Credit spreads—the difference in yield between corporate bonds and safer government securities—are beginning to show signs of widening. While this isn’t a cause for immediate panic, it’s a development that savvy investors should monitor closely, as historical patterns suggest it could precede sharper sell-offs in equity markets.

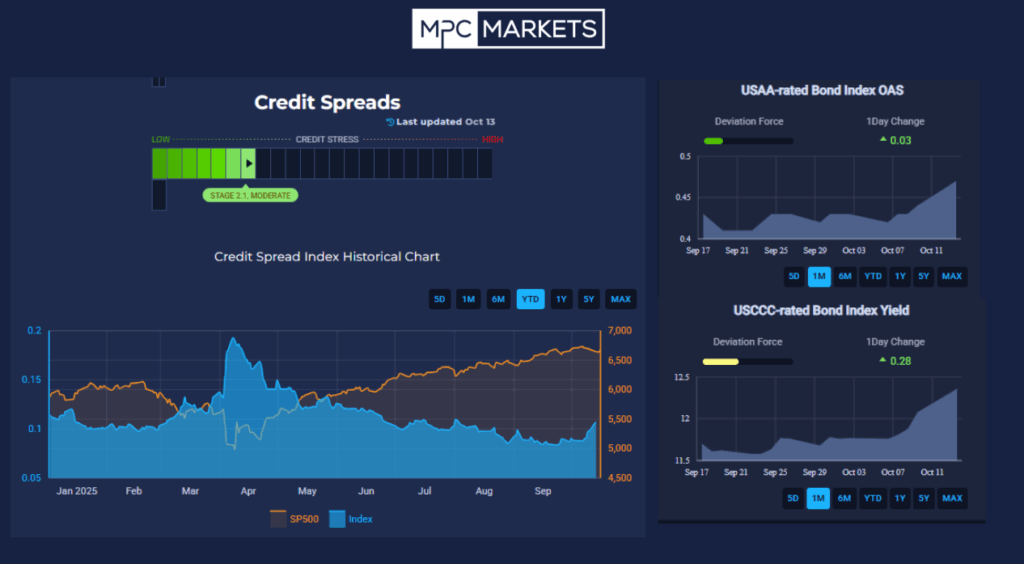

Let’s start with the basics. Credit spreads act as a barometer for investor confidence in corporate debt. When spreads are tight, as they’ve been for much of this year, it signals that markets perceive low default risks and are comfortable lending to companies at rates close to Treasuries. A recent snapshot from MPC Markets, updated as of October 13, illustrates this: the USAA-Rated Bond Index Option-Adjusted Spread (OAS) sits at a deviation force of 0.5 with a modest 1-day increase of 0.03, while the broader Credit Spread Index has trended downward from around 0.15 in January to below 0.1 recently, hovering in “Stage 2.1: Moderate” territory. This low-stress environment has coincided with a robust S&P 500 rally, as seen in overlaid charts where equities (in orange) climb steadily against the blue credit index line.

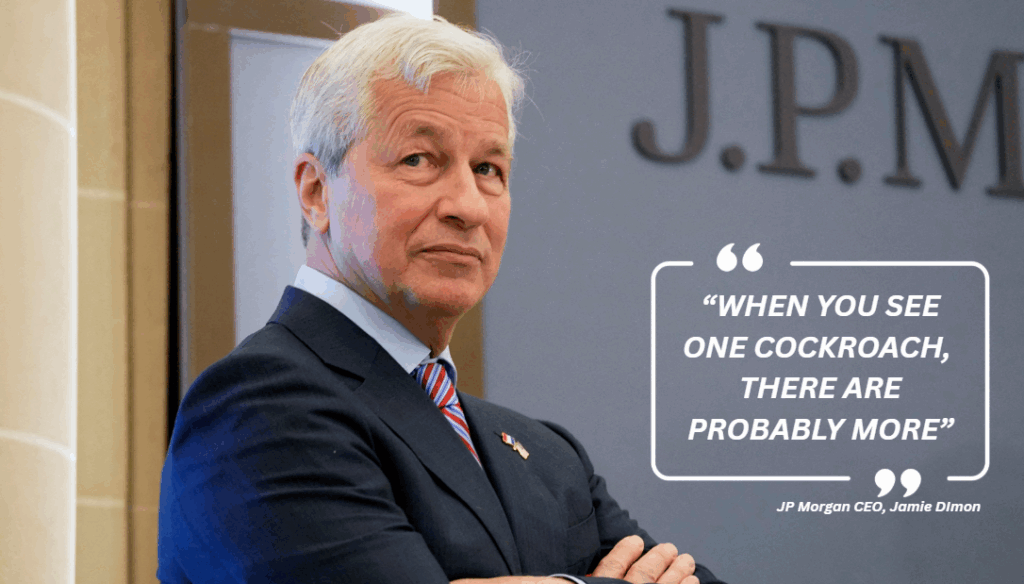

However, cracks are appearing. Jamie Dimon, the outspoken CEO of JPMorgan Chase, recently sounded a cautionary note during earnings discussions. Drawing on his decades of experience, Dimon likened emerging issues in private credit to spotting “one cockroach,” implying more could be lurking. He pointed to bankruptcies like those of auto lenders Tricolor Holdings and First Brands Group as early warning signs. First Brands, in particular, collapsed under $11 billion in liabilities, including $2.3 billion in hidden debts via off-balance-sheet tricks like receivables factoring. This isn’t just isolated drama; it’s symptomatic of broader vulnerabilities in the $2 trillion private credit sector, often dubbed “shadow banking,” where non-bank lenders extend loans to riskier borrowers with less oversight.

These events echo through regional banks too. Over the past 24 hours leading into October 17, stocks like Zions Bancorporation and Western Alliance plunged over 10% amid revelations of $50 million charge-offs and fraud accusations tied to commercial loans. A regional bank ETF dipped 4%, reflecting heightened anxiety about loan quality and rising funding costs. While giants like U.S. Bancorp reported solid results, the sector’s third-quarter earnings show a troubling trend: 24 out of 35 banks posted lower EPS sequentially, with slimmer net interest margins in a high-rate environment.

Why does this matter for equities? Widening credit spreads often signal rising perceived risks—think higher borrowing costs for companies, potential defaults, and reduced profitability. In turn, this can spook stock investors, leading to rapid sell-offs as risk appetites wane. Recall the 2008 Global Financial Crisis: subprime mortgage woes ballooned into CDO meltdowns, causing the S&P 500 to plummet 57% from peak to trough. Today’s private credit boom draws eerie parallels, with analysts like those at J.P. Morgan warning of “subprime 2.0” in bundled loans to zombie companies. X discussions amplify this, with investors like Matein Khalid predicting a $3 trillion consumer credit meltdown that could freeze markets and burst bubbles, much like oil’s 2008 crash from $148 to $35 per barrel.

That said, be alert, but not alarmed. Dimon himself notes these challenges aren’t yet systemic, and JPMorgan is even investing in private credit selectively. The economy isn’t in recession, and post-2008 reforms have bolstered traditional banks. Still, with spreads potentially ticking up amid stagflation fears, clients should diversify portfolios, favor quality over yield in bonds, and watch indicators like CLO issuance and high-yield spreads.

Bottom line is, these credit market fissures are a reminder that complacency can be costly so remiain vigilant, and position yourself to navigate any equity turbulence ahead.

THE TOP PICK OF LAST MONTHS WEBINAR IS +96% IN JUST 4 WEEKS!

DONT MISS OUT

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.