What's Affecting Markets Today

Asia-Pacific markets mostly advanced on Tuesday, tracking overnight gains on Wall Street amid optimism that U.S. President Donald Trump’s proposed tariffs may be less severe than initially feared.

Australia’s S&P/ASX 200 rose 0.52%, ahead of the Federal Budget announcement later in the day by Treasurer Jim Chalmers. Japan’s Nikkei 225 gained 0.80%, while the broader Topix index rose 0.26%. In South Korea, the Kospi added 0.17% and the Kosdaq edged up 0.13%.

Mainland China’s CSI 300 was flat, while Hong Kong’s Hang Seng Index underperformed, dropping 1.06% at the open.

U.S. equity futures dipped slightly after a strong session overnight. The Dow Jones Industrial Average jumped 597.97 points, or 1.42%, to close at 42,583.32. The S&P 500 advanced 1.76% to 5,767.57, and the Nasdaq Composite surged 2.27% to 18,188.59.

Technology stocks led the rebound, with Tesla rallying nearly 12% following Friday’s gains, ending a nine-week losing streak. Meta Platforms and Nvidia also performed strongly, both rising more than 3% as risk sentiment improved.

ASX Stocks

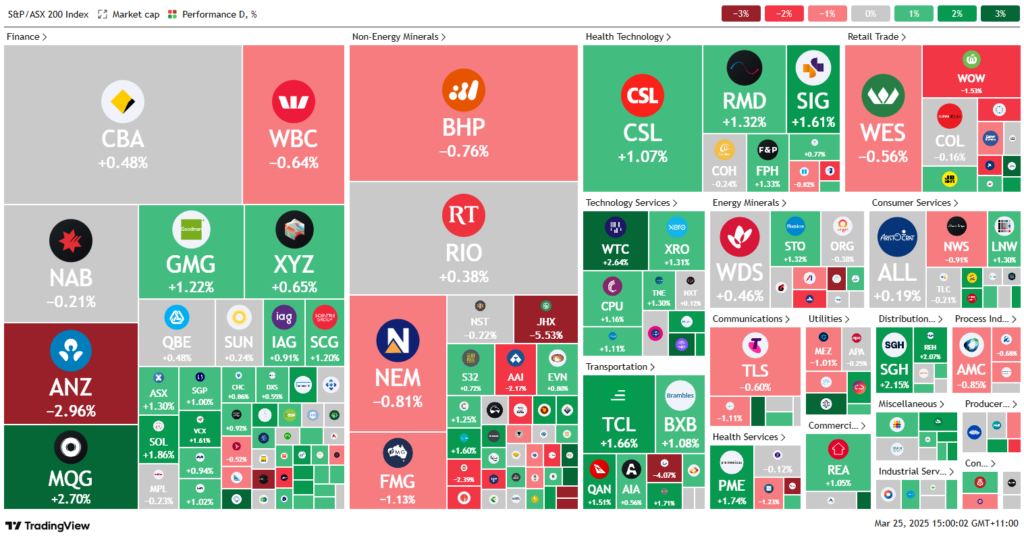

ASX 200 - 7,948.4 (+0.10%)

The Australian sharemarket advanced on Tuesday afternoon, following a strong rally on Wall Street. By mid afternoon, the S&P/ASX 200 was up 0.6% or 48.9 points to 7985.8, marking a fourth consecutive day of gains. Technology led eight of 11 sectors higher.

The rebound was sparked by comments from US President Donald Trump suggesting flexibility on planned tariffs, encouraging a rotation out of US Treasuries into equities. The Nasdaq surged 2.3%, with Tesla jumping 11.9%. Locally, WiseTech and Xero rose over 2%, while property stocks Goodman Group and Vicinity Centres gained 1.4%. Commonwealth Bank added 1.4%, and Macquarie climbed 3.1%.

Despite optimism, BlackRock’s Jean Boivin warned markets remain sensitive to shifts in US trade policy.

In stock-specific news, James Hardie fell another 5% amid criticism of its $14bn bid for Azek. Gold Road Resources surged 14.3% after rejecting a $3.3bn takeover bid from Gold Fields, impacting Northern Star (-0.5%) and De Grey (-0.2%). New Hope slipped 2.2% after revising its bond conversion price. Helia rebounded 1.9% on a Macquarie upgrade, while Atlas Arteria dropped 4.8% post ex-dividend.

Leaders

GOR – Gold Road Resources Ltd (+14.69%)

NXG – Nexgen Energy (Canada) Ltd (+6.86%)

360 – LIFE360 Inc (+6.48%)

RDX – REDOX Ltd (+6.43%)

SPK – Spark New Zealand Ltd (+4.58%)

Laggards

PNR – Pantoro Ltd (-6.06%)

SNZ – Summerset Group Holdings Ltd (-5.71%)

JHX – James Hardie Industries Plc (-5.00%)

DRO – Droneshield Ltd (-4.74%)

ALX – Atlas Arteria (-4.66%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!