lingering economic uncertainty and mixed signals from the labor market.

Market optimism for a year-end rally persists, but uncertainty remains as central bank policymakers weigh the latest economic data ahead of upcoming meetings.

We are not optimistic and think this is the start of a broad and sharp sell-off

ASX Overnight: SPI 8494 (-0.17%)

ASX Overnight: SPI 8800 (-0.47%)

The Day Ahead: Today will be grim. Avoid

The market is expecting updates from Nufarm. Companies holding annual meetings include KMD Brands, Medibank Private and Nuix.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.