What's Affecting Markets Today

Asia-Pacific markets mostly rose on Tuesday as investors awaited further clarity on the impact of U.S. President Donald Trump’s tariffs on corporate earnings and upcoming U.S. economic data. Trade negotiations between the U.S. and regional economies also remained in focus.

China’s CSI 300 Index edged down 0.13 per cent, while Hong Kong’s Hang Seng Index pared gains to close 0.12 per cent higher. In India, the Nifty 50 rose 0.22 per cent while the BSE Sensex was little changed. South Korea’s Kospi advanced 0.63 per cent and the Kosdaq gained 1.03 per cent. Australia’s S&P/ASX 200 climbed 0.96 per cent. Japanese markets were closed for a public holiday.

U.S. futures were steady after a volatile Monday session on Wall Street. The S&P 500 added 0.06 per cent to close at 5,528.75, marking its fifth consecutive gain. The Dow Jones rose 114.09 points, or 0.28 per cent, to 40,227.59, while the Nasdaq Composite dipped 0.1 per cent.

Among major tech names, Apple and Meta Platforms posted modest gains, while Microsoft and Amazon slipped ahead of earnings releases.

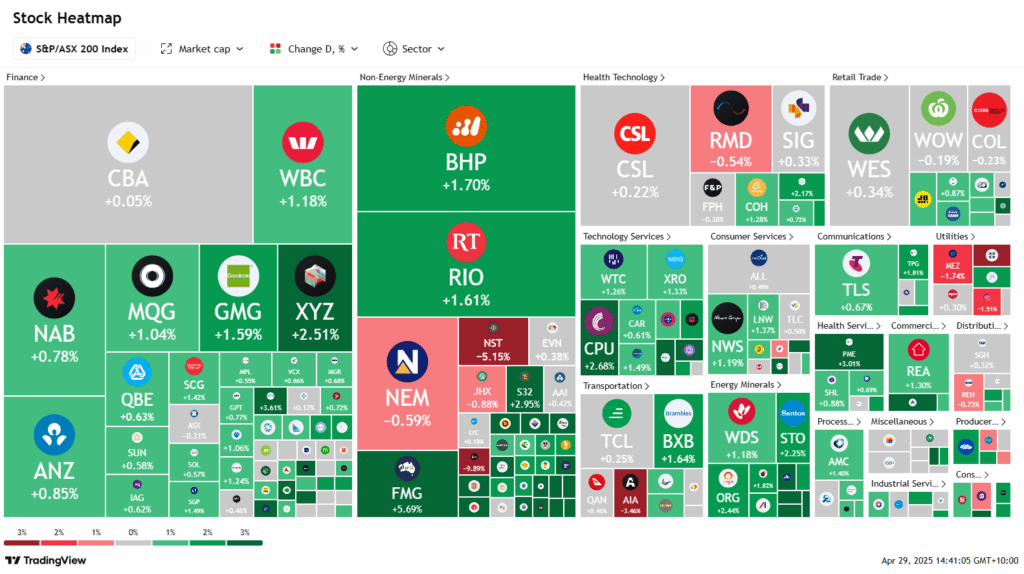

ASX Stocks

ASX 200 - 8,074.3 (+1.00%)

The Australian sharemarket advanced to a two-month high on Tuesday, buoyed by easing US tariffs and optimism over a cooling inflation outlook. The S&P/ASX 200 Index rose 0.9 per cent, or 72.8 points, to 8069.9 near 2pm, while the All Ordinaries lifted 1 per cent. All 11 sectors traded higher, led by energy stocks.

US Treasury Secretary Scott Bessent signalled a shift in trade focus away from China, while the White House eased some automotive tariffs. US equities were volatile but closed marginally positive, with the Nasdaq down 0.1 per cent.

Expectations for a softer inflation print on Wednesday pushed the Australian dollar towards a year-to-date high. Technology and real estate stocks gained, with Xero up 1.5 per cent and Goodman Group up 1.9 per cent.

Mineral Resources surged 13.6 per cent despite downgrading its iron ore output. Uranium producers also rallied, led by Boss Energy, Deep Yellow, and Paladin Energy.

Meanwhile, Northern Star Resources fell 5.5 per cent after lowering gold production guidance, while Whitehaven Coal rose 4.9 per cent despite quarterly production declines.

Leaders

MIN Mineral Resources Ltd +13.53%

BOE Boss Energy Ltd +12.86%

DVP Develop Global Ltd +12.36%

DYL Deep Yellow Ltd +10.24%

PDN Paladin Energy Ltd +10.00%

Laggards

VGL Vista Group International Ltd -8.41%

NST Northern Star Resources Ltd -5.41%

CYL Catalyst Metals Ltd -4.50%

MCY Mercury NZ Ltd -4.16%

AIA Auckland International Airport Ltd -2.66%

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!