In a week with around 30% of the ASX200 reporting, we take a look at some of the best performers of the year so far and give you the context of where they are, where they are valued and what to focus on

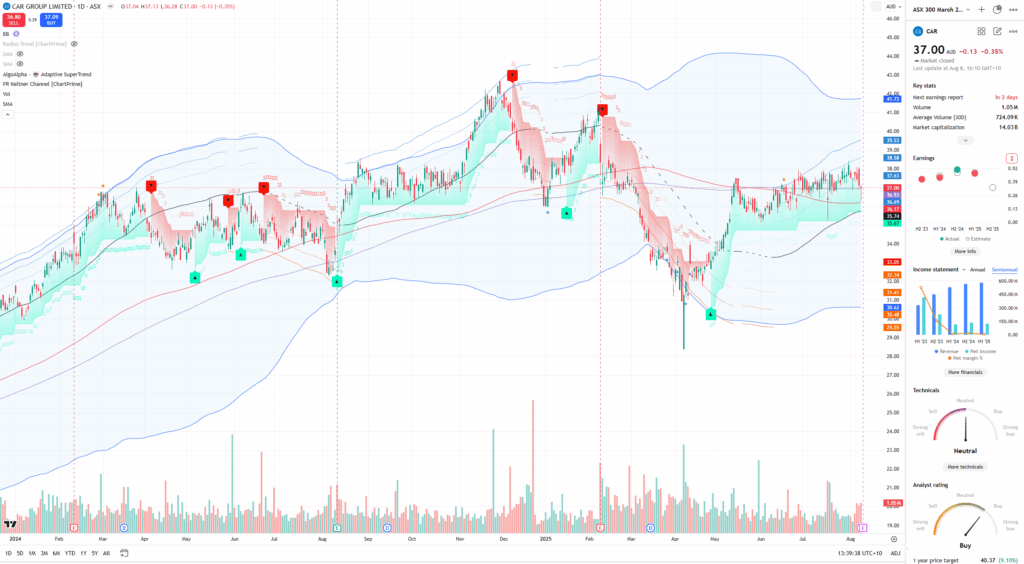

Carsales.com (CAR) Growth Engine, Lofty Multiple

- Price: A$37.00 | 1Y Return: 12.4% | Dividend Yield: 1.9%

- Forecast (FY25):

- Revenue A$1.15B (+4.3%),

- EPS A$1.00 (+51%),

- Net Income A$377.80M (+51.1%)

- Street View: 10 buys, 5 holds, consensus “Buy”. Highest target: A$46.

- Valuation: P/E at a rich 44.6x;

- What to Watch: Will staggering EPS growth justify the premium? And will international expansion keep fueling top-line momentum?

Carsales.com (CAR) is set to report its Q4 and full-year FY25 results in August, with analysts anticipating a marked improvement over a subdued Q1. FY25 performance is underpinned by the company’s continuous investments in marketplace technology, which are expected to drive both revenue and earnings growth for the year. Consensus forecasts call for FY25 revenue of A$1.15b—up 4.3% year-over-year—and a sharp bounce in EPS to A$1.00 (+51%), with net income projected at A$377.8m, also up 51.1% thanks to improving dealer listings and resilient international operations. Recent broker commentary highlights that while Australian private listings have softened, higher-margin dealer volumes and ongoing international market momentum, especially in Brazil, remain key growth levers. Management’s updated guidance and outlook will be closely watched, particularly in the wake of a recent CEO transition and macroeconomic headwinds in the US and Brazil.

Despite the robust earnings momentum, valuation remains a central debate. CAR shares currently trade at A$37.00, reflecting a lofty 44.6x forward P/E ratio and a 1.9% dividend yield. Broker sentiment is largely positive—10 “buy” ratings versus 5 “holds,” with the highest price target at A$46—but consensus implies limited near-term upside amidst the elevated valuation, with some fair value models flagging as much as 16.7% downside risk. Investors should watch for whether CAR’s blockbuster earnings growth and potential for upside surprises in newer geographies can continue to justify the stock’s premium multiple. Any signs of slower operational momentum or disappointing forward guidance may put pressure on these high expectations, especially if international growth slows or macro risks materialise.

JB Hi-Fi (JBH) Retail Rocket, But Is It Overheating?

- Price: A$117.70 | 1Y Return: 82.2% | Dividend Yield: 4.7%

- Forecast (FY25):

- Revenue A$10.50B (+9.5%)

- EPS A$4.31 (+7.9%),

- Net Income A$471.44M (+7.4%)

- Street View: 3 buys, 7 holds, 4 sells—mixed, but UBS still says “Sell” despite raising target to A$109.

- Valuation: Trades at 14.9x P/E; fair value estimate implies -18.7% downside.

- What to Watch: Whether margin expansion can persist given the massive share price run-up.

JB Hi-Fi (ASX: JBH) heads into its FY25 earnings with market anticipation high following an 82.2% share price rally over the past year and a current price of A$117.70. Consensus expects FY25 revenue to reach A$10.5b (+9.5% YoY), EPS of A$4.31 (+7.9%), and net income of A$471m. Macquarie forecasts FY25 EBIT at A$704m, up 8.7% from last year, reflecting strong consumer electronics demand even as a delayed RBA easing cycle weighs on discretionary retail. Despite these gains, market sentiment is mixed, with the street divided—3 buys, 7 holds, 4 sells—and UBS maintaining a “Sell,” citing decelerating sales momentum and margin compression even as it lifts its target price. Current valuation stands at 14.9x P/E, while market consensus sets an average target near A$99, implying potential downside from current levels.

Investors will be watching closely to see if JB Hi-Fi can sustain margin expansion after a stellar run, especially as several brokers warn that the stock may have run ahead of fundamentals. Citi and Bell Potter remain bullish, expecting margin risks to be lower for JBH than the sector and forecasting a retail rebound as rate cuts flow through. However, others—like Morgans and Morgan Stanley—see structural headwinds, slower like-for-like sales growth, and limited upside from here. With a forecast dividend yield of 4.7% and a fully-franked payout ratio above 70%, JB Hi-Fi remains a key large-cap retail pick for some, but the debate remains whether earnings growth in the coming year can justify the recent share price surge.

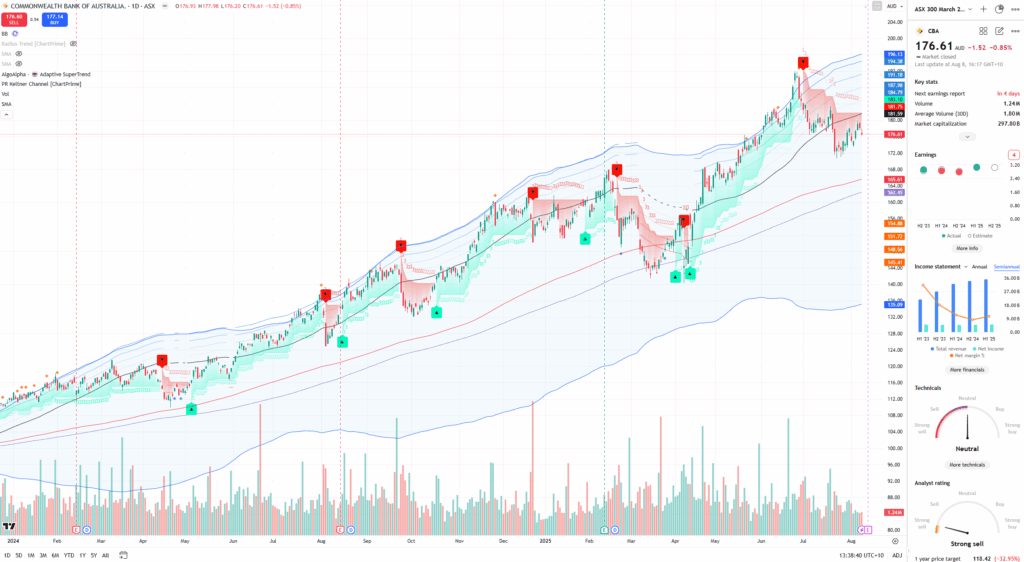

Commonwealth Bank of Australia (CBA) Cautious Optimism Hits a Valuation Wall

- Price: A$176.61 | 1Y Return: 40.8% | Dividend Yield: 3.7%

- Forecast (FY25):

- Revenue A$28.41B (+8.8%)

- EPS A$6.12 (+8.8%)

- Net Income A$10.24B (+8%)

- Street View: 0 buys, 13 sells, consensus “Sell”—but price has surged anyway

- What to Watch: Any hints on how AI-driven cost cuts (including job reductions) might affect future margins and customer experience

Commonwealth Bank of Australia (CBA) is set to report its FY25 results on August 13, 2025, against a backdrop of exceptional share price momentum—up 40.8% over the past year—even as consensus sentiment remains overwhelmingly bearish. Market expectations point to solid revenue growth, with forecasts suggesting a rise to A$28.41b (+8.8%) and net profit after tax of about A$10.24b (+8%). Earnings per share (EPS) is projected to climb 8.8% to A$6.12, while return on equity is expected to register a robust 13.8%. Despite this strong operating performance, CBA’s price surge has far outpaced underlying earnings, prompting analysts to flag significant downside risk based on stretched valuation. Notably, consensus views remain cautious with a rare alignment—zero “Buy” ratings versus 13 “Sell” calls, and target prices from major brokers (CLSA: A$154, Morgans: A$97.40, UBS: A$120, Ord Minnett: A$105) all well below the current market price, implying a downside of at least 27.1%.

Analyst commentary highlights several critical themes for this upcoming result. Loan and deposit growth continues to underpin revenue, but net interest margin (NIM) pressure is persistent, with brokers projecting only marginal quarterly gains and warning that market expectations may remain too high given the current interest rate environment. The market is also closely watching for any disclosures about AI-driven cost initiatives—especially job reductions—which could shape future margin trajectories and customer experience. Although CBA’s operational performance remains resilient, the valuation debate is unlikely to dissipate soon: most brokers view recent gains as driven primarily by multiple expansion rather than fundamental earnings upgrades. Watch for management commentary on cost control, competitive dynamics, and any signals regarding the sustainability of high returns relative to global peers.

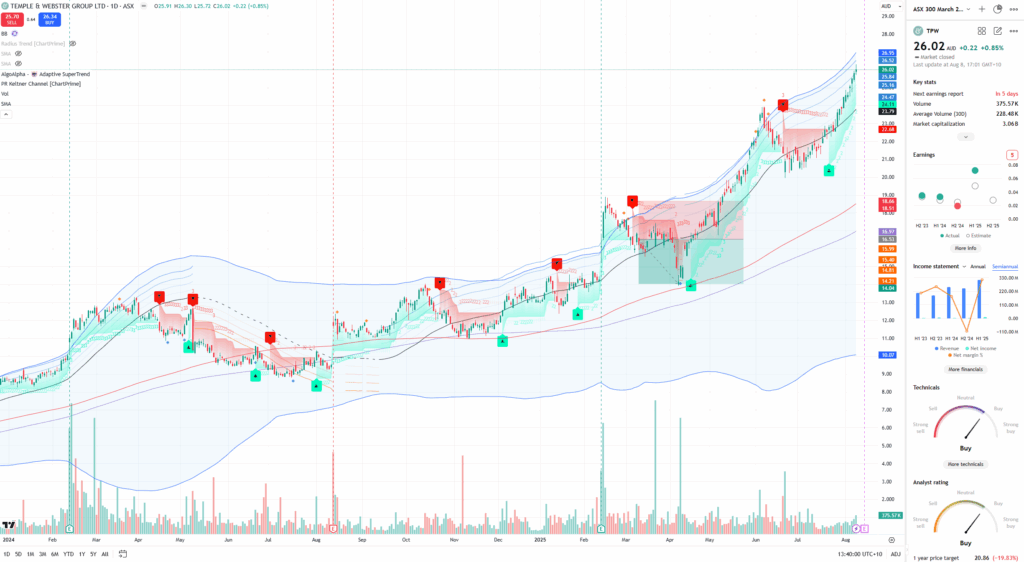

Temple and Webster (TPW): Growth Rocket with Lofty Expectations

- Stock up a staggering 179.8% in a year (A$26.02), trading near its 52-week high.

- Forecasts:

- Revenue A$296M

- EBITDA for FY25 seen up 98%,

- Net Income up 555%.

- Valuation: P/E a nosebleed 215.2x, fair value upside a sobering -35%.

- Bottom line: The street is bullish on growth (2.3 Buy rating), but sky-high multiples mean the bar for disappointment is very high.

Temple & Webster (ASX:TPW) heads into its August 14 earnings with expectations riding high after an extraordinary 179.8% 1-year share price surge, putting the stock just below its 52-week high at A$26.02. Momentum is unmistakable—FY25 revenue is projected to jump 21.8% to A$296M and EPS growth a staggering 588.8%, building on a FY24 that already delivered A$8.05M in operating income and a growing active customer base up 22% year-on-year. However, the analyst community remains unconvinced by the breakneck rally: the consensus target price sits at A$21.32, implying an 18% downside, with cautious commentary focusing on valuation—current forward P/E and EV/EBITDA multiples are far above even growth-stock norms. Jefferies’ recent Underperform and target of A$17.00 squarely highlight market fears around stretched valuations and competitive threats.

Despite strong profitability and liquidity, risks remain front of mind. TPW’s return on equity (1.7%) and ROIC (4.8%) lag high-growth benchmarks, and the company pays no dividend, keeping returns strictly tied to ongoing price appreciation. Analyst sentiment is fractious: while Morgan Stanley remains Overweight (A$28.00 target), others like UBS and Ord Minnett warn the market is “overly optimistic,” especially given margin compression and increased competition from both local and global rivals. With a 5-year beta of 1.66 and overbought technicals, this earnings season is shaping up as a verdict on whether TPW’s valuation premiums can be justified by continued operational outperformance—or if momentum will finally give way to reality.

Got a question about this article? Ask the Team at MPC

ASK A QUESTION

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.