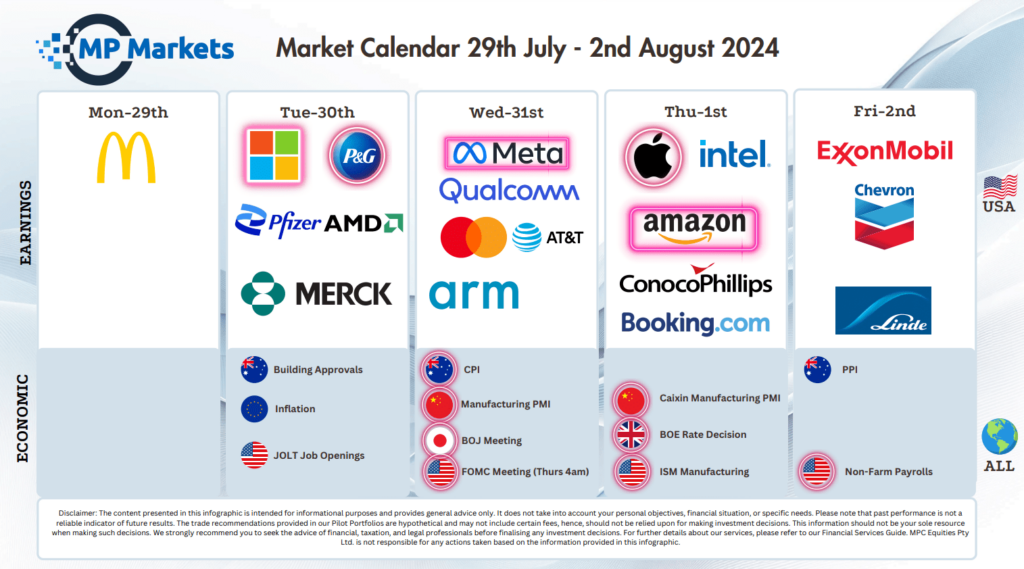

Pre-Market Pulse 29th July – Investors buy the dip in Tech on rate cut hopes

Equities closed the week higher as investors flocked back to tech megacaps that had triggered broad sell-offs earlier in the week, and inflation data boosted optimism that the Federal Reserve will soon commence cutting interest rates.